Pang Tun Yau

21st June 2023 - 8 min read

Credit cards are always designed with different users in mind, and are usually categorised as cashback credit cards, rewards credit cards, and travel credit cards. This latter part is particularly interesting because over time, they’ve evolved to branch out to cover different aspects of travel (and for different income levels).

Today, travel credit cards have become more popular as consumers are more aware of the various benefits that come with these cards – in fact, there’s a whole different subset of travel credit cards focused on accelerated air miles accumulation. So, how do we determine what makes a good travel credit card? As always, there is no “best” card out there that fits the needs of everyone, but here are some aspects that all good travel credit cards must have.

Start Your Journey In Style

In the age of revenge travel, it is not uncommon that airports are now recommending arriving up to six hours before your departure time. After hustling through check-in and airport security, it’s always nice to be able to wait for your flight in more comfortable chairs than the ones near the gate. Or, at the very least enjoy a snack that does not cost substantially more than what you normally pay for outside the airport.

Hence, a good travel credit card must always offer complimentary airport lounge access – especially at your departure airport. Previously a benefit reserved only to those in business class and above, airport lounge access is a perk you always want to have on hand. While waiting for boarding, wouldn’t it be fantastic to rest in comfortable chairs, eat as much as you’d like…or even better, enjoy a quick shower or an indulgent massage?

For casual travellers, airport lounge perks are a great perk to start your trip on a positive note. Meanwhile for those who travel regularly for work, you’d want a card that offers a higher quota to accommodate your travel needs.

Make Your Journey Home A Comfortable One

At the end of your holiday, the last thing you want is a long line waiting for the airport taxi or taking the express train before hopping on to another vehicle to head home. Thanks to ride sharing services like Grab, your trip home is made much smoother with just a few taps on your phone. In fact, Grab’s airport ride services is a much better option in other local airports besides KLIA Terminals 1 and 2, where taxi services are often less reliable – or prone to issues like touts and unreasonable fares.

A good travel card should handle the last leg of your trip well. Look for airport transfer perks like complimentary rides or cashback that can offset the cost of your trip home. Do check the T&Cs too, as these perks usually come with some spending requirements – the good cards usually don’t make them too difficult to meet.

Prepare For Your Next Journey – While In Your Current One

A big appeal of travel credit cards is the accelerated rate that you earn points which can be redeemed for air miles. These air miles can then be used to redeem flights for your next trip!

Of course, different travel cards have different earn and redemption rates – it’ll need a bit of math to figure it out and may seem complicated at first. But for those who do, the rewards can be as luxurious as flying Business (or even First!) class at a fraction of the price.

A good travel credit card should offer competitive earn and redemption rates for air miles – the goal is to earn the most air miles by spending the least amount of money. Since different cards from different banks offer varying rates, enthusiasts have coined a common denominator, known as “miles per dollar” (or mpd for short) to create a uniform standard to better identify how much air miles are earned per dollar (or Ringgit). The higher the card’s mpd, the better the card’s ability to earn air miles and thus the better it is as a travel credit card.

Enjoy Exclusive Travel Benefits On Your Journey

Banks or card issuers (like Mastercard) usually offer targeted campaigns exclusive only to specific cards. These are usually year-long campaigns that – admittedly – are not as easy to find, as they’re usually located in a different microsite and may require you to sift through various offers that you may not be keen on.

That said, there are some gems that can make your trip extra memorable. It’s not uncommon to find offers like hotel-related perks like room upgrades, free breakfast buffet (highly valuable in expensive countries!), and complimentary nights if you meet specific conditions. There’s also plenty of shopping and dining perks in various cities around the world in these campaigns, giving the opportunity to stretch your travel budget and make your trip extra memorable.

Journey With Peace Of Mind

All good travel credit cards will always offer value-added benefits – in addition to the previous perks. Complimentary travel insurance is an often neglected benefit, which cardholders are automatically entitled for when you purchase your flight ticket and accommodation with it. Of course, not all travel insurance plans are the same, so look out for coverage on the most common inconveniences like baggage or flight delays (and the minimum number of hours required before you are entitled to claim), as well as for theft – these tend to occur more frequently than the other areas of coverage.

You may also want to look out for other value-added benefits like competitive foreign exchange rates and fees – some cards even waive the bank fees. Lastly, smaller touches like a dedicated customer service hotline (separate from other cards) make a big difference when you need them the most.

Introducing The Standard Chartered Journey Credit Card

Refining the benefits of one of Malaysia’s most popular travel credit cards, Standard Chartered has launched the new Journey credit card for the Malaysian market. This card, which replaces the WorldMiles World Mastercard – is designed to enhance the existing perks to benefit more cardholders around the country.

Enjoy unlimited airport lounge access in KLIA Terminal 1 and Terminal 2 with the Journey credit card, starting your international trips in comfort and style – no matter your departure time. This is one of the best benefits of the WorldMiles card, and is now one of the very few cards in Malaysia to offer this benefit. No need to worry about how much quota you have left, just show your card and your international boarding pass and you’re good to go.

The Standard Chartered Journey card also enhances the WorldMiles card’s airport transfer benefit, now allowing those traveling locally to also enjoy a comfortable ride home. All cardholders will enjoy cashback capped at RM65 for any Grab ride from any airport in Malaysia, as long as you meet the spending requirements of RM2,500 in Travel-related expenses (airlines, hotels, and online travel agents) within 90 days before the Grab ride.

Meanwhile, the points earning mechanic of the new Journey card has been revised as well. Cardholders now enjoy an accelerated rate of 1 Miles Point for every RM1 spent on Travel, foreign currency, and a new Dining category. 2 Miles Point can be redeemed for 1 air mile from a choice of AirAsia, Malaysia Airlines Enrich, and Singapore Airlines KrisFlyer frequent flyer programmes. Additionally, Miles Points can be redeemed for cashback, gifts, and vouchers as well.

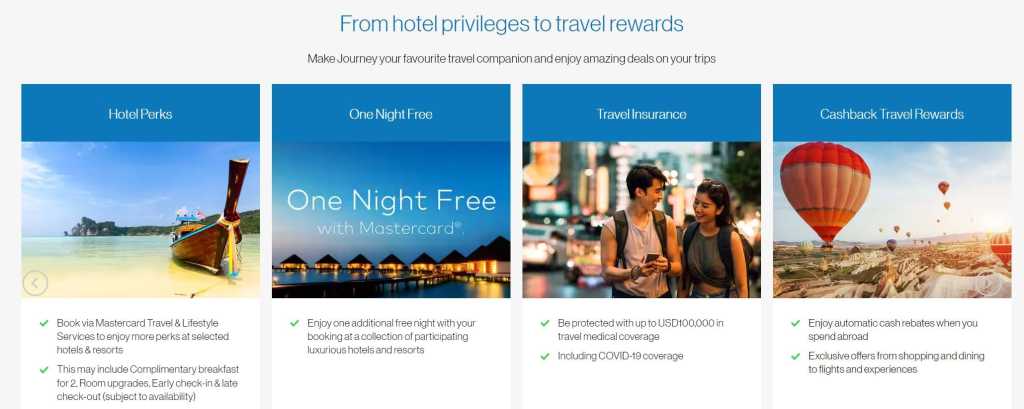

Cardholders will also enjoy exclusive access to Mastercard Travel Experiences, a dedicated platform offering exclusive offers to Mastercard-issued cards (including the Journey credit card, which is a World Mastercard tier). With campaigns running all year long, enjoy exclusive hotel offers including Free One Night with Mastercard across various hotel and resort chains; hotel upgrades such as complimentary breakfast, room upgrades, and early check-in and late check-out options; as well as shopping deals with instant rebates at participating outlets around the world with Mastercard Travel Rewards.

Not to forget, flight and accommodation purchases made with the SC Journey credit card will be entitled to complimentary travel insurance with up to US$100,000 medical coverage. This plan will also include Covid-19 coverage as standard, in addition to the other medical benefits as well as travel inconvenience coverage.

Ready to take your Journey to the next level? Find out more about the new Standard Chartered Journey Credit Card here, or apply now and enjoy exclusive sign-up rewards on RinggitPlus!

To further sweeten the deal, Standard Chartered is making it even more rewarding to own the Journey card. From now until 10 September 2023, every RM100 spent with the SC Journey credit card will earn entries towards a grand prize of 200,000 Enrich Points – that’s enough for a return business class trip from Kuala Lumpur to London with Malaysia Airlines! There’s a total of 1 million Enrich Points to be given away exclusively for SC Journey cardholders – get a head start with 10 bonus entries if you apply and activate your card during this period. Find out more about the campaign here.

Comments (0)