Alex Cheong Pui Yin

13th October 2023 - 2 min read

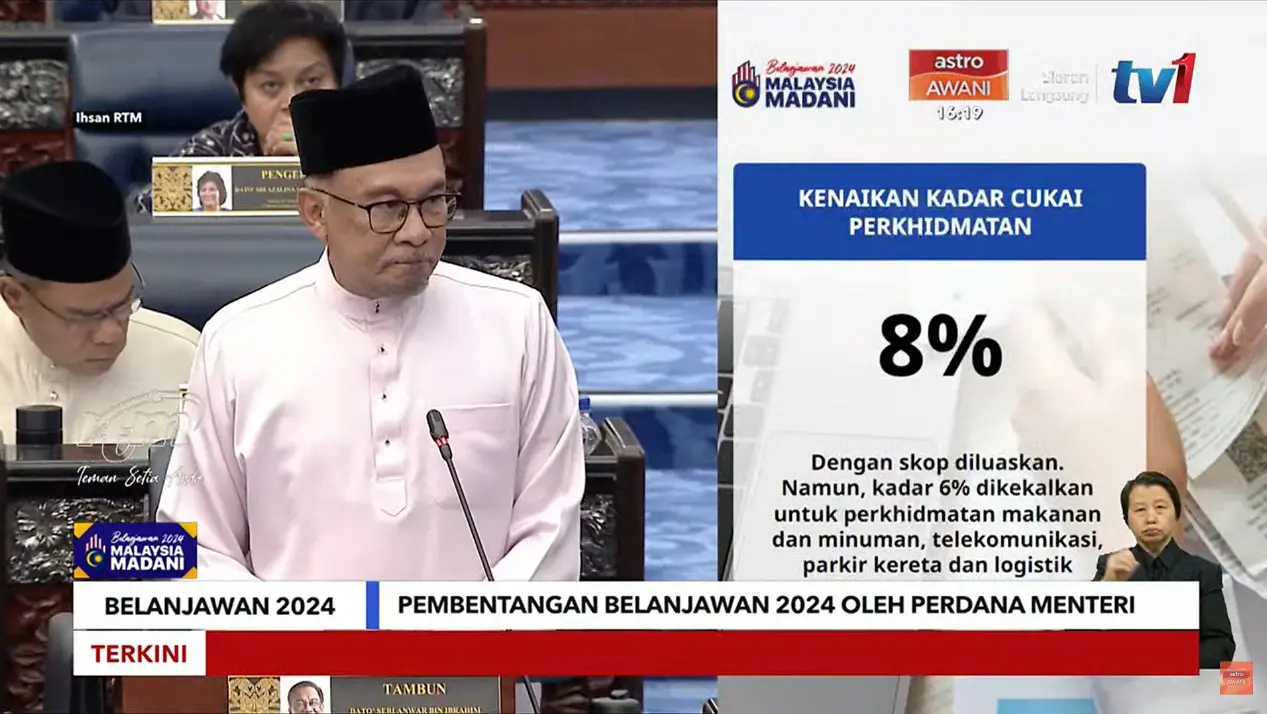

Prime Minister Datuk Seri Anwar Ibrahim has proposed to increase the sales and service tax (SST) from the existing 6% to 8% in the tabling of Budget 2024 today. However, the implementation will be limited to selected services and industries so as not to burden the people.

As an example, Datuk Seri Anwar said that the 2% increase in SST will not be applicable to services such as food and beverages (F&B) and telecommunication as they are essential expenses of the people. Additionally, the government will expand the scope of taxable services in 2024 to include logistics, brokerage, underwriting, and karaoke services. These services are currently not subjected to service tax.

Aside from that, the government will also begin implementing capital gains tax on the disposal of unlisted shares by local companies starting from 1 March 2024, at a rate of 10%. It may, however, be exempted for selected circumstances, such as the disposal of shares for initial public offerings (IPOs), internal restructuring, and venture capital firms – subject to set conditions.

Thirdly, Datuk Seri Anwar also proposed the implementation of high-value goods tax at a rate of 5% to 10% on certain high-value items. These include jewelleries and watches, based on its value threshold.

The introduction of both the capital gains tax and high-value goods tax, specifically, is an extension from the prime minister’s previous announcements during the re-tabling of Budget 2023 back in February 2023, where he had already indicated that the government intends to introduce a luxury goods tax and capital gains tax.

Comments (2)

Any idea when is the effective rate of SST to 8%?

Expected in 1st march