Jacie Tan

25th March 2021 - 16 min read

NOTE: This is the income tax guide for the year of assessment 2020. If you are filing your taxes in 2022, then head on over to our income tax guide for YA2021 here.

That time of the year has come around again – so let’s see how ready you are to file your taxes. Have you got your EA forms at the ready? Do you know how to figure out your income tax rate, add up your tax reliefs, and calculate your tax refund? Have you registered as a taxpayer with LHDN, logged yourself into e-Daftar, and familiarised yourself the right e-Borang to fill?

If you’re still uncertain about it all, here’s our complete guide to filing your income taxes in Malaysia 2021 for the year of assessment (YA) 2020.

Do You Need To Pay Income Tax?

If you are an individual earning more than RM34,000 per annum (which roughly translates to RM2,833.33 per month) after EPF deductions, you have to register a tax file. Income tax doesn’t just cover your monthly salary, but all types of income – whether it is from your business or profession, employment, dividends, interest, discounts, rent, royalties, premiums, pensions, annuities, and others. For salaried employees, this also includes things like bonuses, overtime, commissions, and all other taxable income.

You don’t have to pay taxes in Malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside Malaysia. If you’re not sure what counts as income that you have to declare for tax purposes or not, scroll down to our section on stating your income below.

Income Taxes in Malaysia For Foreigners

Do foreigners or expatriates who are working and earning income in Malaysia need to pay income tax? Yes, any foreigners who have been working in Malaysia for more than 182 days are eligible to be taxed under normal Malaysian income tax laws and rates, just like Malaysian nationals. Foreigners employed in Malaysia must give notice of their chargeability to the Non-Resident Branch or nearest LHDN branch within 2 months of their arrival in Malaysia.

YA 2020 Malaysia Tax Rates And Chargeable Income

You can refer to the income tax rates for personal income tax in Malaysia YA 2020.

| Chargeable Income (RM) | Calculations (RM) | Rate % | Tax (RM) |

| 0 – 5,000 | On the first 5,000 | 0 | 0 |

| 5,001 – 20,000 | On the first 5,000

Next 15,000 | 1 | 0

150 |

| 20,001 – 35,000 | On the first 20,000

Next 15,000 | 3 | 150

450 |

| 35,001 – 50,000 | On the first 35,000

Next 15,000 | 8 | 600

1,200 |

| 50,001 – 70,000 | On the first 50,000

Next 20,000 | 14 | 1,800

2,800 |

| 70,001 – 100,000 | On the first 70,000

Next 30,000 | 21 | 4,600

6,300 |

| 100,001 – 250,000 | On the first 100,000

Next 150,000 | 24 | 10,900

36,000 |

| 250,001 – 400,000 | On the first 250,000

Next 150,000 | 24.5 | 46,900

36,750 |

| 400,001 – 600,000 | On the first 400,000

Next 200,000 | 25 | 83,650

50,000 |

| 600,001 – 1,000,000 | On the first 600,000

Next 400,000 | 26 | 133,650

104,000 |

| 1,000,001 – 2,000,000 | On the first 1,000,000

Next 1,000,000 | 28 | 237,650

280,000 |

| Exceeding 2,000,000 | On First 2,000,000

Next ringgit | 30 | 517,650

……….. |

Based on this table, there are a few things that you’ll have to understand. First of all, you have to understand what chargeable income is. Chargeable income is your taxable income minus any tax deductions and tax relief. As you can see, the tax rate you are charged with increases as your chargeable income does. The more you reduce your chargeable income (through tax reliefs and such), the lesser your final tax amount will be.

As an example, let’s say your annual taxable income is RM48,000. Based on this amount, the income tax to pay the government is RM1,640 (at a rate of 8%). However, if you claimed RM13,500 in tax deductions and tax reliefs, your chargeable income would reduce to RM34,500. This would enable you to drop down a tax bracket, lower your tax rate to 3%, and reduce the amount of taxes you are required to pay from RM1,640 to RM585. That’s a difference of RM1,055 in taxes!

Income Taxes in Malaysia For Non-Residents

You are regarded as a non-resident under Malaysian tax law if you stay in Malaysia for less than 182 days in a year, regardless of nationality. You’ll still need to pay taxes for income earned in Malaysia and will be taxed at a different rate from residents.

Therefore, whether you are a Malaysian or a foreign national, as long as you reside in Malaysia for less than 182 years in a year, any income you earn in Malaysia is taxable under non-resident income tax rates.

Here are the income tax rates for non-residents in Malaysia.

| Types of Income | Rate (%) |

| · Business, trade or profession

· Employment · Dividends · Rent | 30 |

| · Public entertainer

· Interest | 15 |

| · Royalty

· Payments for services in connection with the use of property or installation, operation of any plant or machinery purchased from a non-resident · Payments for technical advice, assistance, or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme · Rent or other payments for the use of any movable property | 10 |

How To File Income Tax in Malaysia

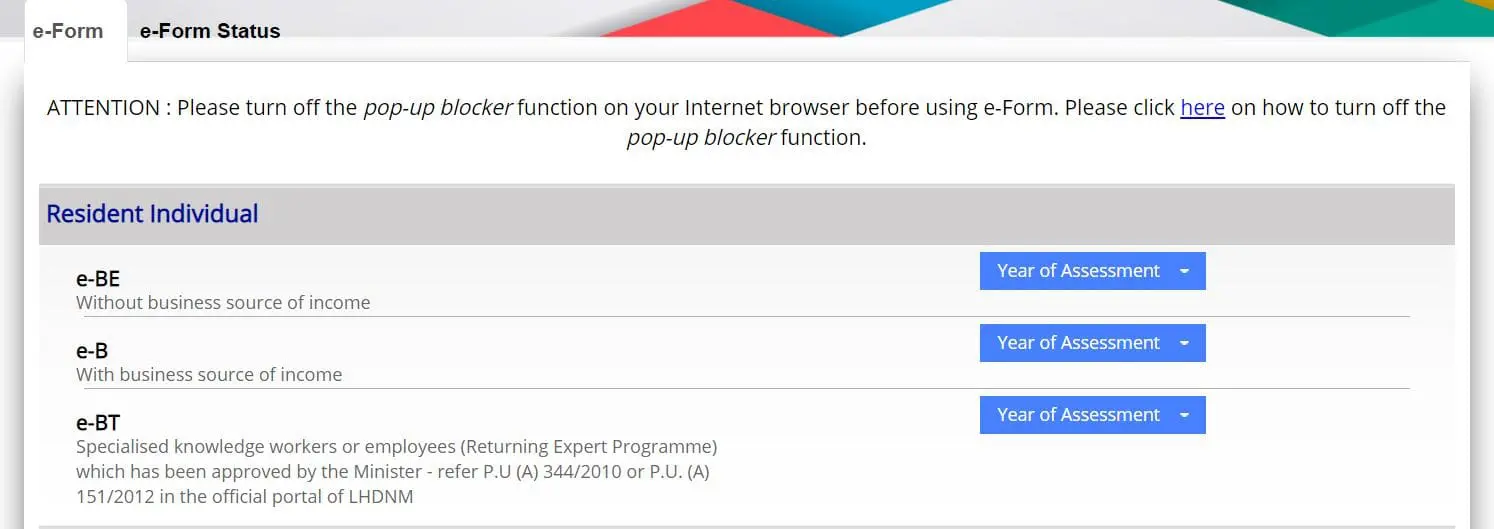

In Malaysia, the process for filing your income tax returns depends on the type of income you earn and subsequently, what type of form you are filing. Resident individuals who do not carry on a business will file the BE form, whereas resident individuals who do carry on a business will file the B form; meanwhile, non-resident individuals file the M form. You can find the full list of the different types of forms on the LHDN website.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. For the BE form (resident individuals who do not carry on business), the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Meanwhile, for the B form (resident individuals who carry on business) the deadline is 15 July for e-Filing and 30 June for manual filing.

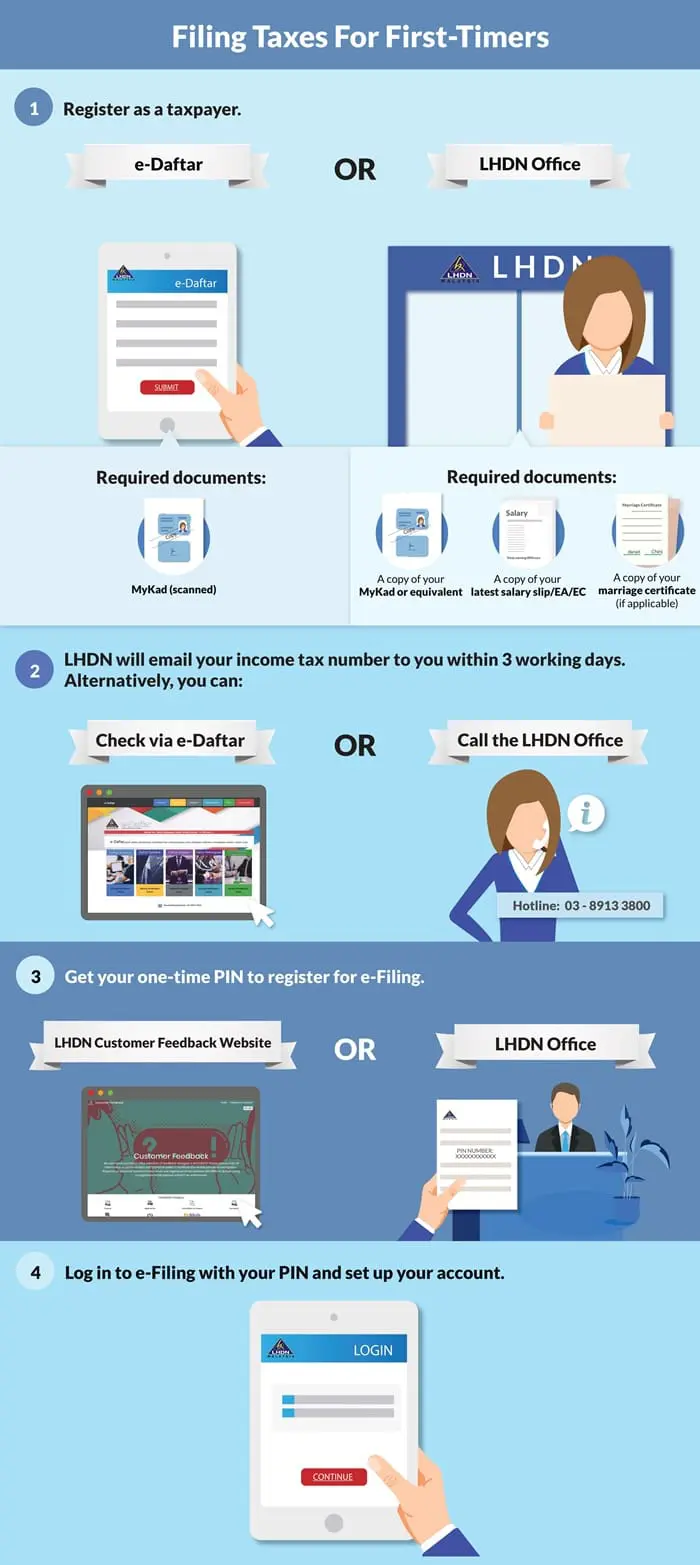

Register as a first-time taxpayer on e-Daftar

Before you can file your taxes online, there are two things that you will need: your income tax number and your PIN. You can get your income tax number by registering as a taxpayer on e-Daftar, and you can get your PIN after that either online or by visiting a LHDN branch. Check out our step-by-step guide on registering as a first-time taxpayer here.

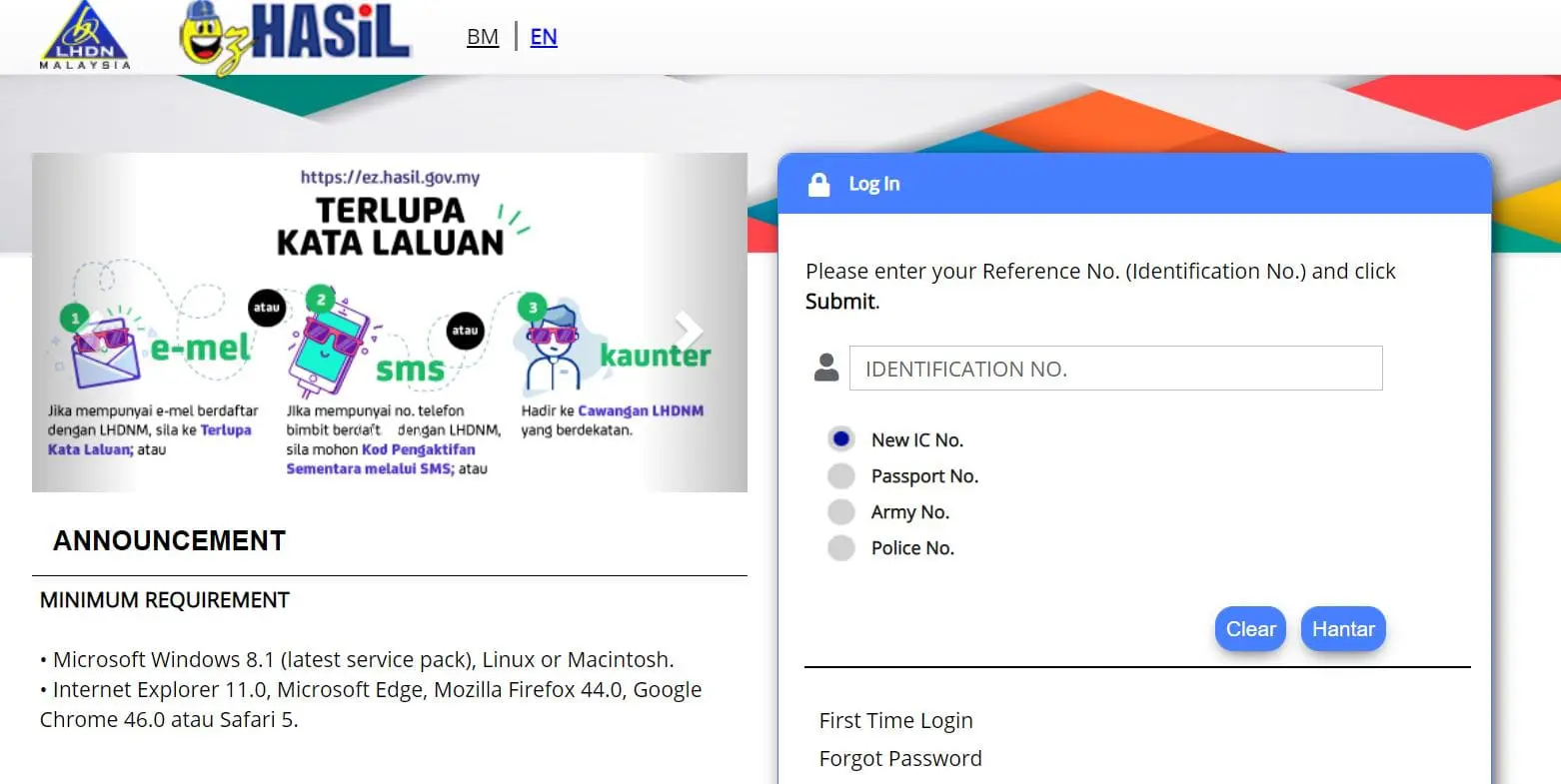

Log in to e-Filing

You can access e-Filing through ezHASiL or through LHDN’s new tax dashboard, MyTax. Once you have logged into e-Filing for the first time and set up your account as per the steps above, you can start filling up your Income Tax Return Form (ITRF) online. Remember that you can choose to view e-Filing, your form, and in act the entire LHDN website in either English or BM – just select the language of your choice at the top of the screen.

Fill up your income tax return form

Make sure you choose the right type of ITRF depending on which category of income you fall under:

| Income Tax Return Form (ITRF) | Category |

| e-B/e-BT | For residents earning income from business/knowledge or expert worker |

| e-BE | For residents earning income without a business |

| e-M/e-MT | For non-resident individuals/knowledge workers |

Choose the right form and select the year of assessment 2020 (remember, you are declaring your income earned for the year before). Next, we can get right down to the business of filling out your form; here’s a breakdown of what the BE form for residents earning income without a business will look like.

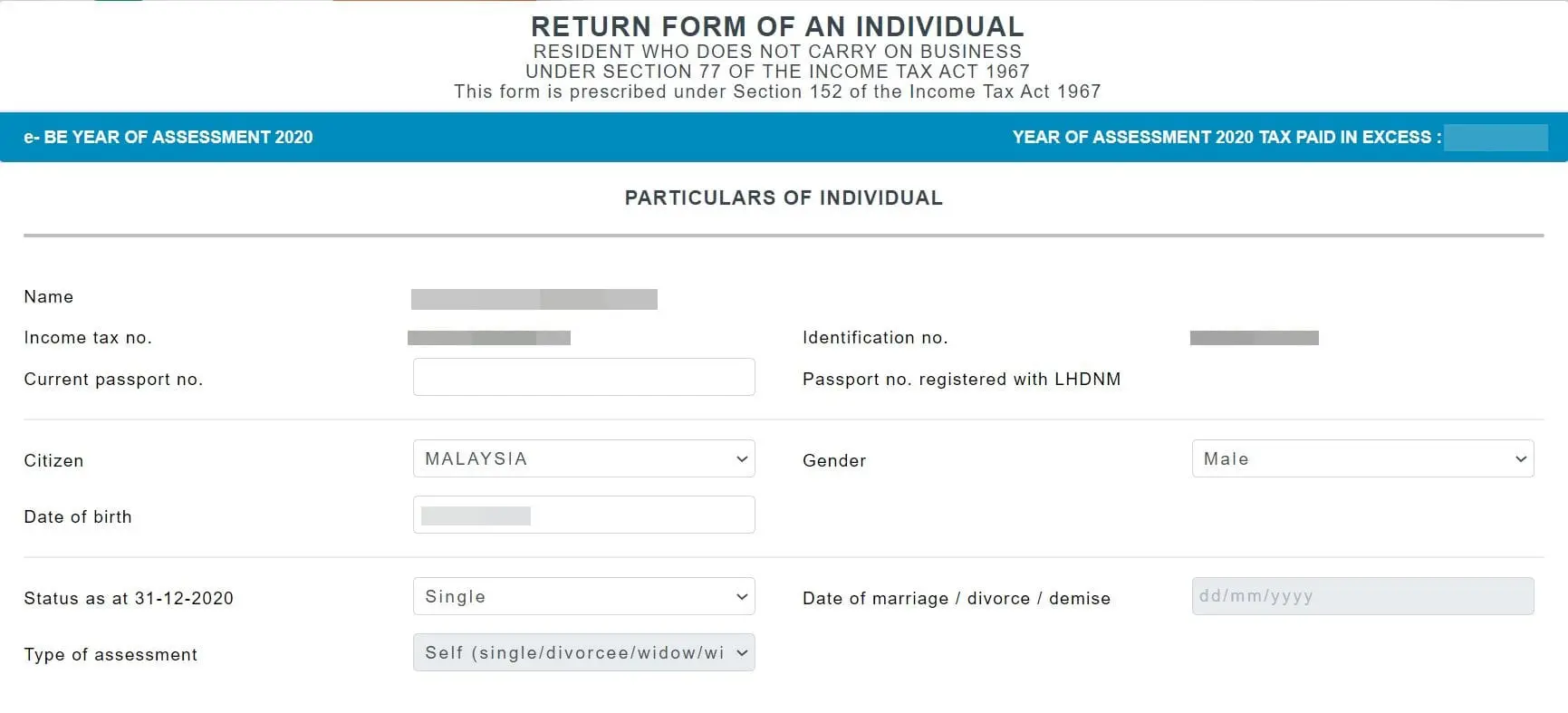

Particulars of individual

In this section, check to see that your basic personal details are displayed correctly on the form. Some of them will already have been filled out for you based on the information you provided when registering as a first-time taxpayer. You should also make sure that you select the right type of assessment, which determines whether you will be filing as a single person, or filing together or separately with your spouse.

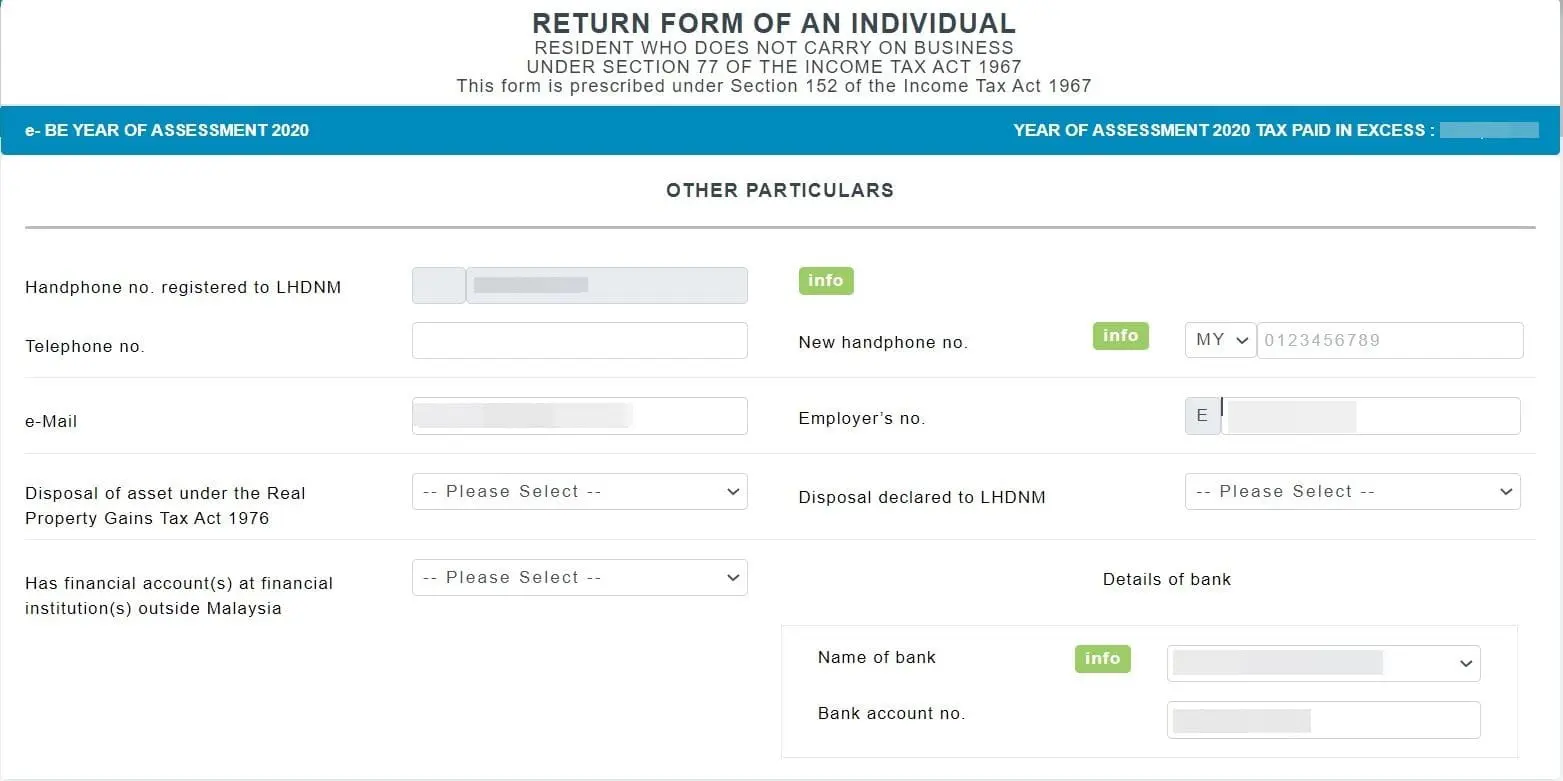

Other particulars

This is a continuation of the previous section that relates to your individual particulars. Make sure to get your handphone number down correctly, as LHDN will send you a TAC when you sign and submit your e-form, and your bank account number must be accurate if you want to get your tax refund.

Besides that, the disposal of asset under the Real Property Gains Tax Act 1976 will be relevant to you if you’ve sold any property in the last year. You will also find the section for Incentive Claims under paragraph 127(3)(b) and subsection 127(3A) here, which relate to specific exemptions made under gazette orders and exemptions given by the Minister of Finance, respectively; you can leave this section blank if this does not relate to you.

Declare Your Income

Under statutory income, fill out all the money you earn from employment, rents, and other sources in the respective boxes. This is where your EA form comes into play as it states your annual income earned from your employer.

However, there are several reasons why you shouldn’t accept the annual income stated on your EA form as the final figure for your statutory income from employment. Don’t miss out any non-salary related benefits that can count as “income from employment” and may need to be added on to your income figure. Similarly, you wouldn’t want to include any income that is entitled to tax exemptions on your form either.

For instance, perquisites (which cover things like parking, medical, and transport allowances) and benefits-in-kind (such as cars, personal drivers, accommodation, and so on) are taxable under law, but the government has provided some tax exemptions for them. If you want to find the answer to whether or not your RM100 monthly travel allowance is tax exempt, check out our article on tax exemptions.

Once you’ve keyed in all your statutory income, the form will automatically total it up to show your aggregate income. The next step will be to move on to any tax deductions you may be eligible for so you can lessen your aggregate income. For example, you can make a tax deduction from your aggregate income if you have made a contribution of gifts or donations to the government or a government-approved charitable organisation. After making the deductions, you will be left with your total income.

At the bottom of this section, you’ll have to key in the total monthly tax deductions (MTD) paid during your year of assessment. MTD or Potongan Cukai Bulan (PCB) is the compulsory mechanism where employers deduct monthly tax payments from a taxable employee’s salary. You can find this amount on your EA form.

You will also find a section on non-employment income of preceding years not declared, approved investment under angel investor tax incentive, and self installments, which you can fill out if relevant.

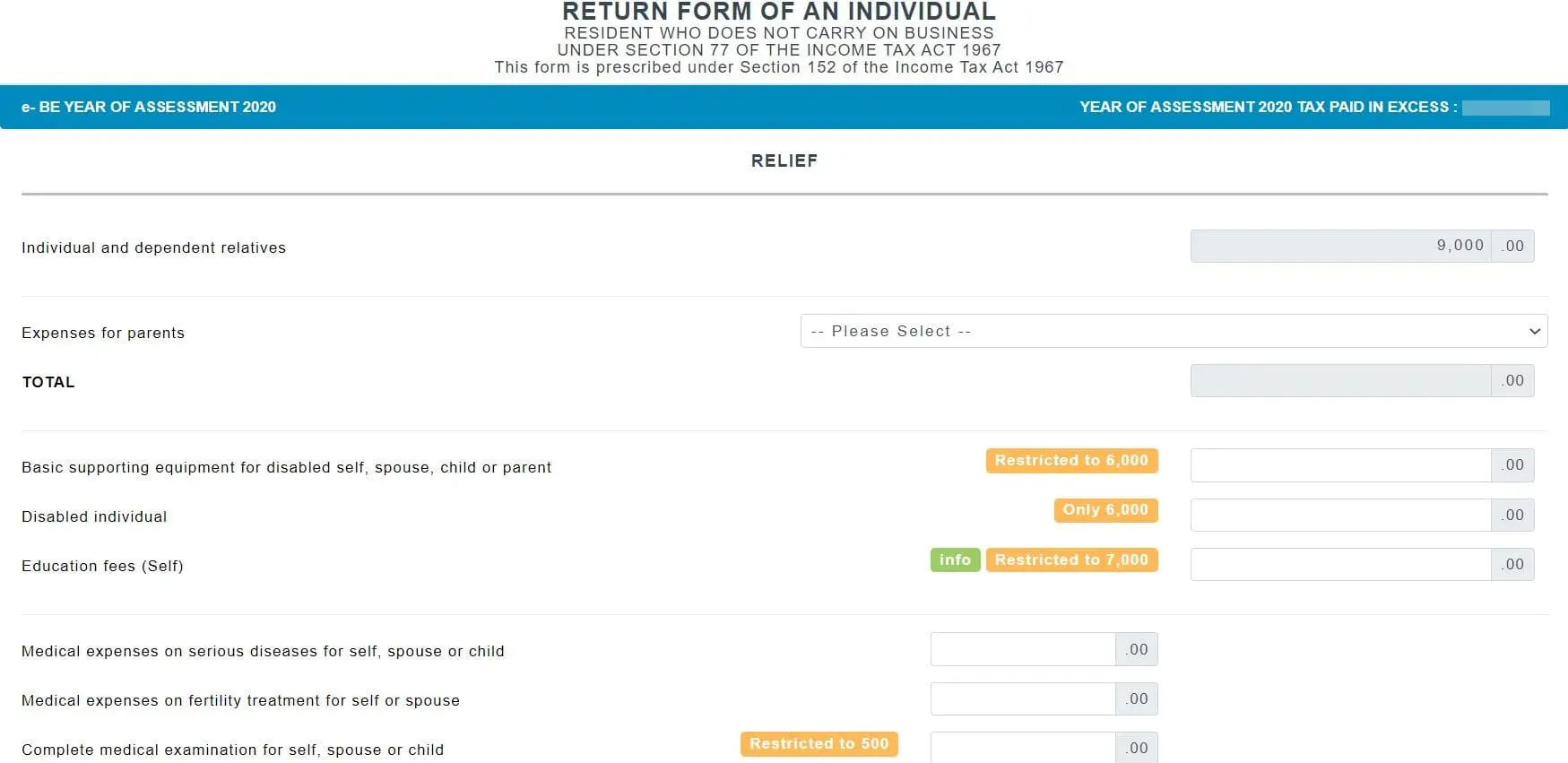

Claim for tax reliefs and tax rebates

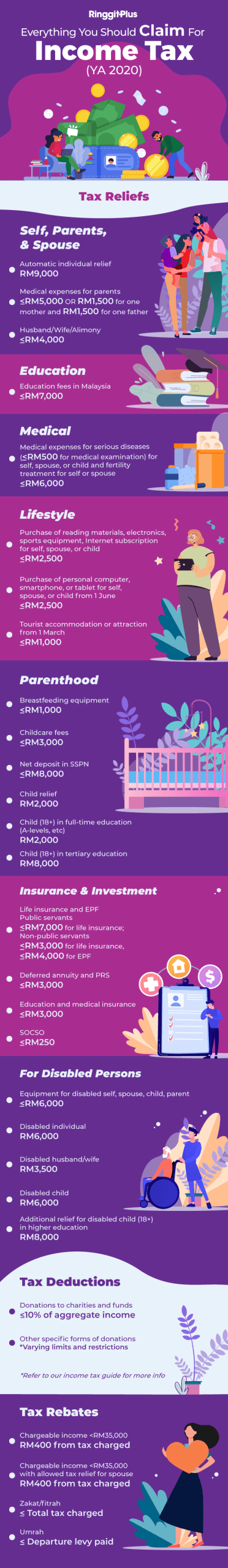

Here comes one of the most important parts of filing your taxes – claiming for tax reliefs and rebates! We’ve already explained how tax reliefs can reduce your chargeable income (and thus your tax rate and tax amount) above. For the full list of tax reliefs you can claim for in YA2020 and an explanation of each relief, you can refer to our post on everything you should be claiming for here or refer to this infographic below.

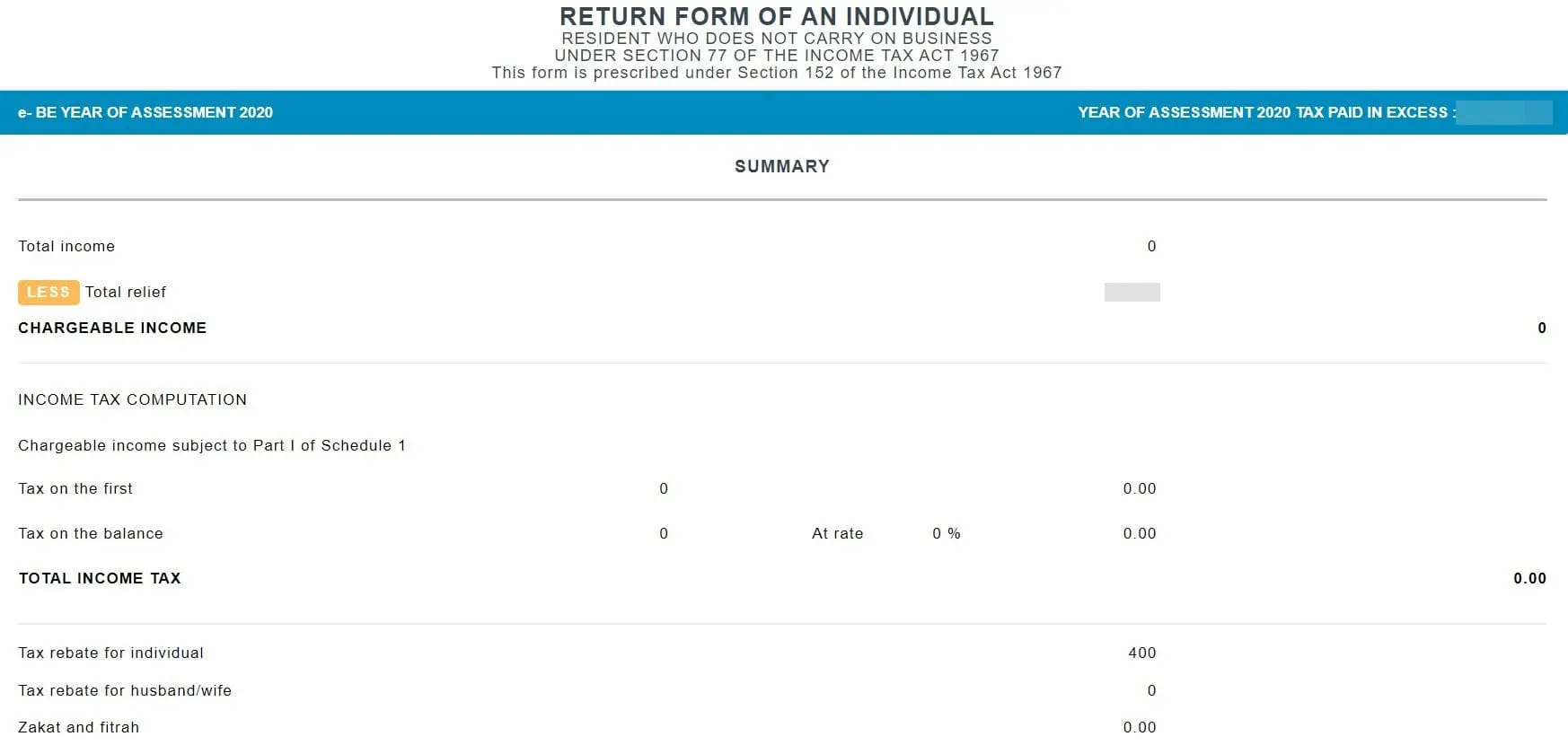

Once all your tax reliefs have been claimed, your chargeable income determined, and your tax rate and amount decided, you can claim for any tax rebates you are eligible for. Zakat and fitrah can be claimed as a tax rebate for the actual amount expended up until the total tax amount.

For example, say your employment income is RM50,000 a year and you have claimed RM15,000 in tax reliefs. This would bring your chargeable income down to RM35,000 and the amount of tax you have to pay is RM600. If you have contributed RM400 in the last year on zakat, you can minus that amount from the RM600 and end up with a final tax amount of RM200 to pay.

Besides zakat and fitrah, you are also eligible for a tax rebate of RM400 for yourself if your chargeable income does not exceed RM35,000. To find out more about the tax rebates that you could be eligible for, you should check our article on it here.

Check your summary

You’re almost done! On this page, you should see the final tax amount displayed. Don’t worry if your tax amount is in the negative as this is due to what you have already paid through MTD. This means you will get a tax refund from the government.

You can always go back through the form at this stage and amend any details that you may have missed out on; the form will make the necessary changes to the final tax amount automatically as you do so. Once you’re certain your form is free from errors, click “Next”.

On the declaration page, request a TAC from the number you’ve registered with LHDN and key it in. Then, click the sign and submit button, enter your identification number and password in the pop-up, and press the sign button. Finally, you’re done with filing your income taxes for YA 2020!

Before you say goodbye to income taxes for the rest of the year, make sure to save and print the acknowledgement and e-BE form for records purposes.

Amending Your Income Tax Form

Once you’ve submitted your form, you can’t make any further changes to it online via e-Filing. If you wish to make any amendments to your income tax declaration, you need to submit an appeal for amendments on or before 30 April 2020.

Here are the steps that you will need to take:

- Print your e-form and make corrections in the wrong space (a brief signature next to the correction). Next, make the tax calculation manually up to the “Tax Paid” level. In the event of any balance due, the balance shall be paid on/before 30 April 2020.

- Attach a letter of appeal that explains the changes you wish to make along with a copy of your e-form and all original documents and receipts to confirm income, all claims and tax deductions. Once you have done that, you will need to send it to the branch that you have registered with.

- Do note that LHDN will go through each error appeal as a part of the audit process and the time taken for the amendment will depend on the information and documents submitted.

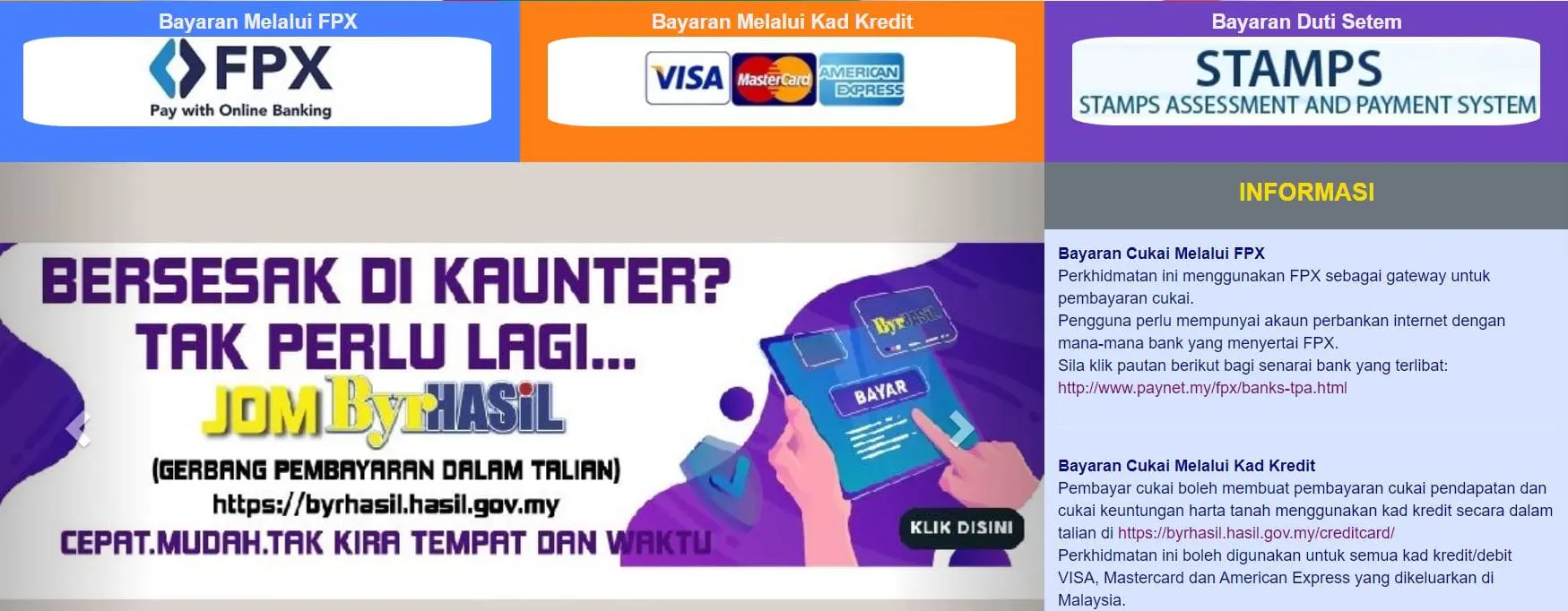

How Do You Pay Your Income Taxes?

With your taxes filed and your final tax amount determined, you will find yourself in either one of two situations.

For those subject to MTD, you may find that tax reliefs and rebates have contributed to making your final tax amount less than what was deducted each month. Therefore, you are eligible for a tax refund! It will be automatically credited to the bank account you’ve provided in your tax form within 30 working days after submission.

On the other hand, if you find after filing that you still owe more taxes, you’ll have to pay them before the due date which is 30 April 2021. Here are a few of the ways you can pay your income taxes in Malaysia:

| Method | Details |

| Online banking through FPX | Requires a bank account with AffinBank, Alliance Bank, Ambank, Bank Islam, Bank Muamalat, BankRakyat, BSN, CIMB, Maybank, OCBC, Public Bank, Deutsche Bank, HLB, HSBC, KFH, RHB, Standard Chartered, or UOB |

| Online using credit card on ByrHASiL | Visa, Mastercard, American Express accepted |

| Pos Malaysia | Over the counter (cash only) or online |

| Via ATM | Only at Public Bank, Maybank, and CIMB |

While it is a positive thing to be able to pay your taxes with your credit card, do note that almost all banks do not provide benefits for government-related spending. Therefore, it is unlikely that you will be able to earn cashback or rewards points on the amount that you pay for your taxes. However, some cards do include government spend as part of your monthly or annual spend requirements that go towards unlocking higher cashback tiers or annual fee waivers.

What happens when you pay your income tax late in Malaysia? A penalty of 10% will be imposed on the balance of tax unpaid after the deadline of 30 April 2021. A further penalty of 5% will be imposed on the amount owed if the tax and penalty is not paid within 60 days.

If you disagree with the late payment penalty, you can forward an appeal in writing to the Collection Unit of LHDN within 30 days of being issued a Notice of Increased Assessment. However, the penalty imposed has to be settled regardless of any appeal – if you are successful, LHDN will refund you the relevant amount.

Appealing Your Income Tax Notice of Assessment

After you file your taxes, there is a possibility that LHDN may serve you a notice of assessment. A notice of assessment is a written statement by LHDN that states your taxable income, amount of tax due, and so on. If you disagree with any of the info laid out – perhaps because of a discrepancy in tax reliefs or any sort of error – you can file an income tax appeal.

The appeal must be made within 30 days from the date of notice in writing to the LHDN branch which issued the assessment. You’re required to fill in the Q form, write a letter identifying the mistakes, and submit supporting documents for any expenses, deductions, or reliefs claimed. The appeal will be forwarded to the Special Commissioners of Income Tax. Should you have a valid reason for requiring more than 30 days to file an appeal, then the N form is the one you’ll need. Both Q and N forms are available at the LHDN office.

More On Malaysia Income Tax 2021 (YA 2020)

We hope that this guide will help with filing your taxes this year and claiming all the tax reliefs and incentives that you are eligible for. Remember, if you would like to read up on the different aspects of filing for income tax in further detail, you can check out our dedicated articles on each subject below:

- Everything You Should Claim For Income Tax Relief Malaysia 2021 (YA 2020)

- How To File Your Taxes For The First Time

- Income Tax Malaysia: What’s New For YA2020?

- How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

- MyTax: One-Stop Portal To Make Tax Filing More Convenient

- How To Claim Income Tax Reliefs For Your Insurance Premiums

- Income Tax Malaysia: Quick Guide to Tax Deductions for Donations and Gifts

- Understanding Income Tax Reliefs, Rebates, Deductions, And Exemptions In Malaysia

- Income Tax Glossary

Comments (18)

Hi, anyone here knows if I work in a foreign country, but due to the pandemic I’m currently resides back in Malaysia and basically working from home, but my employer and employment are still tied to the foreign country. In this case am I still eligible for income tax? Thanks in advance.

Hi, I would like to know if my foreign source income is tax exempted.

I am employed by a company in Singapore, and have been working from home in Malaysia since the start.

I am paid from the Singapore company into my bank account in Malaysia, for services i rendered to the Singapore company.

Is this considered foreign source income and tax exempted?

Hi

As an individual, in calendar year 2021, do i file for YA2020 tax? And does YA2020 means my income earned in 2019?

Yup, that’s correct.

Hi, for my 2019 return, I was considered as non resident. Then for 2020’s, I had filed my return as tax resident. My question is, can I re-submit my 2019’s return as resident since it was linked to YA 2020?

Hi,I am working but my wife is not (housewife). Can I choose “diri sendiri di mana suami/ isteri tiada punca pendapatan” ? and then I include my wife’s life insurance premium for the rebates ?

if not, which one is to select ?

thank you in advance.

Isn’t non-resident’s tax rate 30% now instead of 28%?

Thank you!

Hi, Do we have to fill in any separate forms to claim refund? or will it be automatically refunded?

It will be automatically refunded.

A friend had been out of Malaysia since 2009, and has earned some good amount. The friend is still abroad. Does the friend have to pay income tax, and if no, can a letter of exemption be obtained from the inland revenue department

My daughter works as a teacher in Malaysia and is leavinng one school and starting at another school in August. Her current school have said that they will withold 2 months salary until after she has left that school. Is that legal?

Hi Jacie

I’m making an enquiry on behalf of my boss for the Talent Corp Returning Expert Programme on the taxable rate of 15%. He has obtained the letter of approval. Under which section of the e-BE can he access this to input the relevant data?

Appreciate your urgent reply, thank you.

I am a foreigner residing in Malaysia (MM2H). I am retired and receive a pension from a non-Malaysian pension fund. That pension fund transfers the payments from abroad directly into my Malaysian bank account. Are these foreign pension payments considered income under Malaysian tax? Do I have to pay income tax on this pension?

Which type of form need to fill up if to declare tax of both husband and wife together.

HI, i have an online business, wo which form should i use to declare my income tax?

are dental implants tax deductible in Malaysia?

I am 74 years old and am fully retired. I have not no employment for the past 20 years. I have no income from rental properties. The only income I get is from the small amount of interests in my savings account besides some small amount of government assistance money. Do I still need to fill out a income tax form?