Christina Chandra

10th November 2025 - 6 min read

Personal accident insurance sounds straightforward enough. You get hurt, insurance pays out. Simple, right? Not quite. Most people discover how their policy actually works only when they file a claim, and the confusion can cost thousands of ringgit.

The biggest misconception? Thinking personal accident insurance works like medical insurance. They’re completely different products that pay out in completely different ways.

What’s the Difference Between Personal Accident and Medical Insurance Claims?

Personal accident insurance pays you a set amount when you get injured. Your hospital bill could be RM2,000 or RM8,000, but if your policy says broken arm equals RM5,000, you get RM5,000. The actual cost doesn’t matter.

Medical insurance works the opposite way. It pays your actual medical bills, either to you or directly to the hospital.

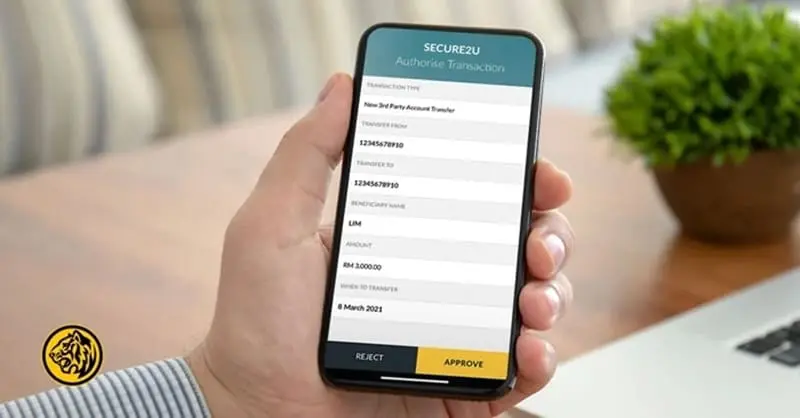

With personal accident insurance, you handle the claim yourself. Send in proof that you got injured, usually medical reports and X-rays. The insurer checks that your injury is covered, then transfers the money straight to your bank account.

Once that money hits your account, you decide how to spend it. Medical bills, Grab rides to the hospital, groceries while you’re recovering, whatever you need. Medical insurance can’t help with these extra costs, but personal accident insurance gives you cash to handle them.

Does Personal Accident Insurance Cover Injuries From Sports or Extreme Activities?

Most standard policies exclude organized sports entirely. Your regular badminton league, weekend futsal games, even amateur cycling competitions all fall outside standard coverage. Insurers view these as regular activities with predictable injury risks, not unexpected accidents.

Extreme sports always require separate coverage through optional riders. The standard exclusion list covers skydiving, BASE jumping, scuba diving beyond 40 metres without PADI or equivalent certification, rock climbing, skiing outside marked trails, motor racing, and white-water rafting. Less obviously extreme activities like mountaineering with ropes, competitive cycling, triathlons, and martial arts competitions also commonly appear on exclusion lists.

Standard policies stick to covering everyday accidents like slipping on wet floors, motorcycle collisions, or falling down stairs. Insurers price high-risk sports separately because they represent voluntary risk-taking rather than unforeseen accidents.

Can I Claim if I’m Injured in an Accident That Was My Fault?

Simple carelessness doesn’t void your coverage. Tripping over your own feet and breaking your ankle qualifies for a payout. Causing a minor accident because you weren’t paying attention still counts, assuming your injury meets policy requirements.

The line gets drawn at intentional behaviour. Deliberately causing injury voids everything. Suicide attempts and self-harm receive no coverage, and insurers actively investigate suspicious claims that look like fraud attempts. Filing false claims or exaggerating injuries can lead to criminal charges beyond just losing your payout.

Certain behaviours also eliminate coverage. Getting injured while drunk or high typically leads to claim rejection. Injuries sustained during criminal activity receive automatic denials. For genuine accidents where you simply made a mistake or weren’t careful enough, coverage applies normally.

What Injuries or Situations Are Typically Excluded From Coverage?

Personal accident insurance only covers injuries from sudden physical impact or force applied from outside your body. Anything developing from internal medical conditions gets excluded. Bacterial infections, dengue fever, and food poisoning all fall outside coverage because they stem from illness rather than physical trauma.

Pre-existing conditions create frequent claim disputes. Aggravating an old back injury or experiencing complications from diabetes management typically leads to denial. Insurers argue these stem from existing conditions rather than new accidents.

Pregnancy and childbirth complications never qualify. Insurers classify pregnancy as a natural biological process. Even serious delivery complications won’t trigger payouts. Insect bites and stings also fall outside standard coverage unless you’ve purchased specific envenomation riders.

Large-scale catastrophic events receive universal exclusions. War, terrorism, and nuclear incidents fall too far outside normal risk calculations for standard policies. On a completely different scale, elective cosmetic procedures also get excluded. The policy covers only unexpected accidents, not complications from planned surgeries you chose to undergo.

Some policies limit coverage for long-term consequences. The immediate injury gets covered, but extended physiotherapy months later or chronic pain developing from the original trauma might not qualify. The payout typically covers the accident itself rather than ongoing management of lasting effects.

How Long Do I Have to File a Claim After an Accident Occurs?

Contact your insurer within 24 to 72 hours of your accident. While some policies allow more flexibility, prompt reporting strengthens your claim and starts the process immediately. Delaying notification by weeks makes insurers suspicious about whether the accident actually happened as you describe it.

The binding deadline appears when submitting your complete claim documentation. Most policies specify 30 to 45 days from the accident date, though this varies by insurer. Check your policy document for the exact timeframe, because this deadline determines whether you receive any payout at all.

Missing this submission deadline means forfeiting your entire claim, even for injuries that clearly qualify under policy terms. Extensions require extraordinary proof like ICU admission records showing you were physically incapable of filing. Standard excuses like being busy or forgetting won’t work.

Collecting required documentation takes longer than most people expect. You need original medical reports from your treating doctor, X-ray or CT scan results, detailed doctor’s certificates specifying your diagnosis, and accurately completed claim forms with all required signatures. Hospitals may take several days to release these documents. Start requesting everything immediately after your accident rather than waiting until a few days before the deadline.

Read the Exclusions Before Comparing Prices

Most people shop for personal accident insurance by comparing premiums and payout amounts. That’s backwards. The exclusions list matters far more, because it determines whether you’ll actually receive anything when you need it.

Generous payout schedules mean nothing if your lifestyle involves excluded activities. Regular sports participation requires verifying exactly what your sports rider covers, as generic sports coverage often excludes specific activities you actually do.

Match your coverage to your actual financial vulnerabilities. Calculate what three to six months off work would cost you. Add your medical insurance deductible. Factor in likely transport and care costs during recovery. Your personal accident benefit should comfortably cover these combined expenses.

Personal accident insurance works best alongside medical insurance, not instead of it. Medical insurance handles your hospital bills. Personal accident insurance handles everything else, the deductibles, lost wages, and extra costs that pile up during recovery.

Follow us on our official WhatsApp Channel for the latest money tips and updates.

Comments (0)