Eloise Lau

9th January 2026 - 8 min read

School supplies are barely paid off. Between uniforms, textbooks, and new shoes for kids who’ve outgrown last year’s pair, January has already taken a serious bite out of your wallet. And now you’re staring at the calendar, realising that Chinese New Year falls on 17 February, Ramadan would likely begin on 19 February, and Hari Raya might approximately arrive on 21 March.

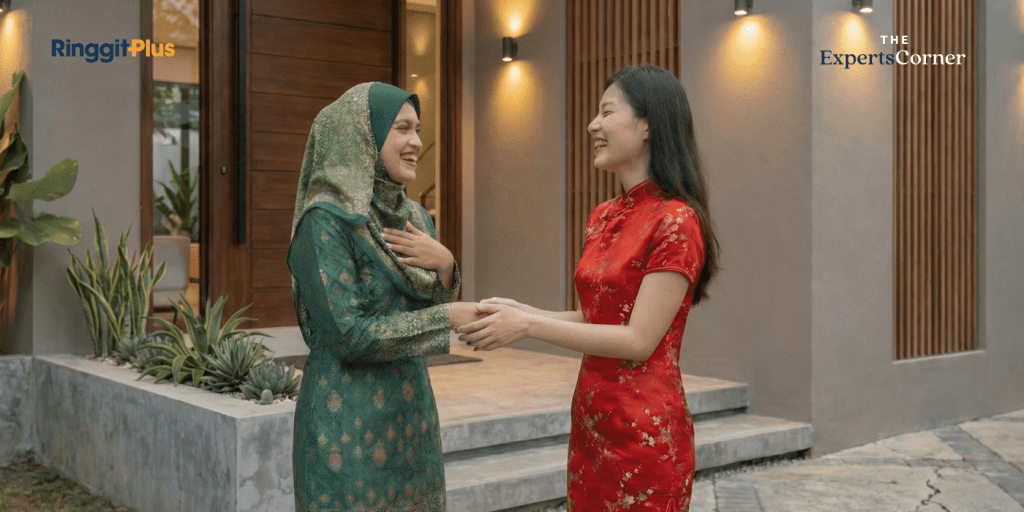

For young Malaysian families, 2026 brings a rare calendar crunch. Whether you’re celebrating CNY, Raya, or both, the timing creates a perfect storm: back-to-school expenses flowing straight into festive spending, with barely a paycheque in between to recover. You’re juggling Balik Kampung logistics with young kids, giving out Angpow or Duit Raya for the first time as “the adults,” and possibly hosting guests at your first home. Your parents did this with one income and somehow survived. Now it’s your turn.

You can still celebrate properly. You just need to pace your spending so April doesn’t arrive with an empty bank account.

Pace Yourself (Don’t Sprint At The Start)

January’s back-to-school spending has already stretched most family budgets thin. The biggest mistake now is treating your festival as a standalone event when your finances haven’t recovered from the school year kickoff.

A temporary tweak to your monthly budget across February and March can make all the difference. If you normally follow something like a 50/30/20 split (needs, wants, savings), consider shifting to 60/25/15 just for these two months. The extra 10% in your “needs” category covers festive expenses without blowing up your emergency fund.

For big, unavoidable purchases, look into 0% instalment plans. That new air-conditioner for the guests or the tyre change before the highway drive doesn’t have to drain your account in one hit. Spreading RM2,000 over 12 months keeps cash in your pocket for the RM50 Angpow packets you’ll be handing out.

If you’re using e-wallets like Touch ‘n Go or GrabPay, check whether they’re running any festive cashback promotions. These platforms often boost rewards during CNY and Raya periods, so timing your big grocery runs or online shopping to coincide with these promotions can stretch your ringgit further.

Buy Once, Use Twice

Some purchases can work double duty if you think ahead, whether that’s across two festivals for mixed-heritage families, or simply getting more mileage out of what you buy for your own celebration.

Go Neutral on Decor

If you’re celebrating both CNY and Raya, skip the loud reds and deep greens that only work for one festival. Go for “festive gold” tones, warm fairy lights, and floral arrangements with orchids or lilies instead. These colours read as elegant celebration regardless of which festival is happening, and you won’t need to swap everything out halfway through.

Even if you’re only celebrating one, neutral-toned decor can be reused for birthdays, anniversaries, or next year’s festivities. You’ve just cut your decoration budget for the whole year.

If you’re feeling crafty, reuse CNY Angpow or Raya envelopes to make your own lanterns. It’s a fun activity for the whole family, and the kids get to contribute to the decorations.

Create Your Own Gift Hampers (Or Just Smarter Ones)

If you give gifts to clients, neighbours, or colleagues, consider what works across different households. Premium nuts, sparkling juices, and high-quality butter cookies are appreciated by everyone, regardless of which festival they’re celebrating. Buy supplies in bulk from Lotus or NSK, and you’re looking at savings of 30-40% compared to buying pre-made hampers.

Stretch the Kids’ Festival Wardrobe

Children’s festival outfits add up fast, especially right after you’ve just bought school uniforms and shoes. Rather than buying a full themed outfit they’ll wear once, consider high-quality basics in neutral or pastel colours that can be dressed up with festive accessories.

A nice neutral kurta top works for Raya mosque visits. A simple, well-cut dress or smart pants can be styled with red or gold for CNY. Your kids stay comfortable, and you’ve spent on one quality piece instead of a cheap themed outfit that falls apart after one wear.

The same logic applies to your own festive wardrobe. A smart outfit that works for CNY or Raya can double as wedding dinner attire or work function wear later in the year. Buy clothes that fit multiple occasions, and you’ll get far more value per ringgit.

Balik Kampung Logistics

If you’re driving back to Ipoh, JB or Kelantan, the petrol and toll costs alone can strain a budget that’s already recovering from school expenses. And in 2026, the timing overlap means highways will be busier than usual, CNY travellers returning home will cross paths with families stocking up for Ramadan.

Top Up Before the Jam

Top up your Touch ‘n Go e-wallet before the jam starts. The week before each festival, reload stations get packed, and you don’t want to be that car holding up traffic at the toll booth with a declined card and a screaming toddler in the back seat.

For petrol, check if your e-wallet has any fuel partner discounts. Setel often runs promotions at Petronas stations, while Touch ‘n Go occasionally offers cashback at Shell. On a RM300 tank fill, even a 5% discount saves you RM15, just enough for an extra packet of kuih.

Service Your Car Early

Car service workshops get slammed the week before each major festival. By the time your Balik Kampung date approaches, they’re booked solid and charging premium rates for urgent appointments, sometimes 20-30% more than regular pricing. That’s an extra RM100-150 you could’ve spent on festive food.

Schedule your car service in late January or early February, before the CNY rush hits. Get the full works done: tyres checked, oil changed, air-conditioning serviced, brake pads inspected. You avoid the panic of realising your car needs work when every mechanic in town is fully booked.

Managing Angpow And Duit Raya

Young parents face an uncomfortable shift: you’re now on the giving side. Your nieces and nephews are multiplying. Your parents’ friends all seem to have grandchildren. And somehow, you’re expected to produce packets for all of them, right after paying for school books and uniforms.

Go Digital Where You Can

DuitNow and e-Angpow make tracking so much easier than withdrawing a lump sum of cash that somehow “disappears” over the festive period. You know exactly how much you’ve sent, to whom, and when. Some banks even offer festive-themed digital packets that feel just as special as physical ones.

For close family, physical packets still feel meaningful. But for casual giving at open houses or to colleagues’ kids, digital transfers are increasingly accepted and keep your spending visible.

Set a Per-Family Cap

You have young children. Everyone understands that your family is in receiving mode more than giving mode right now. Use this to your advantage.

Set a “per family” cap rather than a “per person” cap for relatives you see once a year. RM50 per family feels reasonable and adds up to far less than RM20 per child when some families have four or five kids. For immediate family (your own parents, siblings), you can be more generous, but set a hard number before the festivals begin and stick to it.

Nobody remembers whether they got RM20 or RM30 in a packet. They remember whether you showed up, whether the kids had fun, and whether the food was good. Focus your money on the memories, not on impressing distant aunties with packet thickness.

Spread Out Your Open House Visits

Six weeks of festivities is a marathon, not a sprint. Spread your spending across the full period, and don’t try to do everything in the first week of each festival.

Stock up on non-perishable festive food (cookies, nuts, drinks) during pre-festival sales in late January. Accept that you won’t visit every relative’s open house. Pick the important ones and let go of the guilt. If you’re hosting, consider one combined open house during the overlap period. Two separate events means double the cooking, double the cleaning, and double the cost. And build in rest days. Your kids (and your wallet) need recovery time between celebrations.

Make It To April

The 2026 calendar crunch is real, thanks to school expenses flowing into festive spending with barely a break. Whether you’re celebrating CNY, Raya, or welcoming friends from across communities to your open house, a bit of planning and realistic expectations about what you can afford will get you through with your savings intact.

We’ll be posting more festive guides throughout the season, from Chinese zodiac wealth productions, Ang Pow reviews and digital Angpow options to Raya buffet promotions.

Don’t Miss Out! Stay tuned to RinggitPlus or follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)