Jacie Tan

4th September 2020 - 2 min read

Fi Life has expanded its existing 20-year term life insurance policy to include 10, 15, 25, and 30-year terms as well. With these additions, customers will be able to enjoy fixed premiums for a period of up to 30 years with no increases in the premium price.

As explained by Fi Life, these different level term durations give flexibility to customers to select the term duration that is best suited to their needs. “For example, a parent with very young children might opt for a 20 or a 25-year level term policy, where the coverage period lasts until his children reach working age,” Fi Life said on its website. “For the same reason, another parent, but with teenage children, might select a shorter 10-year level term policy.”

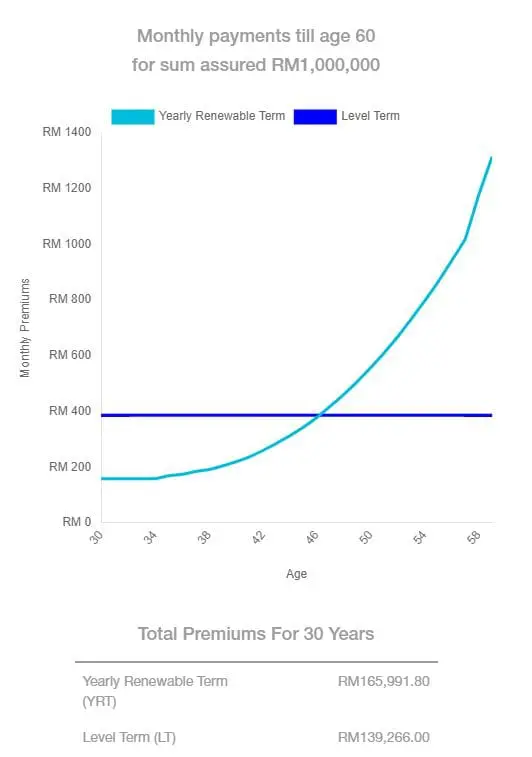

Fi Life and its underwriter Tokio Marine revealed that they co-developed the new level term policies based on feedback from customers and financial planners. According to Fi Life, its term-life policies can provide a price saving of up to 57% for a 30-year term premium in comparison with a yearly renewable term plan for a 40-year-old non-smoking male.

Illustration provided by Fi Life on the potential savings achieved with a level term policy

Illustration provided by Fi Life on the potential savings achieved with a level term policy

Fi Life also provides yearly renewable term policies, where the premiums start out lower but increase slightly every year with the policyholder’s age. Both types of life insurance policies provided by Fi Life come with a critical illness add-on option.

Thanks to our partnership with Fi Life, RinggitPlus readers can enjoy an exclusive 10% rebate on their first-year premium! Simply purchase a Fi Life policy through this link and enter the code RPLUS10 at the payment section.

(Source: Fi Life)

Comments (0)