Guo Heng

18th February 2015 - 8 min read

Once a domain of tech geeks, futurists and libertarians, bitcoin has been seeping into the mainstream consciousness bit by bit (excuse the pun) in recent years.

In 2012, WordPress became one of the first major online services to accept payments with bitcoins. PayPal, the world’s most popular online payment platform started processing bitcoin payments through it’s subsidiary Braintree in September 2014.

Microsoft followed suit last December, announcing that it would begin accepting bitcoin for electronic goods sold over its Windows and Xbox network of stores. Coinbase opened the first regulated bitcoin exchange January this year, with financial backing from a number of esteemed investors including Andreessen Horowitz and NYSE.

Bitcoin Wizard, from btcartgallery.com

From time immemorial, credit cards and PayPal were the de facto channels for online retailers to accept payments. Today, they can accept bitcoins using plugins offered by Bitpay.

So what is this magic internet money we have been reading about lately? To explain what bitcoin is with as little technical jargon as possible, let’s start by exploring the shortcomings in current methods of conducting electronic payments (the reason for it’s conception).

Shortcomings of the Trust-Based Model

Say you run your own side business selling comic books online. You started out accepting credit card payments but after suffering a string of fraudulent credit card purchases, you decided to only accept payments via a trusted-third party payment processor like PayPal.

The problem is, these third-party processors demand a small percentage of your sales as fees for facilitating the transaction. Being a fledgling business, these fees eat into your bottom line. Plus the fees make small transactions nonviable, forcing you to implement a rule where you would only sell to customers making purchases larger than RM50.

Contemporary electronic payment systems rely on a trust-based model. As a merchant, you trust your customers not to use fraudulent credit cards. Third-party payment processors eliminate most of the risk from the trust-based model but they take a cut of each sales in return for their service.

Enter Bitcoin. Bitcoin is a peer-to-peer digital currency that allows you to conduct electronic transactions directly with your customer – without the need for any third-party – just like you would if you were selling your comic books in person.

What is Bitcoin?

Bitcoin is electronic cash in the most literal sense. A purely digital medium, bitcoin relies on cryptography – the usage of mathematical proofs to provide a layer of security – to authenticate each transaction and prevent double spending.

While it sounds like a good idea, would it not take an unimaginable amount of processing power to individually verify every transaction?

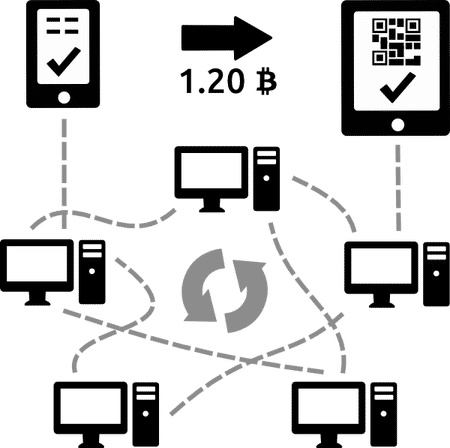

The block chain technology is the breakthrough that enables bitcoin’s existence. The block chain is a public ledger of all bitcoin transactions and is shared among all users in the bitcoin network. A block is a digital record of bitcoin transactions. A new block is added to the chain of blocks once every 10 minutes. New transactions are added to a block in the block chain.

Instead of having a single computer or entity confirming each transaction, the block chain technology allows the number crunching work to be done across a decentralized network of computers around the world.

From bitcoin.org

Computers in the bitcoin network performs the cryptographic calculations required to confirm each transaction in the block. These computers are called miners and they contribute processing power to the bitcoin network and are compensated with newly generated bitcoins for each block they solve.

Why is Bitcoin Groundbreaking?

Bitcoin is the first ever digital equivalent of physical cash.

Bitcoin negates the need for financial institutions or third-party payment processors to facilitate an electronic transaction between two parties. Bitcoin smoothes the process of making and receiving electronic payment and render it as hassle-free as possible.

You have to enter a lot of information, including your home address and occasionally a phone number when you make a credit card purchase online. It is a mechanism implemented to reduce the risk of fraud for the seller, but unfortunately creates a potential privacy risk for the credit card user. With bitcoin, all you need is the seller’s bitcoin wallet address, which is just a string of alphanumeric characters.

The removal of third-party charges meant that small electronic transactions become electronically viable. I would not pay for coffee or cupcakes with PayPal and their vendors are unlikely to accept credit card for them. However, paying for those with bitcoins (assuming the vendor accepts bitcoins) is as simple as taking out a bank note from my wallet and handing it over to the cashier.

Bitcoin Mechanical Wallet 08 by Zoran Kutozovic

How to Use Bitcoins, the Malaysian Edition

To start using bitcoins you would need a bitcoin wallet to store your bitcoins. Storing your bitcoins is metaphorical in this context, as your wallet does not actually store any bitcoins, but rather a private key, a secret data string that grants you the right to spend the bitcoins associated with the wallet.

A bitcoin wallet also comes with an address for you to receive bitcoins from other bitcoin users. Treat your wallet like you would with a physical wallet. You wouldn’t leave your wallet lying open in a public space; likewise you should not leave your bitcoin wallet opened on your laptop or mobile unattended.

There is a large selection of bitcoin wallets available for various platforms. Once you have selected your preferred wallet, it’s time to get your hands on some bitcoins.

While there are a plenty of bitcoin exchanges around the world and emerging services like Circle which allows you to purchase bitcoins with your credit card, the options for purchasing bitcoins in Malaysia is rather limited at the moment.

Buying bitcoins from a reputable bitcoin exchange is one of the safest way to acquire bitcoins.

As of writing, the only bitcoin exchange operating in Malaysia is Bitx.co, a Singapore-based company operating bitcoin exchanges in Malaysia, Indonesia, Kenya and South Africa.

Once you’ve registered and verified your identity with Bitx, you can do a bank transfer to Bitx to fund your account and start buying bitcoins from Bitx’s market.

The Future of Bitcoin

As with new technologies in their infancy stage, bitcoin has its own share of flaws. While there are a plethora of reputable bitcoin exchanges around the world, as of writing there is only one regulated bitcoin exchange.

The importance of regulated exchanges could not be underscored: in 2014, the largest bitcoin exchange in the world, Mt.Gox filed for bankruptcy after losing nearly 750,000 of its customers’ bitcoins and 100,000 of its own bitcoins (together worth around $473,000,000 at that time), citing that the missing bitcoins were stolen by hackers. Mt.Gox’s spectacular collapse dragged bitcoin’s public perception together with it.

2014 was also a turbulent year for bitcoin as it lost two-thirds of its value, further reinforcing bitcoin’s reputation to be highly volatile, an unfortunate side effect of being a completely decentralized and unregulated currency.

While the inspiration behind the creation of bitcoin was to create an efficient peer-to-peer electronic transaction system, bitcoin has yet to gain sufficient mainstream adoption for it to live up to its ideals.

At this point in its life, bitcoin is a bit like email in the early 1990s: while the email protocol allows you to instantly send a document, the low adoption of email – let alone personal computers – back then meant that a large percentage of your recipients are unlikely to have access to email. Paying for a courier service was still the best way to deliver an urgent document.

Despite those current shortcomings, Bitcoin has the potential to be one of the most disruptive innovation in recent times. A method for efficient peer-to-peer electronic transaction creates ripples in a multitude of industries, besides the obvious ones like e-commerce.

Bitcoin is gradually shaking up the remittance industry. A growing number of small remittance providers are using bitcoin to reduce the cost of sending money across borders. Mobile banking is taking hold in the developing world as it becomes increasingly popular for people without bank accounts use their mobile phones to conduct financial transactions. Bitcoin could impact the same demographic and become a contender to mobile banking.

As bitcoin adoption grows, so will the services built on top of bitcoin. Today Circle offers one of the most efficient ways to purchase bitcoins with your credit card, but only for US credit cards. It is not far-fetched to imagine Malaysians purchasing bitcoins from Circle a year or two down the road.

The current financial system was designed in the pre-internet era and it struggles to make full use of the spontaneous nature and far-reaching connectivity of the internet, as demonstrated by the legion of protocols and hassle required to mitigate the risk of fraudulent online credit card transactions. The financial sector is one of the last bastions of pre-internet institutions to be disrupted by technological innovation and bitcoin might just be the technology that transforms financial transactions for the better.

Comments (0)