Pang Tun Yau

6th March 2019 - 3 min read

Now that Malaysians can begin filing their taxes, it’s good practice to take a good look at your hard-earned income from the previous year and take advantage of the tax reliefs offered by the Inland Revenue Board (IRB) to get some money back via tax refunds.

It is also good practice to see if there are any changes in different assessment years. These changes may come in the form of different tax rates in different income tiers, or some tweaks to the tax reliefs available. Knowing these changes may be beneficial for you as it can prevent you from overpaying your income tax for the year.

Income Tax Rate Malaysia 2018 vs 2017

For assessment year 2018, the IRB has made some significant changes in the tax rates for the lower income groups. Not only are the rates 2% lower for those who has a chargeable income between RM20,000 and RM70,000, the maximum tax rate for each income tier is also lower.

Similarly, those with a chargeable income above RM100,000 will also see them paying a lower amount of income tax – even though the tax rates have not changed. What has changed is the maximum tax payable for each income bracket; there is an decrease of RM1,000 in each income bracket.

The comparison table below illustrates the changes clearly:

Chargeable Income |

Calculations (RM) |

YA 2017 Rate (%) |

YA 2018 Rate (%) |

YA 2017 Tax (RM) |

YA 2018 Tax (RM) |

| 0-5000 | On the first 2,500 | 0 | 0 | 0 | 0 |

| 5,001-20,000 | On the first 5,000

Next 15,000 |

1 | 1 | 0

150 |

0

150 |

| 20,001-35,000 | On the first 20,000

Next 15,000 |

5 |

3 |

150

750 |

150

450 |

| 35,001-50,000 | On the first 35,000

Next 15,000 |

10 |

8 |

900

1,500 |

600

1,200 |

| 50,001-70,000 | On the first 50,000

Next 20,000 |

16 |

14 |

2,400

3,200 |

1,800

2,800 |

| 70,001-100,000 | On the first 70,000

Next 30,000 |

21 |

21 |

5,600

6,300 |

4,600

6,300 |

| 100,001-250,000 | On the first 100,000

Next 150,000 |

24 |

24 |

11,900

36,000 |

10,900

36,000 |

| 250,001-400,000 | On the first 250,000

Next 150,000 |

24.5 |

24.5 |

47,900

36,750 |

46,900

36,750 |

| 400,001-600,000 | On the first 400,000

Next 200,000 |

25 |

25 |

84,650

50,000 |

83,650

50,000 |

| 600,001-1,000,000 | On the first 600,000

Next 400,000 |

26 |

26 |

134,650

104,000 |

133,650

104,000 |

| Exceeding 1,000,000 | On the first 1,000,000

Next ringgit |

28 |

28 |

238,650

….. |

237,650

…. |

Income Tax Relief Malaysia 2018 vs 2017

Unlike the income tax rates for 2018 and 2017, there is virtually no change in income tax reliefs for the two assessment years. In fact, there is only one minor change, which applies to the medical expenses and examination of the individual, spouse, or child.

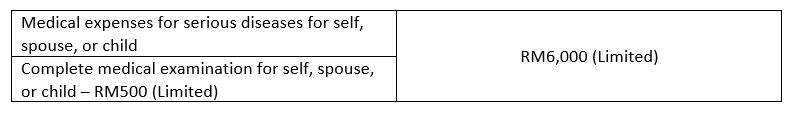

What changed is that the RM500 tax relief for complete medical examination for the individual, spouse, or child has been incorporated into the total tax relief for medical expenses for serious diseases for the individual, spouse, or child of RM6,000.

Here’s a table to show the difference:

YA 2018:

YA 2017:

| Medical expenses for serious diseases for self, spouse, or child | RM6,000 (Limited) |

| Complete medical examination for self, spouse, or child | RM500 (Limited) |

Essentially, for YA 2018, the tax relief for medical expenses for serious diseases as well as complete medical examination has been combined – though the maximum relief for the complete medical examination remains at RM500.

Overall, the changes in income tax rate and relief for YA 2017 and 2018 aren’t too drastically different. The lower- and middle-income groups save a little more, while the high earners pay a little extra, as the government aims to even the scales and be fair to the rakyat from all income groups.

More on Malaysia income tax 2019

- Malaysia Income Tax: An A-Z Glossary

- How To File Your Taxes For The First Time

- How To Maximise Your Income Tax Refund Malaysia 2019 (YA 2018)

- Income Tax Malaysia: Quick Guide To Tax Deductions For Donations & Gifts

- Tax Exemptions: Which Part Of Your Income Is Taxable?

- Malaysia Personal Income Tax Guide Malaysia 2019 (YA 2018)

Find more income tax related content in our Income Tax page.

A seasoned tech journalist who now focuses on his other passion, Pang is a firm believer in old-school DCA and optimised spending.

Comments (0)