RinggitPlus

24th July 2013 - 5 min read

Personal loans are a good way to get cash on the double for

whatever you may need it for. But for many, the need may come at a time where

they are simply too hard-pressed to pay much attention to terms and conditions.

The good thing about personal loan products is that they

seldom differ, regardless if they are an [AmBank personal loan](https://ringgitplus.com/en/personal-loan/AmBank-AmMoneyLine.html) or from other banks. For almost every personal loan; there are only five salient

questions you need ask yourself and the bank in question to get the information

you need to make a decision.

#1: Is a personal loan necessary?

Personal loans can come with quite a few fees, charges and

some high interest rates. Consider if there is no other option besides a personal loan at present. If it is not an emergency; consider saving up over a

period of time or if that isn’t an option; refinancing property could provide

additional cash at a lower interest rate (but you will still be charged legal

fees for a new loan agreement!).

Credit cards may have a higher interest rate but there is

the added flexibility of repaying everything within a shorter period without a

penalty fee.

Before even considering the technicalities of a personal

loan, ask yourself if you’ve truly exhausted every other way to obtain the

money.

#2: Do I need security/particular relationship with the bank to qualify?

For some easy personal loan products; loans are only given to

those with a fixed deposit, investment fund, unit trust or some other account

(such as a savings or credit card) with the bank in question. Sometimes it

isn’t so much a pre-requisite for approval but a way to get a loan with a lower

interest rate.There are also loans specially for civil servants or government-linked company workers. Find the best loan for you.

#3: How much interest will I be paying?

For most people, loan tenures are unlikely to be just a year

and thus, it will be important to consider how much interest you will be paying

for the whole duration of the loan.

New Bank Negara guidelines have reduced tenures of personal

loan financing to 10 years. However, most loans to non-government sector

employees are not affected as tenures are usually capped at 7-8 years. Even at

this number; the level of interest paid for a 6 year loan can be extremely

high.

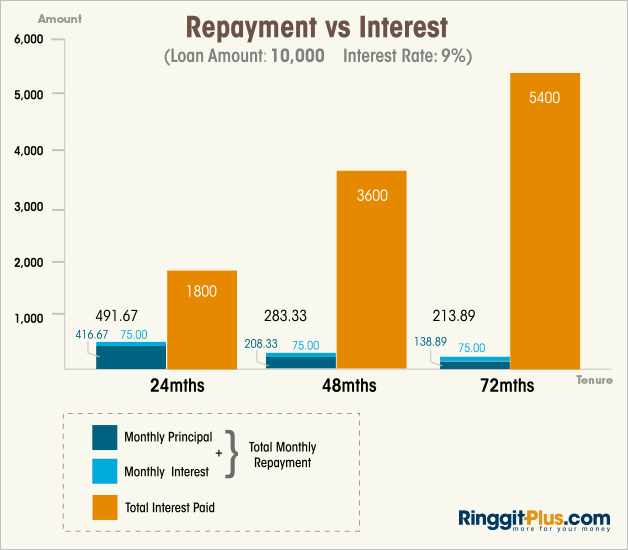

Typically, a loan amount of RM10,000 with a 9% p.a. interest

rate will cost you the following amount in interest depending on 2, 4 or 6

tenure.

| Rate | 9% | |||

| Loan amount | RM10,000 | |||

| 24 months | 48 months | 72 months | ||

| Principal repayment | RM416.67 | RM208.33 | RM138.89 | |

| Interest payment | RM75 | RM75 | RM75 | |

| Monthly repayment amount | RM491.67 | RM283.33 | RM213.89 | |

| Total interest paid | RM1800 | RM3600 | RM5400 |

For each year, the interest rate will be calculated based on

the opening amount and not the remaining balance for most personal loans[1].

As such, you will be charged the same amount of interest every year no matter

how much of the principal you’ve repaid. As illustrated above; a six year

tenure for an RM10,000 loan is charged interest up to more than half the

borrowed amount. However, the repayment monthly only differs by a small amount.

Paying off your loan in two years saves you RM3600[2].

Stretching out your loan for a longer tenure can make the monthly payments more

affordable but total cost of the loan goes up significantly.

Here’s a graphical look at the reduction of monthly

repayment versus the increased interest rate:

#4: How much can I afford to repay every month?

Looking at the interest charged above; if you can afford to

repay your loan quickly, it would be advisable to do so. Consider all

commitments. However, if the minimum is all you can afford to repay; it will be

inevitable to choose the longer repayment schedule: paying more interest but

with a lower risk of defaulting.

#5: What other fees and charges will I incur?

Many are shocked to find that the disbursed loan amount is

lower than what they had applied for after deducting the banks ‘fees and

charges’. If you were to apply for a loan at exactly the amount you require;

the shortfall may cause some inconvenience. There may also be penalties for

early settlement or late payment. Some banks even require that you take out

Takaful insurance on the loan and this will cost you in insurance premiums. Always

check the bank terms for one or more of these most common fees and charges:

1.

Processing fee

2.

Stamp duty

3.

Early termination fee

4.

Late payment penalty fee

5.

Insurance fees

Personal loans can become an even bigger burden than any

other loan product because of late payment fees and high interest rates. Always

consider these four vital points before signing on the dotted line.

[1]

Very few personal loans work on a reducing balance method. Do check with the

bank of choice which method they would employ to calculate your interest.

[2] Based on a comparison with a six

year loan.

Comments (0)