Pang Tun Yau

13th February 2020 - 11 min read

In recent months, e-wallets (and even Shopee and Lazada) began offering bill payment options, which means Malaysians can earn some rewards or cashback for paying their bills. But, one merchant is almost always absent: Tenaga Nasional Berhad (TNB). TNB bills stand in a league of its own in terms of difficulty in earning cashback.

Why you should aim for cashback or rewards from paying electricity bills

The electricity bill is the biggest utility expense we make every month – note that telephone, postpaid plans, Astro, and home internet plans are all NOT utility bills and you can earn reliable returns from all of them. Electricity bills are more complicated.

With the exception of Sabah Electricity (SESB) and Sarawak Energy which have both embraced digital payments on e-wallets and e-commerce platforms for some time now, electricity bill payments for TNB are limited to JomPay (no cashback for credit cards), selected physical outlets including Pos Malaysia and 7 Eleven (cash only), and MyTNB (not eligible for cashback for credit cards) and Kedai Tenaga (“Contactless” payments via credit cards should be eligible if the payment terminals support it, but you need to physically head out).

In short, earning some form of cashback or rewards from TNB bills is surprisingly difficult – and it means we lose out on potentially saving hundreds of Ringgit every year.

That’s not really an exaggeration. Although we calculated that the average electricity bill of a Malaysian household is RM93.98 (based on this 2016 Statista report and assuming a statistical average of 4 persons in a Malaysian household), households with multiple air conditioners and other appliances with high energy consumption result in substantially higher bills. In fact, it isn’t uncommon for urban households to have electricity bills multiple times this national average.

Imagine paying RM300 a month in electricity bills – that amounts to RM3,600 a year in spending that we can potentially earn some returns. With the increasing popularity of e-wallets, we can now earn tangible returns – which this article will show.

How much cashback can I get?

The key to this is to double dip on credit card and e-wallet rewards (or triple dip, if you include the loyalty partners that some options provide).

With the right credit cards, you can earn cashback or rewards points for topping up your e-wallet of choice, and then earn the rewards from the e-wallets when you pay your TNB bills.

While most cashback credit cards no longer count e-wallet top-ups to be eligible for cashback, there are a few that do (more on that below). Your rewards or air miles credit cards will also earn points (if the card issuer allows it, of course).

At the very least, you’ll be earning a minimum of 2.2% in effective cashback – but with luck you could get well over 20%.

2 Ways To Earn Cashback For Paying TNB Bills Using E-Wallets

Thanks to e-wallets, it is now possible to easily earn cashback from paying your TNB bills. We’re listing out two ways you can do so, covering the three most popular e-wallets in Malaysia. They may require some additional steps to achieve cashback – not too complicated, though, and can potentially save you hundreds of Ringgit every year.

1. Pay via Boost or GrabPay on e-pay

(Update 18/2/2020) GHL has removed TNB as a bill payment option, citing “maintenance” and “technical issue” as the reason. There is no timeline or indication if it will return.

e-pay is a payment platform by one of Malaysia’s most prominent payment processing companies, GHL. It has physical touch points as well as an online platform, e-pay.com.my. e-pay offers a huge library of products and services that users can purchase or pay for, from mobile phone top-ups, bills, and game credits.

In the last few days, we found that the e-pay website had enabled Boost and GrabPay as payment options in addition to online banking via FPX. This is a game-changer, as smart Malaysians can now earn cashback (or air miles) for paying TNB bills online. Here’s a step-by-step guide on how to pay TNB bills on e-pay with Boost or GrabPay.

1. Register an account with e-pay. It’s a fairly straight forward process, just enter your email address, verify it from the email sent to you, and you’re in! Don’t forget to enter your details in the account section.

2. On the home page, click on the Bill Payment Collection tab. You can see the extensive list of merchants you can pay bills for. For the purposes of this article, let’s proceed with TNB. Click on the icon, and you can enter the amount you wish to pay, and click “Pay Now”.

(Update: the max payment you can pay per day is now RM800)

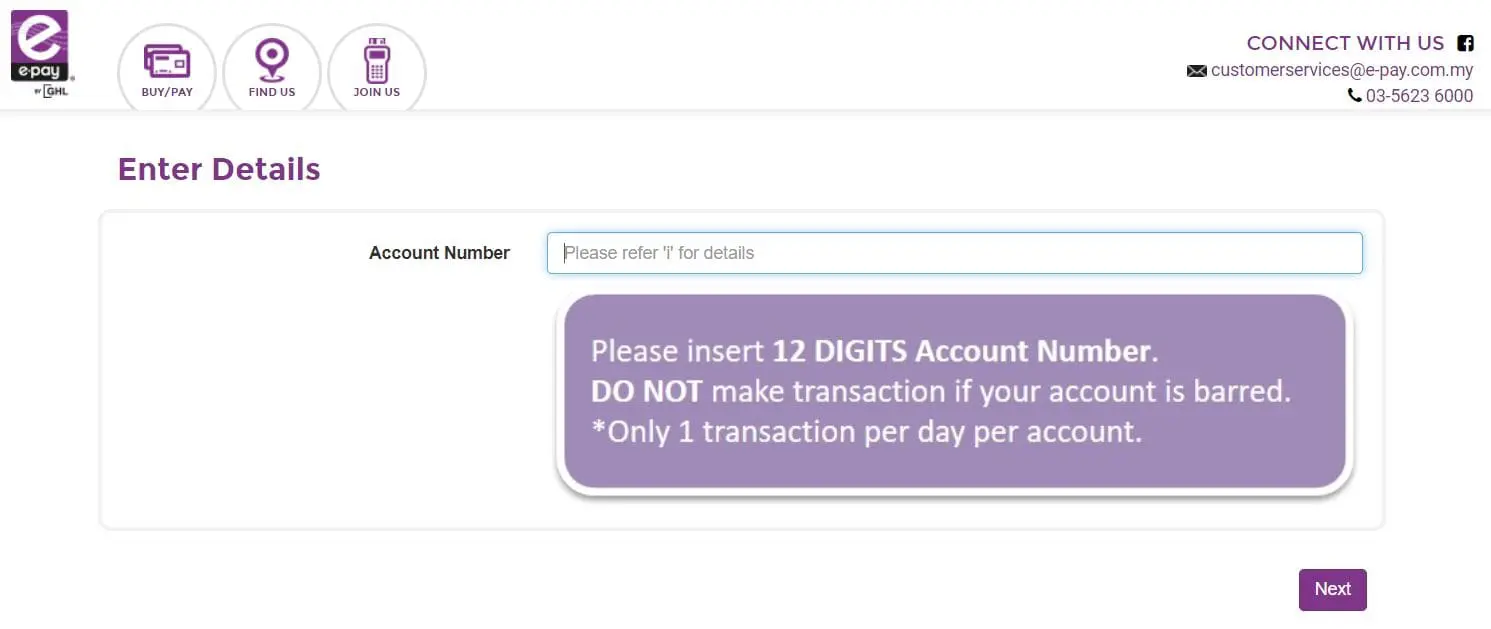

3. In the next page, you’ll need to enter the TNB account number. Note that you can only make one transaction per day. Click “Next” when ready.

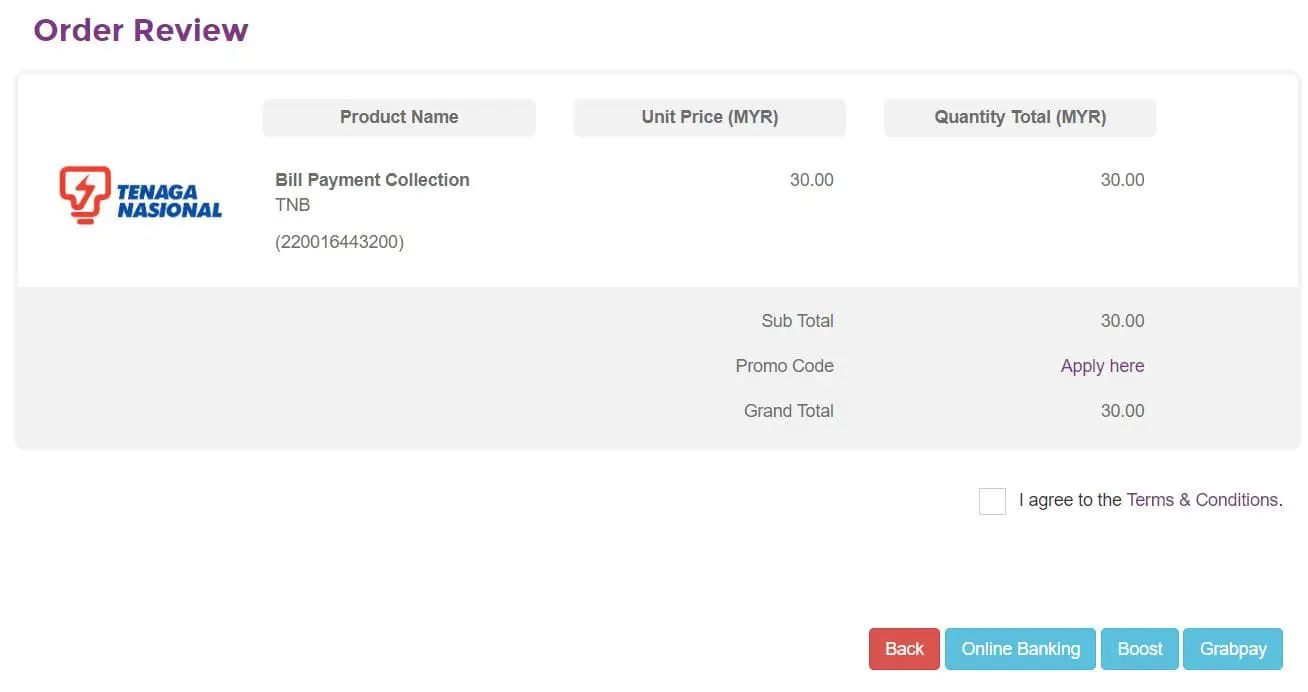

4. You’re almost done! This is the Order Review page. Double check the account number, how much you wish to pay, and tick the checkbox to agree with the T&C. Now, you’ll see three payment options: Online Banking (FPX), Boost, and GrabPay.

5. Let’s try Boost. You’ll need to confirm to proceed, and you’ll see Boost’s Scan and Pay webpage with a QR code. Open up your Boost app, scan the QR code, confirm the transaction with your fingerprint or PIN code, and you’re done! You’ll see the “Payment Confirmed” pop up appear on the Boost QR code webpage.

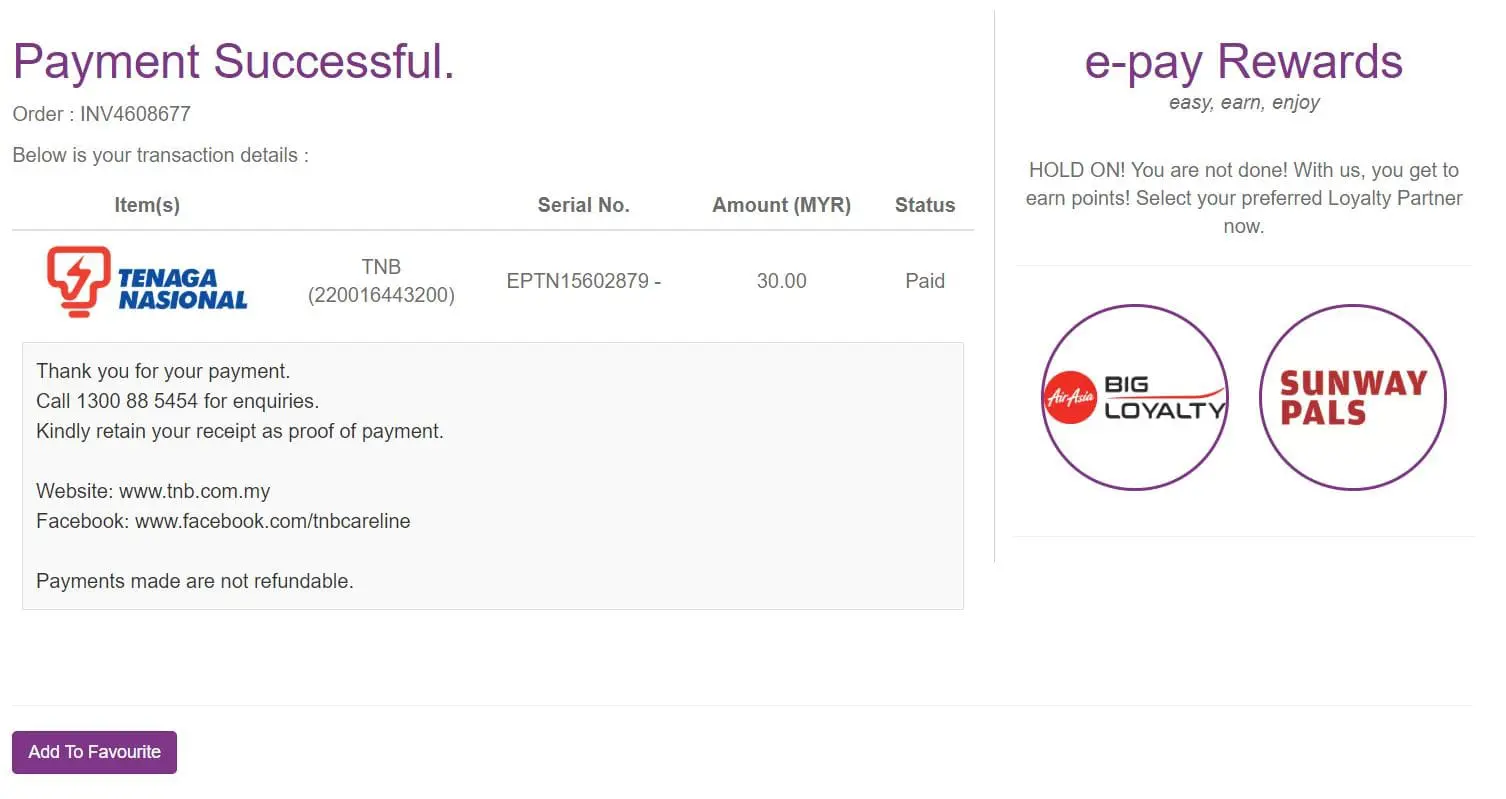

6. If your payment is successful (which it should be, unless your wallet balance is insufficient), you’ll reach the Payment Successful page. Take note to the right column: you can earn (slightly) more returns by entering your AirAsia Big or Sunway Pals account numbers. The points you earn from these loyalty partners are pretty low for bill payments though – but hey, every little counts!

7. Your bill payment is complete! To be sure you got everything right (especially on your first time), you can log in to MyTNB and check your payment history – payment should be reflected in real-time, so if your e-pay transaction doesn’t appear here after a while, contact e-pay ([email protected] or 03-5623 6000).

2. Pay at 7 Eleven via Touch ‘n Go eWallet

Another recently-discovered way to pay TNG bills and earn cashback is by using your TNG eWallet and paying offline at 7-Eleven outlets. While it is well-known that you can pay a lot of bills at 7 Eleven, not many are aware that you can use TNG eWallet to pay for them. In fact, we’ve even come across 7-Eleven cashiers who were adamant that e-wallets are not accepted for bill payment. Interestingly, Razer Pay isn’t supported, but TNG eWallet is.

To pay your TNB bill at 7-Eleven using TNG eWallet, follow this step-by-step guide:

1. Bring a physical copy of your TNB bill that you wish to pay, and inform the cashier that you wish to pay a TNB bill.

2. Tell the cashier how much you’d like to pay. Partial payments are possible, but note that you can only pay TNB bills once a day.

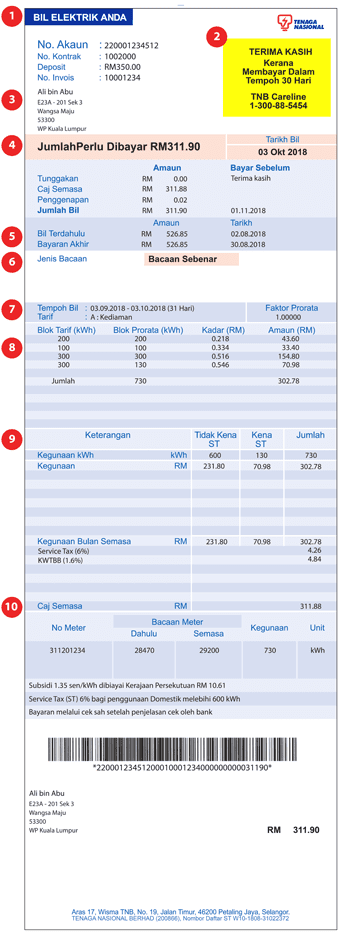

3. Let the cashier scan the barcode on your TNB bill – it contains the TNB account number.

Let the cashier scan the barcode near the bottom of the bill, as shown above.

4. Open your TNG eWallet app, and tap “Pay”. The cashier needs to scan your unique QR code. Depending on the outlet, some scanners can be freely moved (so you don’t have to give your phone to the cashier).

5. If your wallet has sufficient balance, your bill payment is complete! You’ll get a physical receipt from the cashier, and a digital one in your e-wallet app.

Between Boost, GrabPay, and TNG eWallet, which is the better option?

As we calculated earlier, you can earn up to 7.5% effective cashback for every online or Scan & Pay transaction if you are a GrabRewards Platinum member – until 14 March, that is. Grab’s upcoming revision will drastically cut the amount of GrabRewards points you can earn for GrabPay transactions (from 9x to 3x). From 15 March 2020, you can only earn an effective cashback rate of 2.5% (Platinum member).

Just like GrabPay, you’ll need to be on the highest tier of BoostUP (Level 4) to earn meaningful cashback. At Level 4, you’ll earn an effective cashback rate of around 2.2% by taking into account the earning rate (2 Boost Coins for every RM1 spent) and BoostUP’s redemption rate for its RM30 Boost wallet credit (2,700 coins, which gives a value around 1.1 sen for 1 Boost Coin).

But, there’s also the random rewards you’ll receive from the Boost Shake Rewards, which can range from 0 bonus coins all the way to 8x bonus coins (which will yield an incredible 17.6% cashback, but the chances of that happening is exceptionally rare).

Meanwhile, TNG eWallet relies on the various cashback promotions that are refreshed every month. They usually do include some 7 Eleven specific offers, like the current “random cashback” promotion that will end at the end of February.

Since there aren’t any form of rewards points or even its “daily cashback” campaign that ran until 31 December last year, your returns are limited to mainly your credit card benefits and its various campaigns, such as the HSBC TNG eWallet top up campaign as well as the 2020 Citi eWallet campaign.

Which credit cards should I use to top up?

As a general rule, Boost, GrabPay, and TNG eWallet top-ups are not considered “online transactions” – you’ll know it isn’t when you are not sent a TAC code to confirm the transaction. That somewhat reduces the pool of cards to double dip on rewards, but fret not, here’s a list of cards that we know allows cashback or bonus rewards for e-wallet reloads.

Standard Chartered Liverpool FC Cash Back Card: this card is the easiest to earn cashback from thanks to very few exclusions on eligible transactions, but you’ll need to spend at least RM2,000 to earn the RM50 cashback. Effective cashback rate: 2.5%

Citi Cash Back Card (Gold & Platinum): This card offers 10% cashback when you top up your GrabPay wallet – it’s one of the four cashback categories of this card. It’s awesome, but be aware of the minimum spend required to unlock the 10% tier: RM500 for Gold and RM1,500 for Platinum. The cashback cap isn’t high at RM10 and RM15 (Gold and Platinum respectively), but the high cashback rate means you’ll earn higher cashback for lower spend amounts. Effective cashback rate: 8% (Gold), 4% (Platinum)

HSBC Amanah MPower Platinum Card-i: Like the RHB Rewards Card below, this card has a dedicated e-wallet rewards category. Cardholders earn 8% cashback for three categories (e-wallet reloads, petrol, and groceries), subject to a monthly card spend of at least RM2,000, and the cashback is capped at RM15 per category. But, from 1 April onwards, the e-wallet transactions category will be revised to 1% cashback. Effective cashback rate: 0.75%.

Here’s the limited edition card face available now, in conjunction with the 2020 Olympics!

RHB Rewards Card: Another card that specifically offer rewards for e-wallet transactions, you’ll get 3x RHB Rewards Points for every RM1 spent on online and e-wallet transactions – but it’s got a rather poor redemption rate. It’s the only card in this list where you can choose from three different card types: the regular one, the MotionCode variant, and the recently-launched limited edition card face in conjunction with the 2020 Tokyo Olympics. You can redeem a RM50 voucher for 30,000 Rewards Points, giving it an effective cashback rate of 0.5%.

HSBC Visa Signature: HSBC revised the terms of this card to not offer the bonus 4x Rewards Points for e-wallets that allow withdrawals – that means you’ll still earn 5x Rewards Points for topping up GrabPay (TNG eWallet is a grey area; it should give the bonus 4x Rewards Points, but some cardholders have reported otherwise). You can redeem a RM100 voucher for 35,000 Rewards Points, which yields an effective return rate of 1.43%.

While we can’t run away from paying bills, with the right financial tools we can earn something back from this necessary spending. Sure, a minimum of 2.2% may not sound like much, but total up that figure over a year and see how it quickly accummulates!

If you found more ways to earn cashback from paying your TNB bills, we’d love to hear about it. Let us know in the comments section below!

Comments (17)

Great write up. Sadly just discovered ePay ceased operations 15 April 2022. Need to look for another that accepts GrabPay for TM.

How do i get receipts for payments paid to telco and utility companies using tng ewallet?

Wow, all secrets from Lowyat forum got blown up here. Must be someone working there.

Doesnt work anymore. They removed the Tenaga Nasional option. Use gopay.

也对,之前6k变4.5k那边就很不爽了,一个号少了1.5k,10个就多少,就算ringgit没post这类的文章他们axiata也是有在研究作业的

你知道這篇文章如何殺死下金蛋的鵝嗎?!

一些新手只需付清所有賬單

Is this just a coincidence? It was a small problem over tnb. Thanks to the author for sharing and spreading, let more people know!

darn, already use boost to pay almost a year, almost get my reward then your ringgit post make it disappeared. Those who know will always learn. now the results we explored were wiped out before got the results. 1 TNB transaction can cover up how many bills?

Game over for epay after this article. Loophole already closed!!

Thanks for ruining the fun.

TNB payment is not longer in the ePay payment.

I think because of this post, e-pay removed TNB and SSPN from the list 😐

这篇文章一刊登出来没几天,TNB就从epay消失了。我发觉每次RP一刊登好康,不久后 “有关当局” 就会做出调整,不让消费者继续获益。

Pls update this post. TNB payment is not longer in the ePay payment.

Just registered ePay , but don’t see TNB under Bill Payment Collection anymore.

I hope the people in TNB has some sense to add grabpay, boost or touchngo ewallet option in their very own app. So much convenience and less hassle for busy people like us. I pay TNB bills via this app without to wait for the paper version that seldom missing from the mailbox. perhaps e-billing also can cut their cost too.

I use Gopay app.

Can topup into Gopay account using Boost, then you can shake2.

After that, pay TNB bill using Gopay.

Gopay give you cashback for every transaction.

They also sell Touch N Go pin code, so you can get cashback buying the pin code.

(admin: edited. no referral codes allowed to be shared here)