Jacie Tan

8th March 2019 - 6 min read

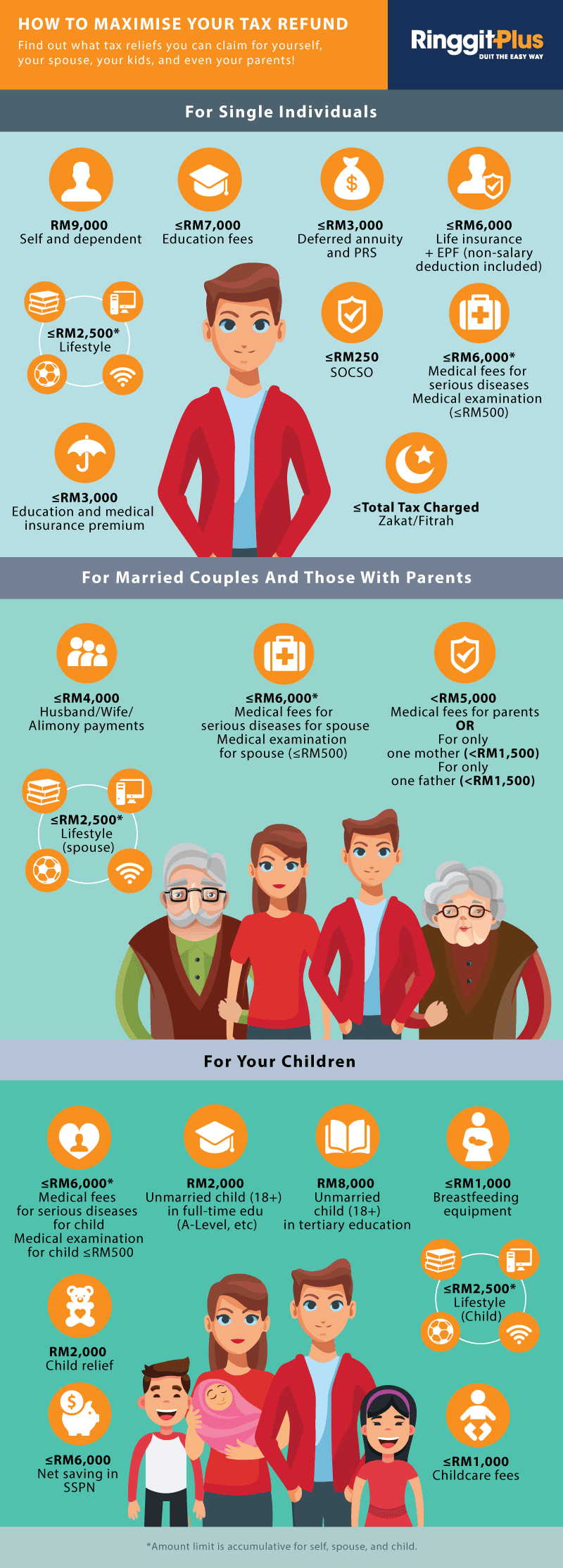

No-one likes seeing a chunk of their hard-earned salary being deducted for tax purposes. If you’re earning above RM34,000 per annum, you’re not going to escape paying your taxes, but what you can do is make sure you get the maximum possible tax refund back. You can do this by identifying all the tax reliefs and tax rebates you are eligible for and claim for them when you file your taxes.

Claiming for tax relief allows you to reduce your chargeable income, but how does this affect your tax refund? As you know, the amount of tax you are charged is based on your amount of chargeable income. If your chargeable income amount is lesser, you will have to pay less tax – sometimes, you may even be charged with a lower tax rate. The Inland Revenue Board explicitly shows the income tax rates for the current assessment year (YA), while we’ve also shown a comparison between the tax rates for YA 2018 and YA 2017.

For example, let’s say your annual taxable income is RM40,000. Based on this amount, the income tax to pay the government is RM1,000 (at a rate of 8%). However, if you claimed a total of RM11,600 in tax relief, your chargeable income would reduce to RM28,400. This would enable you to drop down a tax bracket, lower your tax rate to 3%, and reduce the amount of taxes you are required to pay to RM402.

However, since you are already paying income tax at a higher bracket every month via the monthly tax deductions (MTD) for salaried employees, it is highly likely that you are paying more income tax than you should be. This is where the government has the obligation to refund you the tax you’ve overpaid – which is why the more tax reliefs you claim for, the bigger your tax refund will be. If you’re confused by all these different terms, make sure to check our Income Tax Glossary to set yourself straight.

Here are some examples of tax relief that you can claim to maximise your tax refund in 2019 (for YA 2018).

(Update 12/3/2019: An earlier version of the infographic stated an incorrect value for Breastfeeding Equipment, and has since been rectified. The error is regretted.)

What You Need To Know About Income Tax Reliefs In Malaysia

Lifestyle

You can get up to RM2,500 worth of tax relief for lifestyle expenses under this category. Buying reading materials, a personal computer, smartphone or tablet, or sports equipment and gym memberships for yourself, spouse, or child allows you to claim for tax relief. You can also claim for your monthly home Internet subscription. Yes, you get tax relief for just paying your monthly Internet bills from Unifi, Streamyx, and so on. It’s also the only utility payment you can get a tax relief for, so make sure you don’t miss out on claiming for it.

Deferred annuity/private retirement scheme

If you’re putting some money aside for a mutual fund or unit trust, why not consider investing in a deferred annuity or private retirement scheme (PRS) instead? These come with a tax relief of up to RM3,000 per year. This way you can maximise your tax refund and contribute towards your long-term savings at one go.

Education

- For yourself, you can claim for a Master’s, Doctorate, or a non-degree at Master’s or Doctorate level for acquiring law, accounting, Islamic financing, technical, vocational, industrial, scientific or technological skills or qualifications (CLP, ACCA, etc) for up to RM7,000.

- For your child, the conditions for tax relief are that your child has to be 18 years and above, unmarried, and in full-time education for A-Level, certificates, matriculation, or other preparatory courses. You can claim a higher limit for those receiving further education in Malaysia for diploma level or higher (excluding matriculation/preparatory courses) or outside Malaysia for degree level and above.

SSPN

SSPN stands for the Skim Pendidikan Nasional, or the National Education Savings Scheme. It is a savings plan introduced by PTPTN to enable parents to invest for their children’s higher education and can be opened with Maybank, Bank Islam, Agrobank, Bank Rakyat, or RHB Bank. As long as your total deposit in the year 2018 is larger than your total withdrawal, you’re eligible for a tax relief of your net balance up to RM6,000.

Zakat/fitrah

Do take note that, this is not a tax relief, but a tax deduction. Tax rebates are not deducted from your chargeable income like a tax relief is, but from your final tax amount at the end. So, if your amount taxed after taking all your claimed tax reliefs into account is RM402, you can claim a tax rebate for zakat up to the actual amount expended or the maximum of tax charged.

Keep Your Receipts!

When claiming for any purchases, premiums, donations, or fees, it’s crucial that you have the receipts to back your claims up. It is your responsibility to keep them for the next 7 years from the year of filing. If you fail to produce these receipts and should you be audited by the Inland Revenue Board, you must pay a penalty – so don’t try to claim for anything unless you know you have the receipt.

Don’t Lose Out – Get Your Tax Money Back

From single individuals to those married or married with kids, there are definitely tax reliefs to help reduce your tax burden and maximise your tax refund. When you file your income tax this 2019, make sure to have a good hard look at your expenditure from the year before so you don’t miss out on any tax relief you can claim for. Poring over your finances from last year probably won’t be fun, but at least you’ll know you can get the highest tax refund back possible!

More on Malaysia income tax 2019

- Malaysia Income Tax: An A-Z Glossary

- Income Tax Malaysia 2017 vs 2018 For Individuals: What’s The Difference In Tax Rate And Tax Reliefs?

- How To File Your Taxes For The First Time

- Income Tax Malaysia: Quick Guide To Tax Deductions For Donations & Gifts

- Tax Exemptions: Which Part Of Your Income Is Taxable?

- Malaysia Personal Income Tax Guide Malaysia 2019 (YA 2018)

Find more income tax related content in our Income Tax page.

Comments (3)

Question: I bought a smartphone that costs 3700RM. How can I claim it under lifestyle relief?

Hi, can club studio membership (which includes fitness, swimming and gym) to claim tax relief under lifestyle?

Unfortunately, club memberships, even those which provide gym facilities, are expressly excluded from this tax relief.