Alex Cheong Pui Yin

25th April 2024 - 9 min read

(Updated on 15 May 2024 for clarity.)

The Employees Provident Fund (EPF) has today officially announced its upcoming account restructuring exercise, which will soon see members aged 55 and below having a total of three accounts. This comes as a new Akaun Fleksibel is also introduced.

Along with its announcement, the provident fund also provided a comprehensive FAQ to answer some burning questions from the public. Here are some key highlights and details that you should be aware of concerning the upcoming change:

What is the restructuring exercise about, and what changes will I see?

The account restructuring exercise will see your EPF accounts reorganised from two accounts (Akaun 1 and Akaun 2) to a total of three accounts, namely Akaun Persaraan, Akaun Sejahtera, and the new Akaun Fleksibel. As such, your monthly statutory EPF contribution will also be credited to the three accounts based on a revised ratio (in contrast to the previous 70:30 ratio for Akaun 1 and Akaun 2, respectively).

Here’s a table to help you quickly grasp key information on the three new accounts:

| Accounts | Previously known as | Function | Members’ EPF contribution allocation starting from 11 May 2024 | Starting/Initial balance as of 11 May 2024 implementation |

| Akaun Persaraan | Akaun 1 | – Accumulate savings for retirement – Eligible members can invest a portion in investments managed by approved fund management institutions (FMIs) | 75% of contribution | Your existing balance of Akaun 1 |

| Akaun Sejahtera | Akaun 2 | – New account with flexibility to withdraw funds for short-term financial needs – Can be withdrawn at any time (preferably for emergency purposes and immediate needs only) | 15% of contribution | Your existing balance of Akaun 2 |

| Akaun Fleksibel | N/A | – New account with flexibility to withdraw funds for short-term financial needs – Can be withdrawn any time (preferably for emergency purposes and immediate needs only) | 10% of contribution | RM0 |

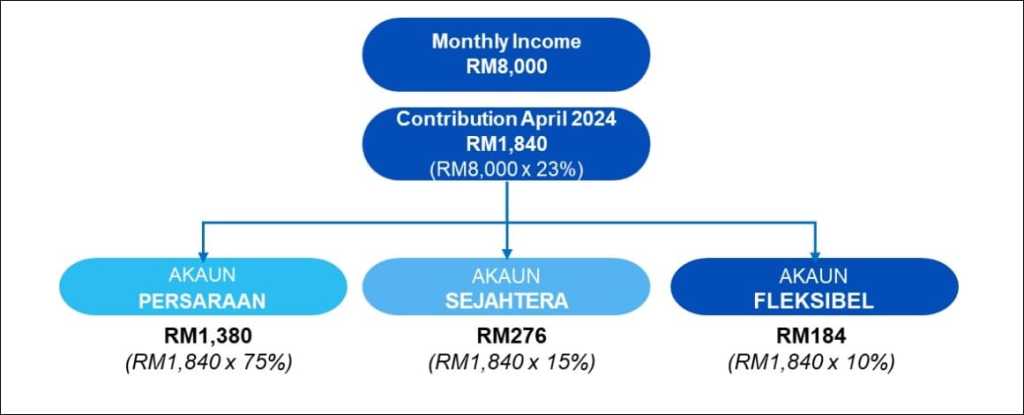

Here’s an example from the EPF to better illustrate how your statutory contribution will be treated come 11 May 2024:

Meanwhile, Akaun 55 and Akaun Emas will remain unchanged; once you hit the age of 55, your savings in Akaun Persaraan, Akaun Sejahtera, and Akaun Fleksibel will be transferred to Akaun 55. New contributions after the age of 55, on the other hand, will be credited into Akaun Emas (which will be locked and can only be accessed when you hit 60 years old).

Who will be impacted by this restructuring exercise?

This exercise will affect all EPF members who are aged 55 and below, including non-Malaysians.

When will the restructuring exercise be implemented?

The new accounts will be made live for eligible members starting from 11 May 2024.

Can I opt out from the EPF account restructuring exercise and retain the existing Akaun 1 & Akaun 2 arrangement?

No, all eligible members will have three accounts starting from 11 May 2024. You will not have the option to stick to the existing arrangement (only having Akaun 1 and Akaun 2).

Why is the restructuring exercise implemented?

EPF said that it implemented this exercise in a bid to help members save more effectively for their retirement, while catering to their short-, medium-, and long-term needs in their life. On top of that, it takes into consideration factors like the evolving employment landscape, demographic shifts, and members’ present and future needs.

What does the EPF mean by an “option for initial amount transfer” for Akaun Fleksibel?

Once your EPF accounts are restructured with the new Akaun Fleksibel, you’ll be given the option to transfer part of your savings balance in Akaun Sejahtera to Akaun Fleksibel as an initial amount; this is so that you can kickstart the new account with some sum instead of RM0.

If you choose to opt in for this initial amount transfer, some of your Akaun Sejahtera funds will be reallocated into Akaun Fleksibel (and Akaun Persaraan) based on the following conditions and arrangements:

| Existing balance in Akaun Sejahtera | Breakdown of allocation and ratio of transfer |

| RM3,000 and above | – Ten out of thirty of your Akaun Sejahtera balance will be transferred to Akaun Fleksibel – Five out of thirty of your Akaun Sejahtera balance will be transferred to Akaun Persaraan – Fifteen out of thirty of your Akaun Sejahtera balance will be retained |

| More than RM1,000 – Less than RM3,000 | – RM1,000 will be transferred from your Akaun Sejahtera to Akaun Fleksibel – Remaining Akaun Sejahtera balance to be retained – No transfers will be made to Akaun Persaraan |

| Less than RM1,000 | Entire Akaun Sejahtera balance will be transferred to Akaun Fleksibel |

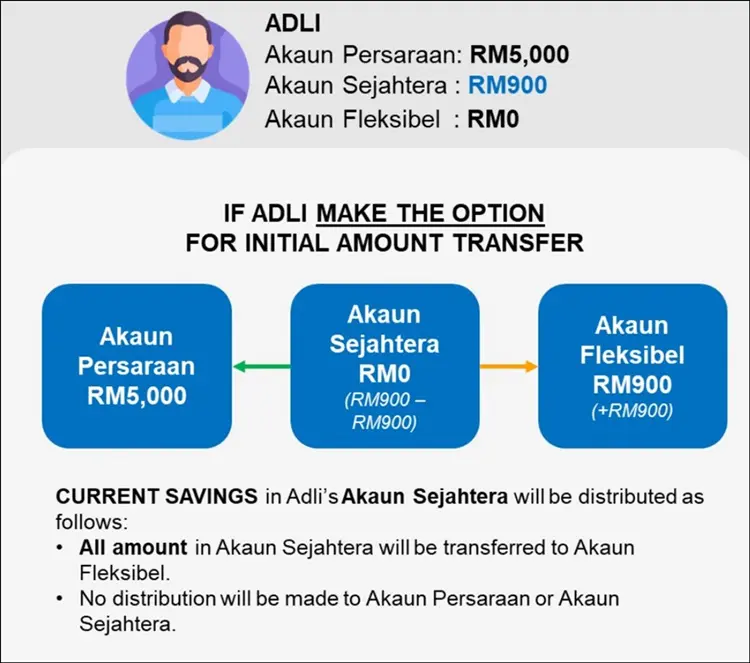

Again, here are three different scenarios from the EPF to show you how the option for initial amount transfer will work in real life:

How can I apply for the initial amount transfer for Akaun Fleksibel?

Members are encouraged to apply online through i-Akaun as it is faster and more convenient, but you may also visit any EPF offices to apply through the self-service terminals (SST).

You can start applying for the transfer starting from 12 May until 31 August 2024. Note that the application can only be made once during the specified period, and cannot be withdrawn once made. Additionally, you can expect your application for the initial amount transfer to be approved within three to five days.

What happens if I do not opt for the initial amount transfer for Akaun Fleksibel?

Your balances in Akaun Persaraan and Akaun Sejahtera will be retained as it is, and you will start your Akaun Fleksibel with RM0. Subsequent contributions after the restructuring will then be credited into the three accounts (Akaun Persaraan, Akaun Sejahtera, and Akaun Fleksibel) with the new ratio of 75:15:10, respectively.

Can I transfer from Akaun Fleksibel to the other accounts?

Members will be allowed to transfer part of their savings as follows:

- Akaun Fleksibel to Akaun Sejahtera

- Akaun Fleksibel to Akaun Persaraan

- Akaun Sejahtera to Akaun Persaraan

You can submit a contribution transfer application at any EPF counter by completing the “Borang Pindahan Simpanan Ke Akaun Persaraan/Akaun Sejahtera” (which will be made available soon).

Can I withdraw from Akaun Fleksibel, and how much can I withdraw?

All eligible EPF members are allowed to withdraw their full balance from Akaun Fleksibel at any time, with the minimum withdrawal limit being RM50 (even those who have applied for the Age 50/55 conditional withdrawal under EPF Akaun 2 Support Facility (FSA2)). Only one withdrawal is allowed per day. However, you are encouraged to withdraw only for emergencies and immediate needs.

How do I make withdrawals from Akaun Fleksibel?

You can apply for Akaun Fleksibel withdrawals through i-Akaun or at any EPF counters; withdrawal applications cannot be cancelled once it has been approved. No supporting documents are required, but make sure to submit an active bank account number to ensure smooth payment processing.

Do also be aware that for online withdrawals, specifically, you’ll need to go through a standard online eKYC process to verify your identity for withdrawals that exceed RM250 (no procedure required for withdrawals that are less than RM250). You are not required to physically visit an EPF branch to perform fingerprint verifications at the counter, although this is also subject to two conditions: your withdrawal history and the withdrawal amount (not exceeding RM30,000).

Meanwhile, if you do not have previous records of withdrawal, you are required to first verify your identity at an EPF self-service terminal or via an online identity verification process:

- Online identity verification: For withdrawal amount that is less than RM10,000

- Thumbprint verification at SSTs (physical attendance required): For withdrawal amount that is more than RM10,000

What is the payment method for Akaun Fleksibel withdrawals?

Your withdrawals will be credited directly into your bank account. As such, make sure to provide an active bank account number, and ensure that your bank account is registered under your own name (it cannot be a joint or company account).

Payment will be made within seven days after your application has been approved.

Will my Akaun Fleksibel withdrawals or the account restructuring exercise change any pre-retirement withdrawal eligibility?

No. You will still be eligible to make existing pre-retirement withdrawals subject to current terms and conditions. For clarity, here are the types of withdrawals that are allowed following the restructuring:

| Before 55 years old | After 55 years old |

| Akaun Persaraan – i-Invest (members investment scheme) Akaun Sejahtera – Housing – Education – Health – Hajj – Age 50 withdrawal – i-Lindung insurance/protection plans Akaun Fleksibel – Emergencies and immediate needs All accounts/Other situations – Disabilities – Death – Leaving the country – Pensionable employee – More than RM1 million savings (members who have savings exceeding RM1 million with the EPF can withdraw any amount) | Akaun 55 – Age 55 withdrawal Akaun Emas – Age 60 withdrawal All accounts – Disabilities – Death – Leaving the country – Pensionable employee |

Will the dividend rate be affected by the account restructuring exercise?

No, the EPF dividend rate will not be affected by the restructuring exercise.

Will Akaun Fleksibel receive lower dividends?

For now, the dividend for Akaun Fleksibel will be the same as the other two accounts. However, this could change in the future as liquid assets – by default – do not attract higher interest rates or dividends.

Will the restructuring exercise have an impact on members’ Simpanan Shariah account status?

No, the exercise will not change the account status of members who have changed to Simpanan Shariah.

For Muslim members, what is the treatment for zakat following the restructuring exercise and the introduction of Akaun Fleksibel?

If you withdraw from Akaun Fleksibel

All withdrawals from Akaun Fleksibel are subject to zakat at a 2.5% rate, without having to wait for a one-year period of haul (completion of a period of one year) if the amounts withdrawn have reached nisab (minimum amount that a Muslim must have before being obliged to zakat).

However, if the Akaun Fleksibel withdrawal is made by a member who does not have sufficient financial resources, or is unable to cover their basic living needs (and those of their dependents), then the 2.5% zakat will not apply.

If you do not withdraw from Akaun Fleksibel

The savings balance in Akaun Fleksibel is also subject to 2.5% zakat annually in accordance with haul if it has reached nisab, after taking into account all the other savings of the member.

***

With this, we hope that you’ll have a clearer understanding of the upcoming EPF account restructuring that is set to take place soon! As per the words of the chief executive officer of EPF, Ahmad Zulqarnain Onn, this initiative is meant to empower members so that they can better balance their future needs for retirement, and with their immediate needs. You can also refer to the EPF’s full FAQ for more information.

Comments (2)

Hi, if I make a voluntary contribution on top of existing EPF, can I decide which account it should go into or it will be split by default into the three accounts?

You have the flexibility to decide which account your voluntary contribution should go into. You can allocate it to any of the three accounts based on your preference and financial goals.