RinggitPlus

15th May 2018 - 6 min read

Ever tried squeezing a quick visit to the bank in between lunch breaks to ensure that your monthly bills are paid on time? Or experienced the wrath of getting swamped in a pile of statements, attempting to make sense out of the due dates for every bill in hand?

In any case, wouldn’t it be awesome if there’s a faster and easier method to repay debt, minus the hassle of time-consuming methods that are usually employed? If you would like eliminate debt and have more saved up for your financial plans, then read on to learn how you can benefit from a debt consolidation loan.

How Do I Know If I Need a Debt Consolidation Loan?

Not sure if a debt consolidation loan is something that you need? Here are a few indications that may want to heed to determine if a debt consolidation loan is a fit for your financial freedom goals:

You Can Only Afford to Make Minimum Payment

Have a habit of paying only the minimum for your credit card bills? Time for you to break that habit because not only will this bleed you financially in the long run, it will also take you years to pay off even the lowest debts that you may have incurred.

When you make only the minimum payments on a credit card, it means that it will take you decades to pay off even the lowest debt you may have. A consolidation loan will run for five to 10 years. This is true even if you are only paying the minimum amount.

Although it’s possible for you to dive into a debt management plan (such as an involuntary arrangement) as an effort to reduce interest rates for your debt, do note that while consultation may be provided for free, you will still need to pay for their services (which is a percentage of your overall accrued debt).

And once the arrangement has been agreed upon, you will need to stick to it for the term of the arrangement leaving you with minimum flexibility to change or personalize it in accordance to your economic situation.

You Want a Tidier Credit Report

When you apply for a loan or a new credit card, the most crucial criteria that will determine whether you’ll be able to apply for the new credit (apart from your personal details and annual income) will be your credit score.

In general, a good credit score lies in the range of 650 to 750 whereas an excellent credit score is between 751 to 850. How your credit score is calculated depends greatly on the way you utilise credit – meaning to say the amount of debt you own compared to the total amount of debt that’s available to you.

On the other hand, having a poor credit score (anywhere below 650) would imply that you are a potentially risky customer. Having a risky customer profile will discourage potential banks and lenders from wanting to do business with you as the preference will always be offered to those who are responsible paymasters.

That won’t be the case however, if you took on a debt consolidation loan as all of your bills and loans will be accumulated as one, so your creditors will only see one debt at a time instead of multiple items on your credit score.

You Have Too Many Debts That You Can’t Keep Track Of

According to the Malaysian Financial Planning Council’s (MFPC), out of the 2,000 participants surveyed, 47.2% stated that their income is only sufficient for basic needs, while 12.3% of those surveyed highlighted that their income is not sufficient for living expenses.

As it is, should you find yourself being unable to pay in full for any of your debts or even resorted to putting balances of one card on another just to try and offset the debt, that’s how you know that you should opt for a debt consolidation loan to sort things out.

What Is A Debt Consolidation Loan?

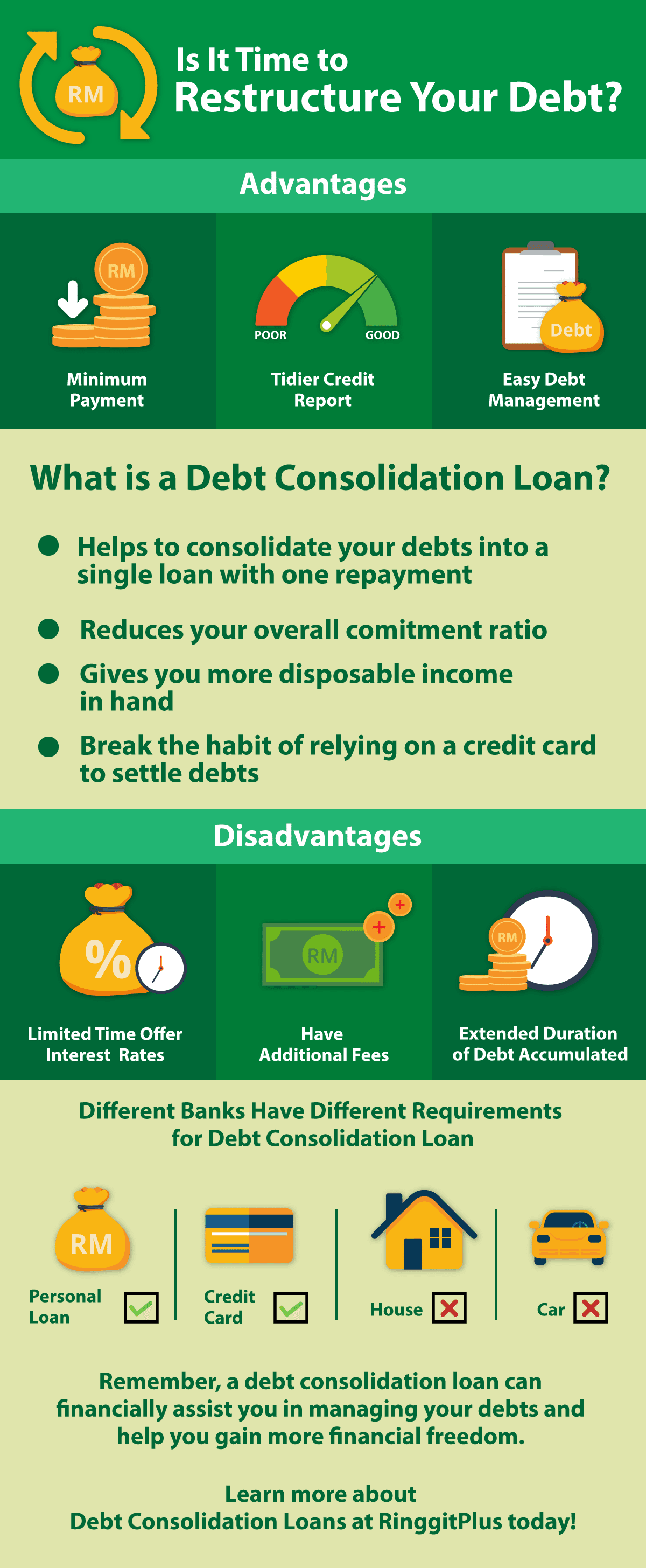

What a debt consolidation loan does is that it helps to consolidate your debts into a single loan with one repayment. You may be having doubts over this as the common perception is that these repayments may cost slightly more and increase the duration of your tenure long, making you stay in debt for a longer period.

With a debt consolidation loan, you will end up paying just one monthly fee. This will then free up cash and reduce your overall commitment ratio. And when there’s more cash in hand, that also translates to a higher disposable income for necessities from your end. This, in turn, will help diminish the habit of relying on your credit cards as a quick measure to settle debts.

Interested in a Debt Consolidation Loan? Take Note Of These…

Can’t wait to get into a debt consolidation plan? Here are the things that you would need to look out for:

- Many of the low interest rates for debt consolidation loans may be offered for a limited time only, all of which will depend on different financial providers.

- The loan may also include fees or costs that you would need to pay such as joining fee, early redemption fee and more.

- Although your monthly payment might be lower, it may be because you’re paying over a longer time. As it is, you will definitely be paying a lot more in the long run. Which is not an entirely bad thing if you are looking to improve your credit score as servicing a debt and paying it on time can play a role in getting your score up.

- Different banks have different requirements when it comes to debt consolidation plans. Some only accept credit card and personal loans, others may accept house or even car loans. All of these comes with different packages at varied interest rates so do remember to shop around!

One Final Tip

We hope that this article is able to help you decide if a debt consolidation loan is something that you should look into for your future financial management goals.

Remember, it will be tough to handle this on your own. In a nutshell, a debt consolidation loan may be able to financially assist you in managing your debts and make informed choices that will help you gain more financial freedom.

This in turn will give you more space to breathe without needing to worry about missing out on a bill or more. Can’t wait to get your hands on a straightforward, no frills debt consolidation loan to sort out your finances? Learn more about Standard Chartered’s CashOne Debt Consolidation Plan and with it’s lower monthly commitment fees, zero stamp duty and processing fees, you are well on your way to financial freedom!

Comments (0)