Jasen Lee

24th June 2024 - 4 min read

It wasn’t too many years ago that cashiers would look suspiciously at you when you tapped the card payment machine with your smartphone; some wouldn’t even allow you for fear of “hacking” the machine!

Fast forward to today, Malaysia is now even above the global average in terms of digital payment adoption. In fact, it is not uncommon that some merchants prefer cashless payment methods over cash. It is truly a win-win situation for all parties, as consumers enjoy the convenience and security of digital payments, while merchants are able to streamline operations and reduce potential security issues such as theft.

On top of the convenience, consumers may also be wondering – how to make the most out of our everyday spending? This is where digital wallets, such as Samsung Wallet, come in handy, turning every shopping into a convenient yet rewarding experience.

Tap With Your Samsung Wallet & Earn Up To RM720* Rebate Yearly

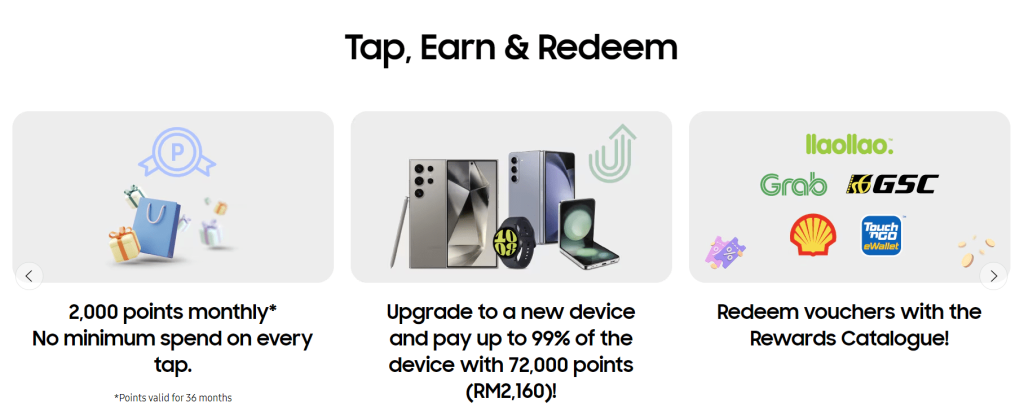

When it comes to paying with your Samsung Wallet, every tap – be it dining or grocery shopping – earns Samsung Rewards points, which can be redeemed to offset up to 99% off the total cost for virtually everything available in the Samsung online store.

This means that if you spend consistently enough with your Samsung Wallet, you could potentially earn up to 2,000 points a month, which is equivalent to RM60 at the Samsung online store. That means that in a year, you’d have accumulated up to RM720 to score a significant discount to purchase a new Samsung home appliance, such as refrigerators, air conditioners, or even vacuum cleaners, by the next Hari Raya!

What’s more – with the Samsung Rewards points having a three-year validity period, optimising your everyday spending for the next 3 years with your Samsung Wallet could save you up to a whopping RM2,160 discount for your next upgrade to Samsung’s latest flagship models.

Redeem Your Favourite Brand’s Vouchers For Just ONE Samsung Reward Point!

Samsung Reward Points doesn’t just allow you to redeem Samsung products. By partnering with Malaysian favourite brands like Touch ‘N Go eWallet, ZUS Coffee, Grab, TGV Cinemas, Domino’s Pizza, and more, you can redeem vouchers for these outlets with just ONE Samsung Rewards point.

These offers are often refreshed monthly, for instance, in June 2024, you can enjoy different vouchers from partners such as Gigi Coffee, Lazada, Shopee, and more, all for just ONE Samsung Rewards point, equating to enjoying these featured brands at RM0.03 only!

Let’s not forget that Samsung Wallet also allows you to “double dip” in rewards. With eight banking partners in Malaysia, you can store your debit and credit cards in Samsung Wallet and earn cashback or reward points from these cards on top of Samsung Rewards points when you spend!

Samsung Wallet: Enhanced Security With Samsung Knox & Digital Tokenisation

While storing your credit or debit cards in the Samsung Wallet will definitely make payments more convenient, some consumers can’t help but worry about the security of our card information, especially given the rise of Android malware apps.

Fortunately, Samsung addresses these security concerns head-on with advanced technological features like Digital Tokenisation and Samsung Knox, which have been integrated even into the latest affordable Samsung smartphones like the Galaxy A15 and Galaxy A25 5G:

- Digital Tokenisation technology enhances security by replacing sensitive card information with a unique digital token, thus creating “one-time” card info for every transaction.

- Meanwhile, Samsung Knox technology continuously monitors and protects your phone from malware and other threats, isolating sensitive data like payment information in a secure environment to ensure your transactions are safe and private.

***

With the Samsung Galaxy A15 (from RM999) or the Galaxy A25 5G (from RM1,299), you gain a smartphone that not only enhances your digital experience but also access to the Samsung Wallet which earns you Samsung Rewards points with every tap.

When consistently used, you could earn up to RM720 in Samsung Rewards points in just one year, effectively allowing the phone to offset about 70% of its value. And if you accumulate these points over three years, you could save a substantial amount on the next Samsung purchase of your choice.

With Samsung Wallet, your quest for a convenient and rewarding way to optimise your everyday spending finally comes to an end! Click here to explore the Samsung Galaxy A-Series smartphones, starting from RM999.

Comments (0)