Alex Cheong Pui Yin

3rd January 2024 - 2 min read

The new rate of sales and services tax (SST) for selected taxable services, which is set to be raised from the current 6% to 8% starting from 1 March 2024, will not apply to credit and charge cards. This means that the SST charge for these cards will remain unchanged at the current rate of RM25 per card (for both principal and supplementary cards).

The introduction of the new 8% SST rate was first announced by Prime Minister Datuk Seri Anwar Ibrahim during the tabling of Budget 2024, where he said that it will be applicable to all taxable services, except for selected essential expenses like food and beverages (F&B) and telecommunication services. This is to avoid burdening the people unnecessarily.

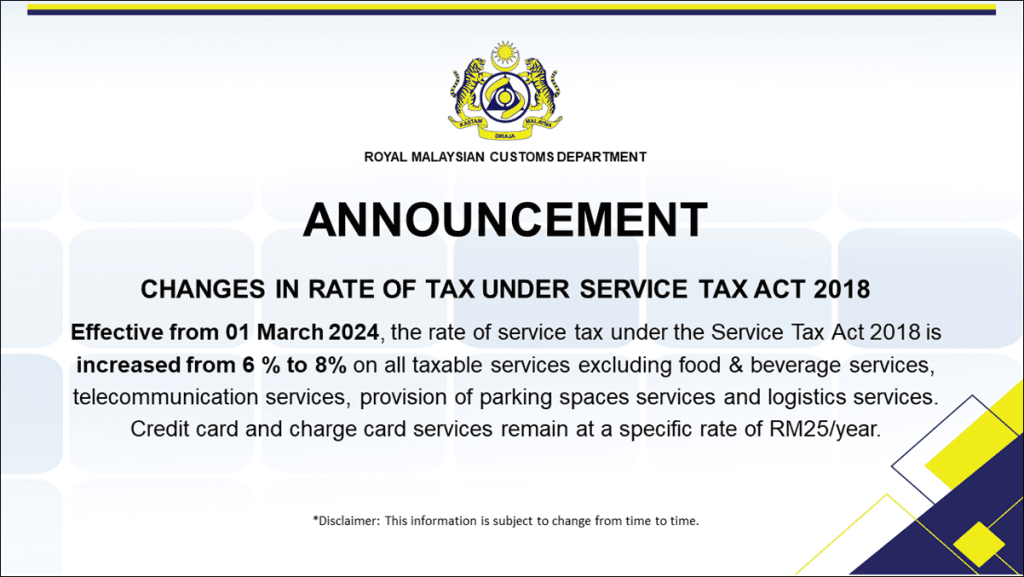

Subsequently, the Royal Malaysian Customs Department (RMCD) shared further details on the matter via a notice on their website, stating that the new SST rate will be implemented on all taxable services excluding F&B services, telecommunication services, provision of parking spaces services, and logistics services. On top of that, it also said that “credit card and charge card services remain at a specific rate of RM25/year.”

Here’s RMCD’s notice in full for your convenience – although we are unable to confirm when this notice was posted and were informed about it by one of our readers:

For context, the RM25 SST for credit and charge cards is charged to credit cardholders during the anniversary month of their cards. New cardholders, too, are required to pay the amount upon activating their credit cards.

Additionally, the service tax for credit and charge cards was set at the present rate of RM25 when the current SST model came into effect back in September 2018. Prior to that, cardholders were required to pay a service tax of RM50 per year on each principal card, and RM25 per year on each supplementary card.

(Source: RMCD)

Comments (0)