Eloise Lau

28th December 2023 - 5 min read

Introduced in April this year, the Alliance Bank Visa Virtual Credit Card is the first virtual credit card in Malaysia with unique security features, such as the Dynamic Card Number (DCN). Available within the allianceonline mobile banking app, it is the first product of its kind to be rolled out here in Malaysia.

Unsurprisingly, the card has garnered positive response from consumers since it was launched. The card was awarded ‘The Best Credit Card in Malaysia’ at the recent Asian Banker Finance Malaysia Awards 2023 and also bagged the New Consumer Lending Product of the Year award at the Asian Banking & Finance Awards 2023 in August. The card also won the Best Omni-Channel Experience and Best Digital Experience at the CX Asia Excellence Awards in November.

Needless to say, if you’re looking for a credit card that keeps your personal information and finances safe, this card is quite a compelling option. In this article, we will explore a few facts you might not have known about the Alliance Bank Visa Virtual Credit Card:

#1 – It’s the first virtual card in Malaysia to offer the DCN technology.

Typically, a credit or debit card comes with a fixed sequence of 16 digits on it, which acts as an identifier that provides information (such as the bank provider and account holder) to the merchant. The Dynamic Card Number (DCN) technology on the Alliance Bank Visa Virtual Credit Card allows cardholders to generate new card numbers, which can be set for single-use or recurring use with enhanced safety features, such as setting maximum transaction limits and expiry dates.

These security features not only make it incredibly challenging to steal your card information and in the event your card number is compromised, the single-use card number would have already expired by the time it is in the hands of unscrupulous individuals. If your recurring DCN is compromised, the additional safety features will help limit your exposure to fraudulent transactions. You can also freeze the card to ensure no further fraudulent activity is conducted as you inform the bank – which we’ll share below.

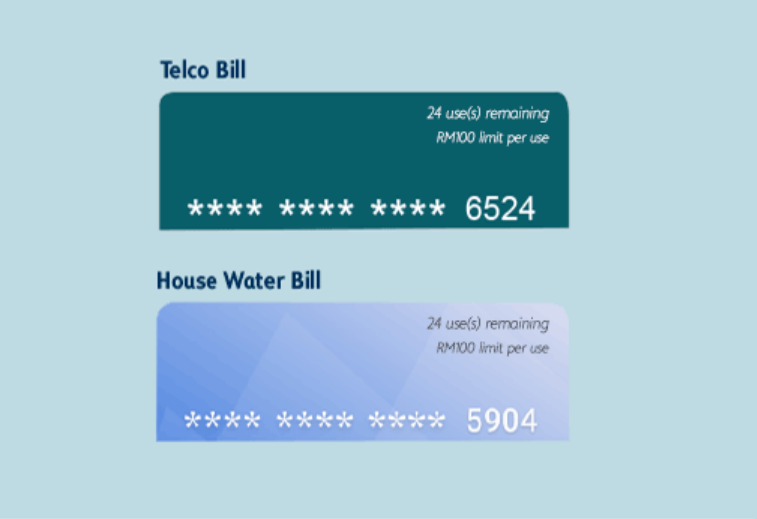

#2 – You can set up as many virtual cards as you like!

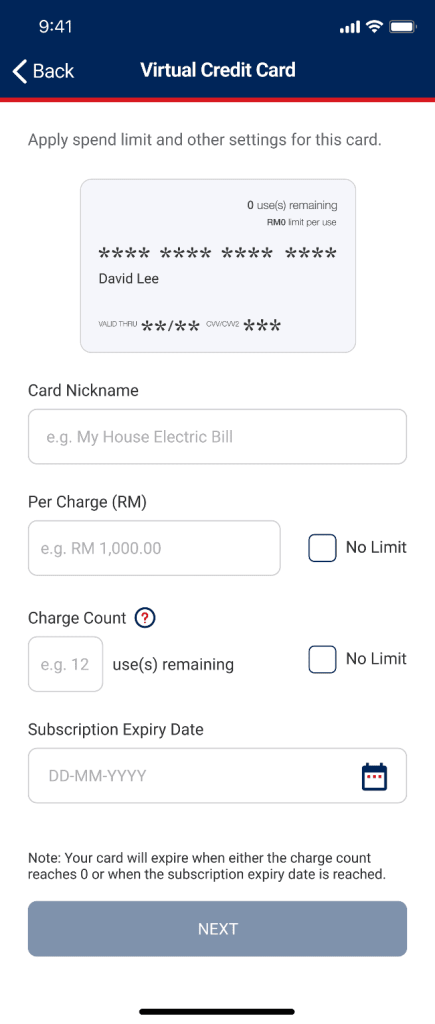

Besides one-time payments, you also can set up additional virtual cards for things that require recurring payment, for example, bills and personal subscriptions. For each card number you generate, you can set specific parameters, including a Spend Limit and expiry dates either based on the maximum number of transactions, maximum amount per transaction or a specific expiry date. This way, even if your card information is compromised, these additional features minimise the risk of losses.

It only takes a few simple steps to set up your card for one-time or recurring payments. All you have to do is:

- Log into your allianceonline mobile app.

- Tap on ‘Create Card Number’

- Select ‘One-Time’ or ‘Subscription’ based on your needs

- Key in your 6-digit Pin

- All done! Your new Dynamic Card Number is ready.

#3 – You can freeze your card without having to call the bank

While it’s important to notify the bank if you notice any suspicious activity on your credit card, with the Alliance Bank Visa Virtual Credit Card, you can take proactive measures by freezing your card immediately if you notice any suspicious transactions. All you need to do is open the allianceonline mobile app and swipe the freeze option, which automatically blocks all subsequent attempts to use the card. You may also unfreeze the card once you know it’s safe to use. All of this can be done without going through the hassle of calling customer service and waiting for the bank to take action.

It is also common for some cardholders to freeze their cards whenever they are not in use, and only unfreeze them before making a transaction. This virtually eliminates the possibility of fraudulent transactions being carried out without your knowledge, as they will not be valid!

For cards that are no longer in use, you could delete them, and they will be removed from your app. To use a new card number, simply generate a new one to make a transaction.

#4 – You’ll still enjoy the best rewards that Alliance Bank Credit Cards have to offer

Enjoy 8x Timeless Bonus Points (TBP) for every RM1 spent on e-wallet (capped at RM3,000 per statement cycle) and online transactions, as well as 1x TBP for all other spending, including contactless transactions, JomPAY, and QR-based payments using DuitNow. This makes the card a great option for heavy online shoppers and e-wallet users, thanks to the ability to earn TBP at accelerated rates to redeem various rewards, vouchers, and air miles.

Plus, the card comes with no annual fee and has a relatively low-income requirement of RM24,000 p.a. However, you’ll still be required to pay RM25 annually for SST for your main card – you will not be charged any fees for the DCN you generate.

#5 – Exciting News! Google Pay and Samsung Pay will soon be available for the Alliance Bank Visa Virtual Credit Card.

Mark your calendars! Google Pay and Samsung Pay will be available in 2024 via the Alliance Bank Visa Virtual Credit Card, providing a secure and modern way to handle your payments.

***

The Alliance Bank Visa Virtual Credit Card offers cardholders plenty of benefits – including robust security features and generous Timeless Bonus Points. On top of that, every virtual card you generate is free, regardless of how many there are housed within the allianceonline mobile app. This offers a safer and, above all, a more enjoyable and personalised banking experience for cardholders.

Sign up for the Alliance Bank Visa Virtual Credit Card on RinggitPlus, and you could take home exciting gifts, including the latest Apple products. Enjoy guaranteed gifts ranging from Touch ‘n Go eWallet credits to earning chances to win high-value prizes such as the new iPhone 15!

Discover the latest sign-up offers here.

Comments (2)

How about Apple Pay?

Apple Pay is supported for select credit cards. You can check with your bank to see if your card is eligible and how to set it up.