Latest Articles

Sales and Services Tax

MOF: SST Revisions Do Not Justify Hotel Rate Hikes

The Ministry of Finance (MOF) has stated that recent changes to the Sales and Service Tax (SST) do […]

Sales and Services Tax

Don’t Worry, Your Ramly Burger and Ice Won’t Cost More – For Now

There is good news for anyone worried about paying more for ice or burgers. The ice supplier Sim […]

Sales and Services Tax

Expanded SST Framework Applauded, Timely Move To Strengthen Malaysia’s Fiscal Resilience

The Chartered Tax Institute of Malaysia (CTIM) has welcomed the government’s decision to expand the Sales and Services […]

Sales and Services Tax

Hotel Room Prices May See Up To 50% Increase Following New SST Rate

Several local hotel associations have estimated that hotel prices in Malaysia could increase by 10% to 50%, following […]

Sales and Services Tax

PSA: 8% SST Not Applicable For Credit Cards, To Remain At RM25 Per Card For 2024

The new rate of sales and services tax (SST) for selected taxable services, which is set to be […]

Sales and Services Tax

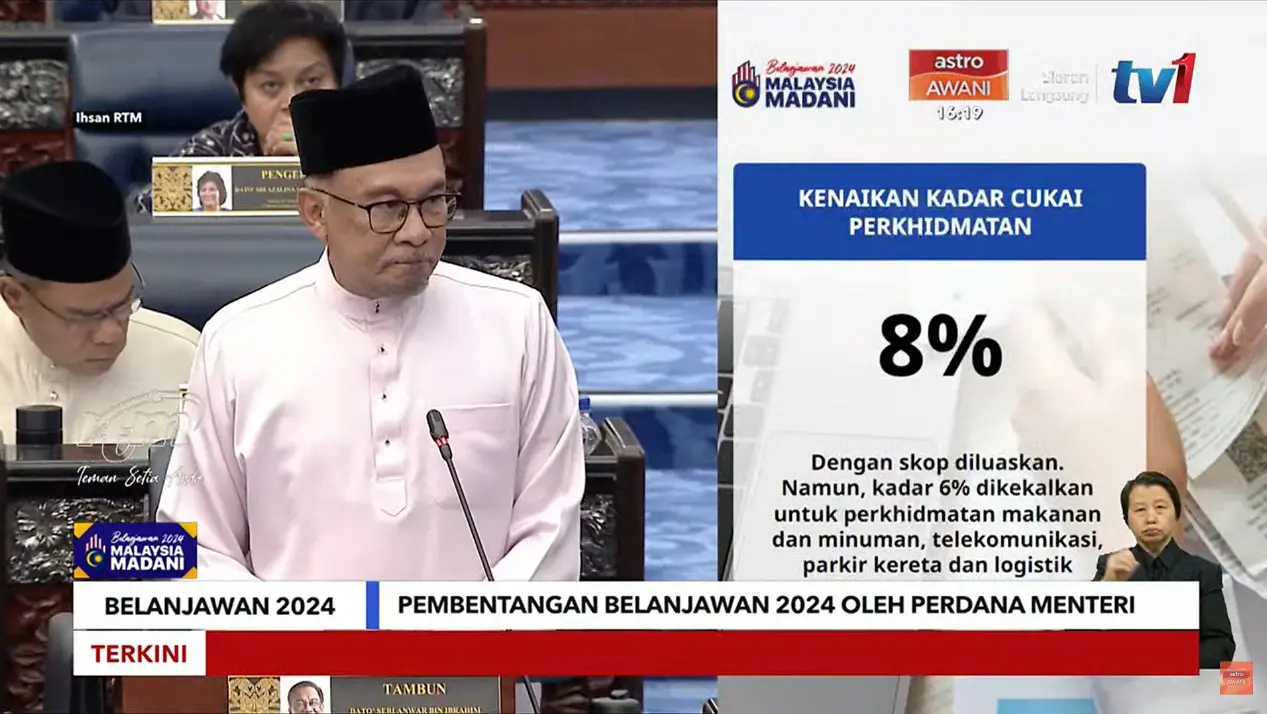

Govt To Increase SST To 8% For Selected Services, Introduce Capital Gains & High-Value Goods Tax

Prime Minister Datuk Seri Anwar Ibrahim has proposed to increase the sales and service tax (SST) from the […]

Sales and Services Tax

PM: Govt Will Not Reinstate GST For Now

Prime Minister Datuk Seri Anwar Ibrahim has said that he will not be reinstating the goods and services […]

Sales and Services Tax

EY: GST Rate Expected To Fall Between 4% To 6% If Reintroduced In Budget 2023

Global financial services firm Ernst & Young Tax Consultant Sdn Bhd (EY) has forecasted that the goods and […]

Sales and Services Tax

Deputy Finance Minister: Not Necessary To Reintroduce GST For Now

Deputy Finance Minister I, Datuk Mohd Shahar Abdullah has commented that the government does not see a necessity […]

Sales and Services Tax

Finance Minister: Vehicle SST Exemption To End On 30 June As Planned

Finance Minister has confirmed that the sales and services tax (SST) exemption for the purchase of vehicles will end on 30 June 2022 as planned.

Load More

Posts pagination

Get personal finance news in your inbox weekly

Subscribe to our exclusive weekly newsletter and we’ll bring you the week’s highlights of financial news, expert tips, guides, and the latest credit card and e-wallet deals.

Thank you

for subscribing!

Stay tuned for what’s to come next in the personal finance world