Alex Cheong Pui Yin

8th April 2020 - 4 min read

(Image: TheSkop)

Malaysian telcos, Celcom and Digi, have partnered with insurance providers to offer Covid-19 insurance protection for their customers amidst the spread of the Covid-19 pandemic. These digital healthcare initiatives will provide short-term coverage for those who may require hospitalisation and treatment during this time.

Digi: Covid-19 Cover Insurance Plan

Campaign period until 30 April 2020

Digi is collaborating with Gibraltar BSN to offer free Covid Cover insurance plans for the first month to the earliest 200,000 customers to sign up for the coverage.

The plan will provide 30 days of free coverage upon approval, during which you will be entitled to a hospital cash benefit of RM60 per day for hospitalisations due to Covid-19. It also offers a death benefit of RM20,000.

The fully digital-enabled insurance plan is open to Malaysians aged between 18 and 60. Those who wish to apply for it will not need to undergo any form of medical examinations. Note, though, that you will need to sign up for this offer through your MyDigi app as it is an exclusive app-only deal. You will also be prompted to re-subscribe to the Covid Cover plan for a fee when your free coverage for the first month is about to end.

The telco further added that Digi customers who have missed this free offer can subscribe to any of the various coverage packages that they offer, with fees ranging between RM5 to RM20 per month for 30 days of coverage.

“All the plans offer full coverage, including hospital cash benefits, death and total permanent disability (TPD) benefits including additional benefits in the event a patient suffers from dengue or zika,” said the telco. It also clarified that postpaid customers will be able to pay for the monthly premiums via their phone bills, whereas prepaid customers will have the amount deducted from their prepaid credit.

The Covid Cover insurance plan is available to non-Digi users through a separate channel as well, and they can pay for the plan via debit and credit cards.

(Source: Bernama)

Celcom: Aspirasi C-Protect Insurance Covid 19 Assist Campaign

Campaign period until 31 December 2020

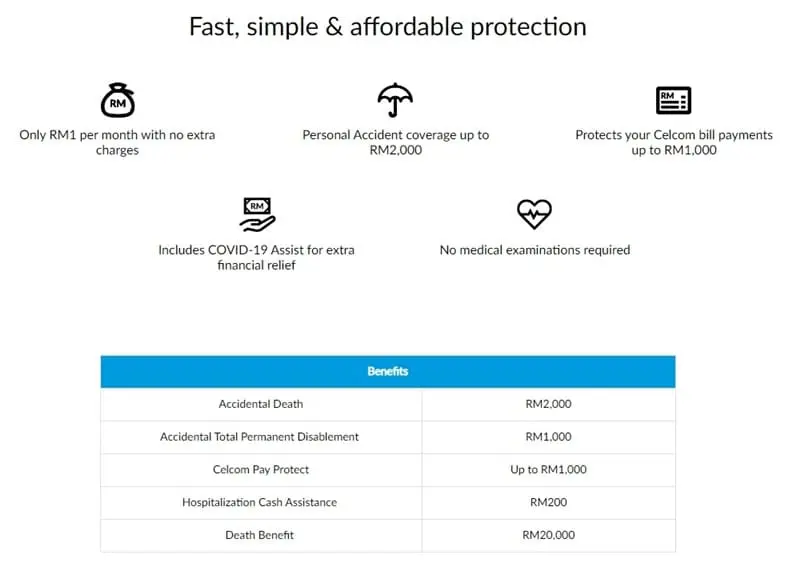

The Aspirasi C-Protect insurance coverage offered by Celcom is essentially a 24-hour worldwide group personal accident (PA) insurance, with additional Covid-19 Assist protection. It is underwritten by Great Eastern, and costs RM1 each month to maintain.

The Aspirasi C-Protect PA insurance offers benefits of RM2,000 sum insured for accidental deaths, as well as RM1,000 for accidental permanent disablement benefit. It also allows up to RM1,000 of reimbursement for the last bill of your Celcom services in the event of your accidental death, accidental permanent disablement, or hospitalisation for more than 4 days due to an accident.

Under the additional Covid-19 Assist coverage, you will be entitled to RM200 per day, up to 60 days, if you are hospitalised and quarantined at any Ministry of Health-designated hospitals when diagnosed with Covid-19. You can also claim a death benefit of RM20,000 upon death due to the coronavirus.

Celcom’s insurance protection plan is open to both new and existing Celcom postpaid and prepaid customers aged between 16 to 80 years of age, encompassing both Malaysians and foreigners legally residing in Malaysia. It also does not require you to go through medical examinations to purchase. You will, however, need to maintain an active Celcom line until the campaign ends on 31 December 2020.

To sign up for the campaign, you will need to dial *365*6#, and subscribe through the USSD. Alternatively, you can also subscribe through the Celcom Life App, or by responding to the SMS notification or USSD invitation from Celcom.

For more information, you can check out the full FAQ from Celcom’s website.

***

These deals by Digi and Celcom are one of the initiatives taken by the telcos to help their customers through this period of Covid-19 pandemic and movement control order (MCO). They are also offering free internet access daily for its customers via the Prihatin Economic Stimulus Package.

Comments (0)