RinggitPlus

10th December 2018 - 5 min read

Whether it’s a Macau scam or Internet love scam, it’s always best to stay aware of all the devious conmen (and conwomen) out there trying to part you from your money. We’ve previously covered how to avoid the latest charity scams, online scams, and even scams targeting the elderly – and now we want to make sure our readers and customers don’t get tricked by any swindlers who are falsely using the RinggitPlus name.

There have been isolated incidents of scammers posing as employees of RinggitPlus on social media and instant messaging apps. These individuals claim to offer services such as securing personal loans and credit cards, only to then ask for various fees to “process” the application.

This is a scam! All application activities for the products offered on RinggitPlus (credit card, personal loan, insurance, among others) are conducted only on our website (www.ringgitplus.com), and all customer data is handled securely and strictly adheres to the Personal Data Protection Act – you can view our Privacy Policy for more info.

RinggitPlus vs Scams: the differences

Here are some key differences between how official RinggitPlus services work, and a scammer who is falsely operating under our name.

- RinggitPlus services are 100% free of charge. We do not charge customers for using our platform to apply for financial products offered by financial institutions in Malaysia. We also do not have any fees after application. That’s right, there are no legal, processing, tax, stamp duty, or even service fees involved.

- However, note that in some application instances (such as with insurance policies), RinggitPlus assists with the payment process only on our website using secure payment gateways.

- We have found that scammers most often inform victims that there are some fees to be paid before the personal loan funds are released. The fees are also usually required to be paid to a third-party bank account. Remember, RinggitPlus is completely free to use!

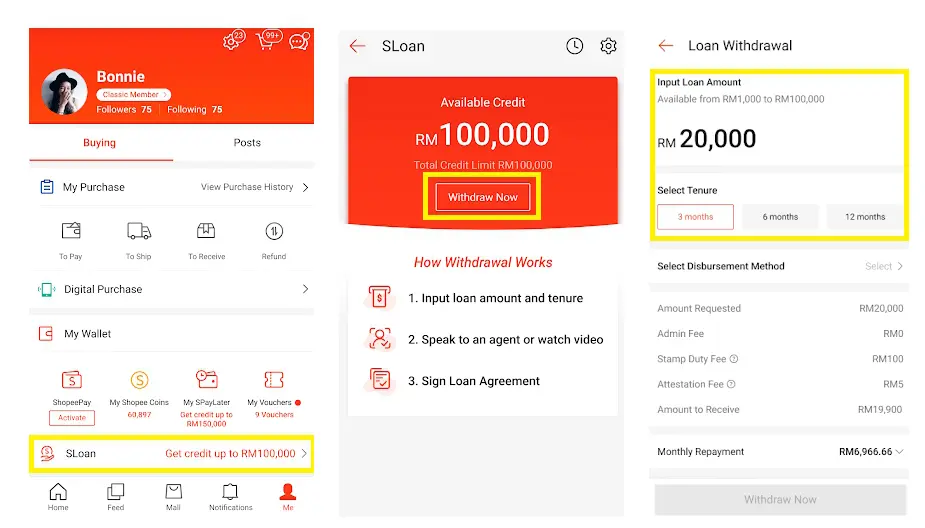

- There is NO SUCH THING as a RinggitPlus Personal Loan. One common scam involves personal loans “offered” by RinggitPlus. RinggitPlus is a platform that allows individuals to apply for personal loans (and other financial products) offered by financial institutions (banks and certified money lenders) in Malaysia. RinggitPlus (nor its parent company Jirnexu Sdn Bhd) does not provide its own personal loans, credit cards, or other financial products.

- In some scam cases, we found that victims were given documents with the RinggitPlus letterhead for personal loan agreements supposedly offered by RinggitPlus. So if someone tries to offer you a “RinggitPlus Personal Loan”, you now know it’s definitely a scam.

Prevention starts with you

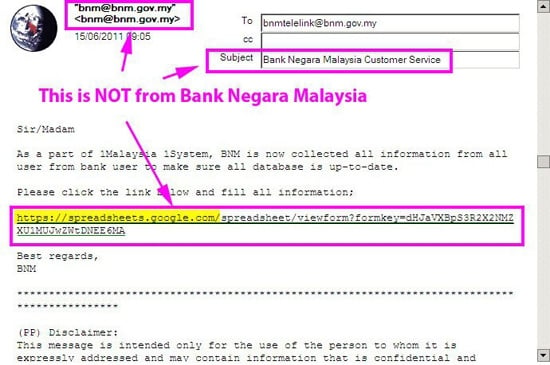

Example of an email phishing scam (Image: Bank Negara Malaysia)

In general, it always helps to be extra cautious. Here are some additional ways where you can protect yourselves from possible scam cases.

- Do extensive background checks. Just because someone says he/she claims they work for a certain company, does not mean he does. These days, anyone can print their own name cards, so that should not be a proof that he/she genuinely works there. Contact the company he or she supposedly works for, and see if the individual actually works there. When it comes to handing over sensitive documents, it doesn’t hurt to be extra cautious. For RinggitPlus, you can contact us at 03 7890 0808 for any queries you may have.

- If something doesn’t feel right, do NOT proceed. If an “agent” starts requesting for fees or charges that sound dubious, contact the authorities immediately. Don’t be pressured into doing something you don’t feel comfortable with.

- Be careful of messages from non-official channels. For example, any follow-up contact from RinggitPlus regarding applications are always conducted via multiple channels: email, SMS, and telephone. For email, always double check the domain name – for example, all official contact via email will be sent from an address ending with “@ringgitplus.com”. Also, note that RinggitPlus will only contact you on these channels if you have already made an application on our website.

- If an offer sounds too good to be true, it probably is. Scammers always prey on the gullible by promising tempting offers, “limited time” promotions, or “backdoor deals” – especially to those who aren’t officially eligible. These shady deals always come with a catch…which usually will cost you dearly. If you receive a message of a “guaranteed approval” personal loan offer which also includes lines like “blacklisted individuals welcome”, be extremely careful.

Macau scams have been around for years, though they’re more notorious in recent times. (Image: NST)

Most of the time, those who fall victims to financial scams are either blinded by the good offers, or are in a situation where they desperately need money. In these instances the victims’ judgment is affected, resulting in making bad decisions.

If you ever come across a potential scam like what we describe in this article, don’t hesitate to double check either with family and friends, or better, with the company where the potential scammer says he/she is working for.

Finally, now that you’ve armed yourself with knowledge, stay informed and spread the word!

Comments (17)

is ringgitplus.com and ringgitplusmc.com same entity…

Hi Arif,

No, ringgitplus.com and ringgitplusmc.com are not the same entity.

Has anyone come across the 2 names below who claimed to be RinggitPlus staffs?

1. Ms Sabrena Abdullah

2. Mr Frank Gan

Just for clarification. Appreciate if anyone from RinggitPlus who are in this chat forum or anybody who knows about this to clarify. I’ve emailed to RinggitPlus but no reply until now. Thanks

They are not RinggitPlus staff. It’s best to report them if they’re making claims about working with us.

Also, please check your spam or promotion folders to see if our email ended up there.

Thanks ssenik for your response. Appreciate it very much. As for the email, I’ve checked the spam & other folders but I can’t find the email from your side. However, your clarification here is more than enough. Once again thank you

Thanks for the update, Yusof! I’m glad the info was helpful. 😊

If you need anything else or have more questions, just give me a shout!

https://iringgitplus.com/

Is this website legit? As I can see ‘i’ at beginning of the ringgit. When I go to the link it appears Personal Loan/CC. When I press the Apply Loan it will ask you to download the iRinggitPlus.apk file. Nothing to fill up just to download the file. Is this legit? Can someone help to explain? Thanks

Hey! Please make sure to stick with official RinggitPlus website; ringgitplus.com. Stay safe!

Thanks ssenik. Appreciate it

You’re most welcome, Yusof! 😊

1st comments :

error : paid two times (18 and 22/01/2024)

error : settled 1k on 18/01/2024

additional : phone number 011-23569853

additional : her whatsapps profile change from RP to anonymous now

Consider contacting your bank or the authorities to report the potential scam. Keeping detailed records, such as transaction receipts and screenshots, will be helpful for any investigations.

ive applied loan thru IG and have been called by ms eleana on 7/1/24. she offered me a loan of 2k (two times paid on 17 and 22/01/2024). the date that i wrote was wrong and she called me before that to remind to settle on 17/1/2024 before 10am. bcoz of my date mistake, i try myself to settle the 1k but at that time, i also have meeting to attend. she kept pushing me and if late 1 hour, i will be charged of interest rm300. i have settled the 1k at 09.30pm on 15/01/2024 then she told me… Read more »

This may be a scam. Take immediate action and report it to the authorities.

What is the procedure to apply credit card through Ringgit Plus? Should we provide personal data through WhatsApp?

Do you guys provide help through Whatsapp app?

Hi! No, we have a WhatsApp chatbot that assists with product application process, but if you need any assistance using our services, you can contact us on our Facebook and Twitter pages 🙂