Eloise Lau

9th December 2025 - 6 min read

Every month, 11% of your salary disappears into your EPF account, matched by another 12-13% from your employer. For most working Malaysians, that money sits there quietly until retirement or until you need to check your balance for a loan application. But here’s the thing: your EPF account can tell you a lot about whether you’re actually on track for retirement, and most people never look closely enough to find out.

The Quick Way To Check Your Balance

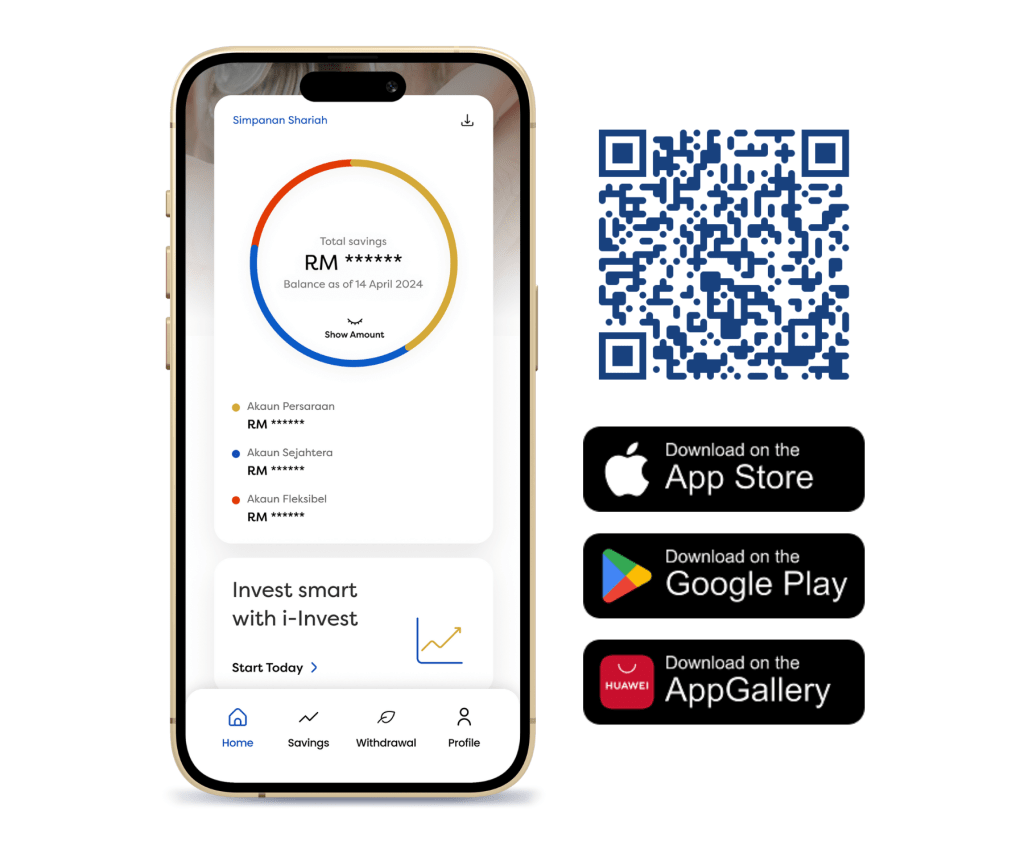

The fastest way to see your EPF balance is through i-Akaun, EPF’s online portal. You can access it via the KWSP website or through their mobile app. If you haven’t set up your i-Akaun yet, you’ll need to register first by visiting any EPF branch for fingerprint verification, or you can get your employer to register you through their system.

Once you’re logged in, your current balance appears on the home screen, broken down into your three accounts: Akaun Persaraan, Akaun Sejahtera, and Akaun Fleksibel. If you prefer not to go online, you can also check your balance by calling the EPF hotline at 03-8922 6000 or visiting the nearest EPF branch or kiosk.

Understanding What’s A Good Dividend Rate

Since 2009, EPF has consistently delivered dividends above 5% per year, with an average of around 5.91% over the past decade. The statutory minimum is 2.50%, but EPF has never paid out that low in recent history.

Here’s how EPF dividend rates have performed over recent years:

| Year | Simpanan Konvensional | Simpanan Shariah |

| 2024 | 6.30% | 6.30% |

| 2023 | 5.50% | 5.40% |

| 2022 | 5.35% | 4.75% |

| 2020 | 6.10% | 5.35% |

| 2019 | 5.20% | 4.90% |

| 2018 | 5.45% | 5.00% |

| 2017 | 6.15% | 5.90% |

| 2016 | 6.90% | 6.40% |

The 2024 rate of 6.30% means that if you had RM100,000 in your account throughout the year, you would earn RM6,300 in dividends. For context, fixed deposits at Malaysian banks currently offer rates between 2.50% to 3.50% per year, and EPF consistently beats these returns.

How To See Your Year-on-Year Growth

Download your EPF statement through i-Akaun, which shows your balance and transactions for the year. You can access statements for the past five years.

Your statement shows: total balance at the start of the year, all contributions received (yours and your employer’s), dividend credited, any withdrawals made, and closing balance. When comparing statements from different years, your balance should increase from three sources: monthly contributions (11% from you and 12-13% from your employer), annual dividend, and ideally minimal withdrawals.

Checking If Your Employer Is Contributing Correctly

One thing many employees don’t realise is that you can verify whether your employer is making the correct EPF contributions. Your EPF statement lists every contribution by date, showing both the employer’s portion and your portion.

Your employer is required by law to contribute 12% of your salary if you earn RM5,000 or less, or 13% if you earn above RM5,000. You contribute 11% of your salary regardless of your income level. These contributions must be made by the 15th of each month for the previous month’s salary.

If you notice missing contributions or amounts that seem incorrect, you can check with your employer first. If there’s been a delay or error, they’re required to make up the contribution plus interest. If the issue persists, you can lodge a complaint with EPF through their online complaint system or by visiting any EPF office.

What Affects Your Account Growth

Your salary is the biggest factor in how fast your EPF savings grow, since contributions are percentage-based. For example, if you earn RM3,000 per month, your combined contributions (yours and your employer’s) come to about RM720 monthly. Get a promotion to RM5,000 per month, and your monthly contributions increase to RM1,200. That’s RM480 more each month, or RM5,760 more per year going into your EPF account.

Voluntary contributions can significantly boost your savings. EPF allows you to make additional contributions beyond the statutory 11%, and your employer can also contribute more than the required amount. Some people make lump-sum voluntary contributions at the start of the year to maximise the dividend earned.

Withdrawals are the other major factor. EPF allows pre-retirement withdrawals for specific purposes like housing, education, and healthcare. While these withdrawals can be useful, they reduce your retirement savings, and you lose out on future dividends that money would have earned.

Here’s a worked example showing how these factors affect annual growth:

Example: Sarah, age 30, earning RM5,000 per month

- Starting balance 1 January 2024: RM80,000

- Monthly contributions (11% + 13%): RM1,200 × 12 = RM14,400

- Dividend on starting balance (6.30%): RM5,040

- Dividend on monthly contributions: ~RM450

- Total growth in 2024: RM19,890

- Ending balance 31 December 2024: RM99,890

If Sarah made a housing withdrawal of RM30,000 in June:

- Balance after withdrawal: RM50,000 (roughly)

- Lost dividend on withdrawn amount: ~RM950

- Ending balance: Around RM69,000 instead of RM99,890

The example shows why withdrawals have such a big impact. Sarah’s RM30,000 housing withdrawal reduced her final balance by RM30,950. The withdrawal itself plus nearly RM1,000 in lost dividends for just six months. That gap keeps growing every year because of compound interest.

What To Do If Your Savings Aren’t Growing Enough

When you review your EPF account and notice your savings aren’t growing as much as you’d like, start by understanding why. Is your salary low, making contributions small? Are you making frequent withdrawals? Has your employer been inconsistent with contributions?

Once you know the issue, you can take action. Low salary means focusing on career advancement or considering side income that can boost your EPF contributions. Frequent withdrawals need reviewing. Try to limit future ones to true needs, not wants.

For missing employer contributions, act quickly. Check your EPF statement regularly (at least quarterly), so you catch any issues early. The longer you wait, the harder it might be to resolve missing contributions.

You can also supplement EPF with other savings vehicles. Private Retirement Schemes offer similar tax benefits to EPF, and unit trusts can provide potentially higher returns, though with more risk.

Making EPF Checking A Regular Habit

Download your EPF statement at least once a year, ideally after the annual dividend is credited in March. Compare it to the previous year’s statement and look for steady growth in three areas: contributions received, dividends credited, and total balance.

Set a calendar reminder for the first week of April each year. Log into i-Akaun, download your statement, and spend 15 minutes reviewing it. Check that all monthly contributions are there, verify the dividend amount makes sense based on your balance, and note your total growth for the year.

Your EPF account grows quietly in the background, but paying attention to it helps you spot problems early and make better decisions about voluntary contributions, withdrawals, and retirement planning. The earlier you start monitoring it properly, the more control you have over your retirement savings.

Follow us on our official WhatsApp channel for the latest money tips and updates.

As a creative content writer, Eloise has covered finance, business, lifestyle topics, and even moonlights as a singer-songwriter outside of RinggitPlus. Her current interests are learning the best ways to optimise spending and credit card hacks to gain more airline miles.

Comments (0)