Eloise Lau

5th January 2026 - 4 min read

Every Malaysian knows the feeling. December arrives with its perfect storm of major expenses, and suddenly your bank account is under siege from multiple directions at once.

There’s the year-end vacations, holiday seasons, festive gatherings at your in-laws’ place, and it will certainly costs you money. You also need to account for balik kampung petrol, toll, angpow, duit raya and festive gifts. And just when you’ve survived all that, January drops its own demands: school fees, uniforms, textbooks, maybe a laptop for your eldest who’s starting college.

This financial volcano eruption happens every year. Yet somehow, every year, it still catches us off guard.

The December – January Damage & Double Festivals Financial Demand

Here’s a snapshot of what the financially demanding months what a typical year-end might cost a Malaysian family with 2 school-aged children:

| Expense | Estimated Cost |

| Holiday travel (flight ticket or road trip travel) | RM300 – RM5,000 |

| Balik kampung (petrol and toll, flight tickets) | RM300 – RM2,000 |

| Festive groceries and hosting | RM500 – RM1,000 |

| Angpow / Duit Raya | RM300 – RM500 |

| Gifts | RM200 – RM500 |

| School fees + back to school essentials(January) | RM500 – RM3,000 |

| Total | RM2,100 – RM12,000 |

For families with multiple children, the school-related costs multiply. That’s a lot of cash leaving your account within a six-week window.

Instead of draining your savings or scrambling for last-minute solutions, spreading that load across several months keeps your budget intact. A RM5,000 expense paid over 12 months is roughly RM430 a month, which is much easier to absorb than a single knockout blow to your December or January bank balance.

How AEON Bank Personal Financing-i (PF-i) Can Ease Your Budget Constraint

AEON Bank’s Personal Financing-i (PF-i) is a Shariah-compliant financing facility for Malaysians who need to bridge temporary cash flow gaps. Three features make it suited for the year-end budget squeeze.

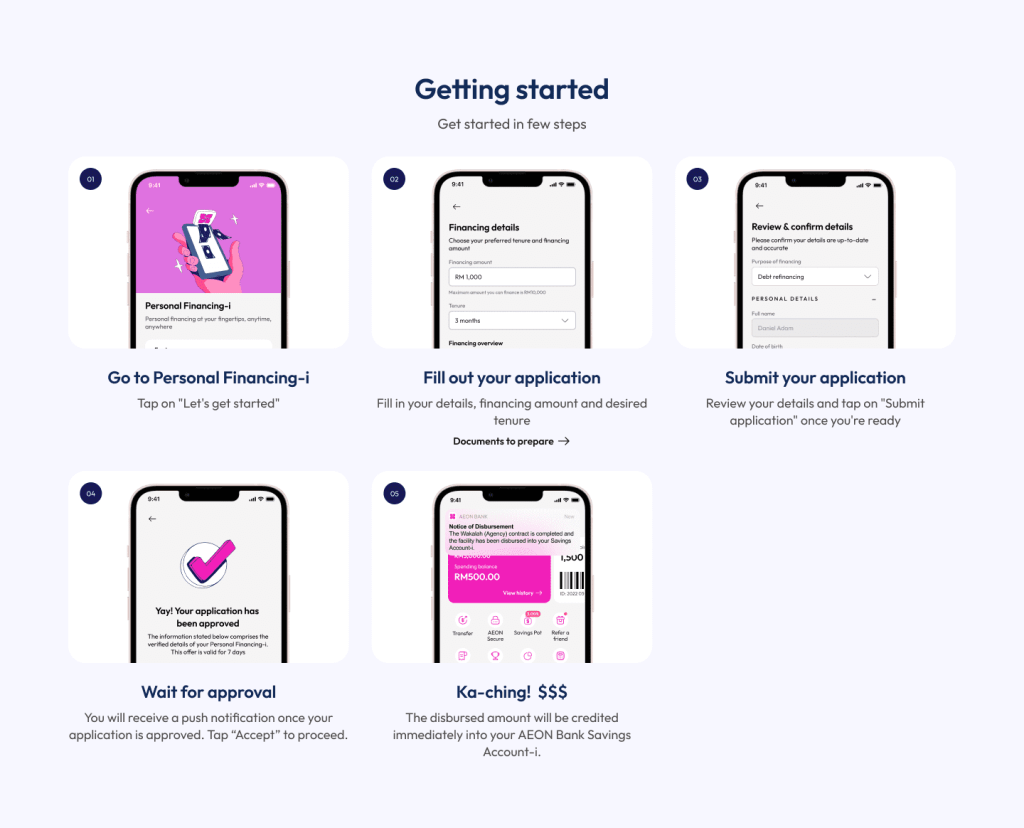

First, speed and convenience where it matters most. School fee payments cannot wait. Neither does the mechanic who’s just told you your car needs major servicing before the balik kampung trip.Thanks to its digital infrastructure, AEON Bank is able to approve your PF-i applications instantly and disburse the fund automatically into your Savings Account-i, so you’re not watching deadlines tick closer while your application sits in a queue.

AEON Bank credits approved funds instantly to your Savings Account-i, so you’re not watching deadlines tick closer while your application sits in a queue.

Second, it’s a hassle-free, zero collateral, 100% purely digital experience that is handled seamlessly on your smartphone. No branch visits, no queues, no taking time off work. The AEON Bank app handles the entire application, and no collateral is required.

Thirdly, manageable monthly commitments. A profit rate starting from 3.88% p.a., combined with payment tenures up to 84 months, lets you adjust payment commitment to something your budget can actually handle. A financing facility of RM10,000 at 3.88% p.a. over 60 months means monthly payments of around RM185. That’s easier to manage than finding RM10,000 cash in a single month.

In fact, PF-i optimises a Risk-Based Pricing (RBP) framework to determine a competitive and personalised profit rate. The offered Flat Profit Rate ranges from 3.88% p.a. to 18% p.a., equivalent to an Effective Profit Rate (EPR) ranging from 5.81% p.a. to 31.76% p.a., depending on factors such as financing tenure and credit history. A nominal Wakalah Fee of RM1 is charged upon acceptance.

Download the App & Apply for PF-i Today!

AEON Bank Personal Financing-i is available through the AEON Bank app. Download it, check your eligibility, and see what financing options you qualify for, all without affecting your credit score until you formally apply.

To qualify, you need to be a Malaysian citizen or permanent resident, aged 18 – 55, with a minimum monthly income of RM2,500. Whether you are salaried employees, or self-employed individuals and workers, anyone can apply for PF-i via the AEON Bank digital banking app.

When the budget constraints are stressing you out, a responsible financing solution option beats scrambling for options that adds on to financial stress. With the right planning and a financing option that fits your budget, you don’t have to. Check out the PF-i and see how it may serve your budgetary needs and purposes – be it an emergency financial support, family budget constraint, small renovation, vehicle repair or the much needed financial aid to bridge the temporary cashflow gaps.

Learn more about AEON Bank Personal Financing-i and empower yourself with flexible financing today.

Comments (0)