RinggitPlus

4th March 2024 - 5 min read

The Employees Provident Fund is a sovereign pension fund which provides retirement incentives for members through managing their savings. With a total of 16.07 million members (as of December 2023), the EPF invests members’ collective contributions in approved financial instruments for more favourable returns. By law, the EPF is required to provide a guaranteed dividend of at least 2.5% a year, but has consistently managed to deliver significantly higher rates since 1960. But how has the EPF dividend rates changed in the last decade?

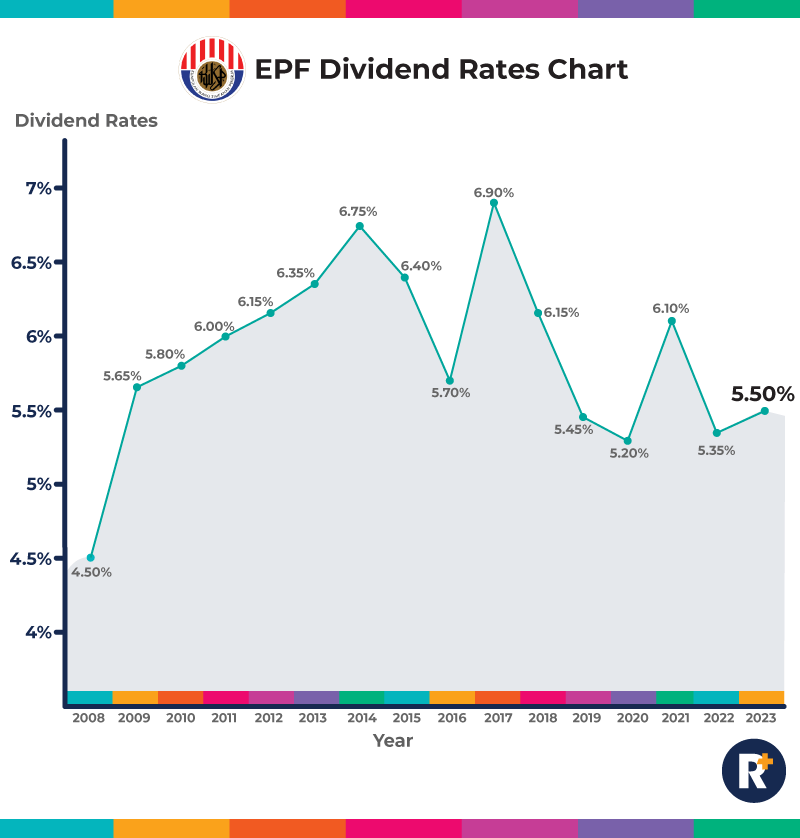

By investing in a mix of equities (both locally and internationally), loans, and bonds, the EPF’s sizeable portfolio is managed prudently, allowing it to offer dividend rates above 5% each year for its members since 2009. Even during the 2008 global financial crisis, the EPF still managed a respectable 4.5% dividend.

During the last decade, the highest dividend rate offered by the EPF was in 2017 (6.9%), followed by 2014 at 6.75%. In both years, EPF stated that the favourable market conditions meant that the EPF’s investments were better than expected.

However, market uncertainties always play a factor in the EPF’s dividend rate. For example, 2016 saw the EPF face tough investment changes due to unsettling events that included Brexit, the US Presidential elections, slower global growth in major economies, a slump in crude oil prices, and a weaker domestic currency.

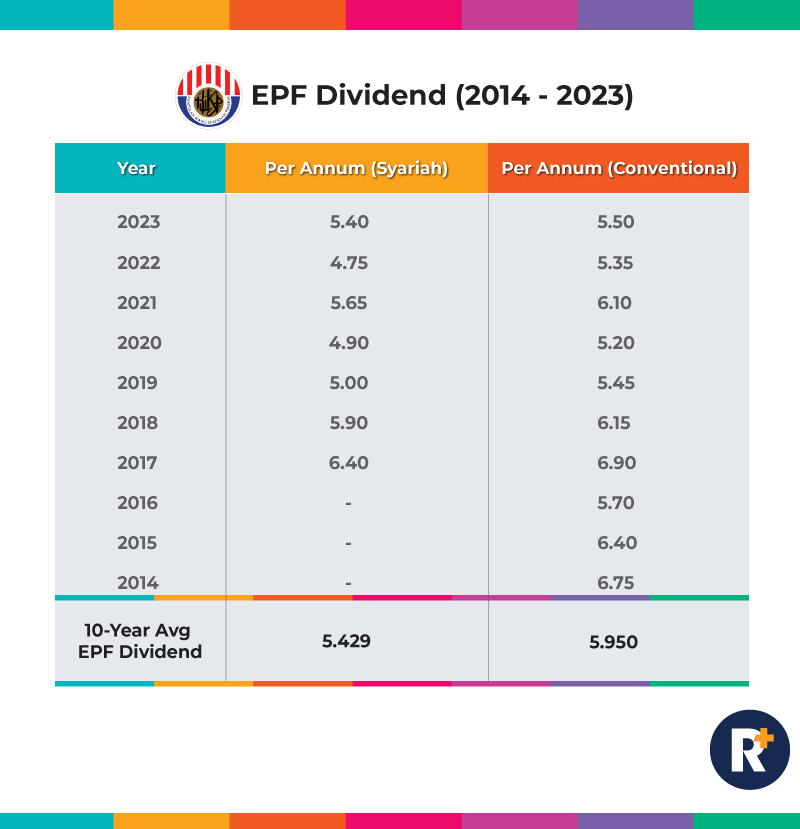

On 8 August 2016, Syariah savings was introduced to provide members with options to have their account managed and invested according to syariah principles. This doesn’t come as a surprise, given Malaysia’s growing influence in global Islamic finance. As such, members who opt for syariah savings would receive dividend payouts based on the syariah-compliant portfolio managed by the EPF.

For 2023, the EPF dividend rate was 5.50% for conventional savings and 5.40% for shariah savings – an increase from the previous year’s EPF dividend performance of 5.35% (conventional) and 4.75% (shariah). Accordingly, the payout will involve RM50.33 billion (conventional) and RM7.48 billion (shariah), coming up to a total of RM57.81 billion.

The EPF pointed out that the world has continued to be plagued by a host of troubles, including intensifying geopolitical tensions, elevated interest rates, inflation, and regional conflicts. Despite that, the global economy showcased resilience and fared better than expected, allowing the EPF to capture opportunities to enhance returns by actively managing its diversified portfolio and tapping into its Strategic Asset Allocation (SAA).

The EPF’s diversification strategy across different sectors and geographies has also been effective in helping it to capitalise on profit opportunities and generate income. As of December 2023, foreign investment made up about 38% of the EPF’s investment assets, and contributed 53% of its total gross investment income.

The EPF further noted that of its 16.07 million member base, a total of 8.52 million were categorised as active members as of December 2023. This allowed the EPF to record an improved active-to-inactive member ratio of 53% to 47%, respectively. The provident fund will also continue to run coverage expansion initiatives to ensure that more individuals will have access to proper social protection and future income security.

How EPF Dividends Are Calculated

For any given year, the final dividend rate proposed by the EPF management would first need the Minister of Finance’s approval, before the proposal is sent to the EPF Board. Should the Board agree to the rate, the declaration of the EPF dividend rate for the year can be finalised.

In general, the final dividend rate follows the following formula as stated on the EPF website:

Dividend Rate = Net income (a) x 1% Total for a 1% dividend (b), where

(a) Net income: Investment income + Non-investment income – Expenses

(b) Total for a 1% dividend is based on:

– Opening balance of contribution (after withdrawal) that obtain dividend for a 12-month period, and

– Monthly contribution that obtain pro-rated dividend i.e. dividend for the n-month will get (12-n) month dividend. For example, the September contribution (n=9) will obtain a 3 months dividend.

Under Section 27 of the EPF Act 1991, the guaranteed minimum dividend rate is 2.5% per year on members’ savings. As such, members are guaranteed to receive the minimum dividend rate in any situation.

Is EPF Enough For Retirement?

There is a growing concern among Malaysians that an individual’s EPF savings may not be enough to last through their retirement. There are a variety of factors behind this, such as the ability to withdraw EPF savings for certain big ticket expenses, low EPF investment returns, and the poor spending habits of those who withdraw their funds when they reach the eligible age.

Nevertheless, the EPF remains a crucial product to help Malaysians save for retirement – but one that Malaysians should not solely rely on. Other financial products like Private Retirement Schemes (PRS), unit trusts, and even investment-linked life insurance policies all help build retirement savings with potentially better returns compared to conventional savings via fixed deposits or even basic savings accounts.

But, all of this depends on cultivating a savings habit early on and let the power of compounding interest help along the way.

Comments (0)