Alex Cheong Pui Yin

15th February 2023 - 3 min read

Shopee has expanded its digital financial offerings to now include a personal loan service, dubbed SLoan. At present, it is made available only to selected users, but the product will soon be offered to more users in the near future.

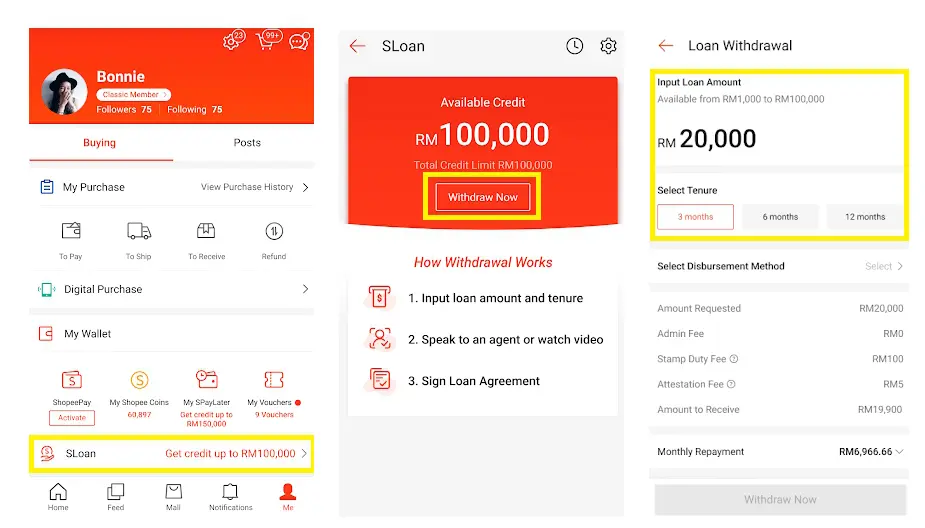

According to Shopee’s FAQ, the new SLoan offering will provide loans of up to RM100,000 (as seen in various screenshots in the FAQ) at an interest rate of 18% p.a., with a repayment tenure of either three, six, or twelve months. When tapping into the service for the first time, you will be required to make a minimum withdrawal of RM1,000, while subsequent withdrawals can be made in multiples of RM100.

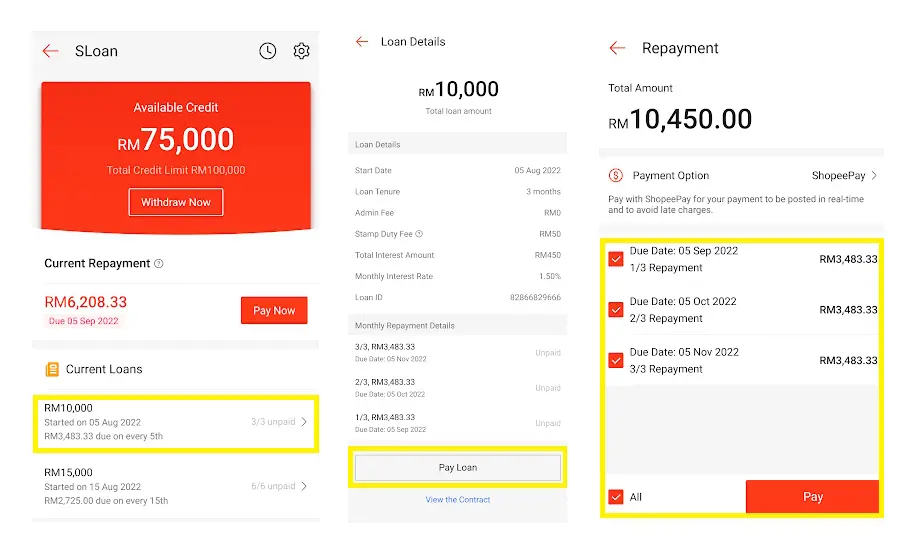

Shopee further noted that users’ credit limits will be predetermined – most likely to be decided based on their payment history and credit utilisation, among other factors. You will also not be able to apply for an increase in your SLoan credit limit, although it may be adjusted at Shopee’s discretion when they review your account (conducted periodically).

You can also opt to either receive your cash loan in your ShopeePay or bank account, but note that the speed of loan disbursement will differ. Specifically, payments made to ShopeePay will be instant, whereas bank account transfers will take up to one day.

As for fees, users will need to pay a stamping fee of 0.5% and an attestation fee of RM5 per loan withdrawal; both fees will be deducted upfront from the disbursement amount. Meanwhile, late payments will incur a penalty of 8% p.a. on overdue monthly instalments, to be charged on a daily basis.

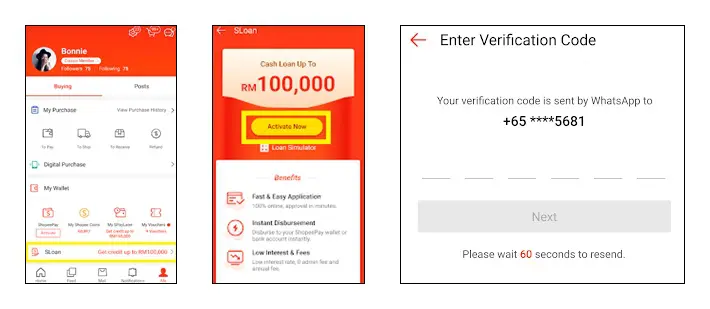

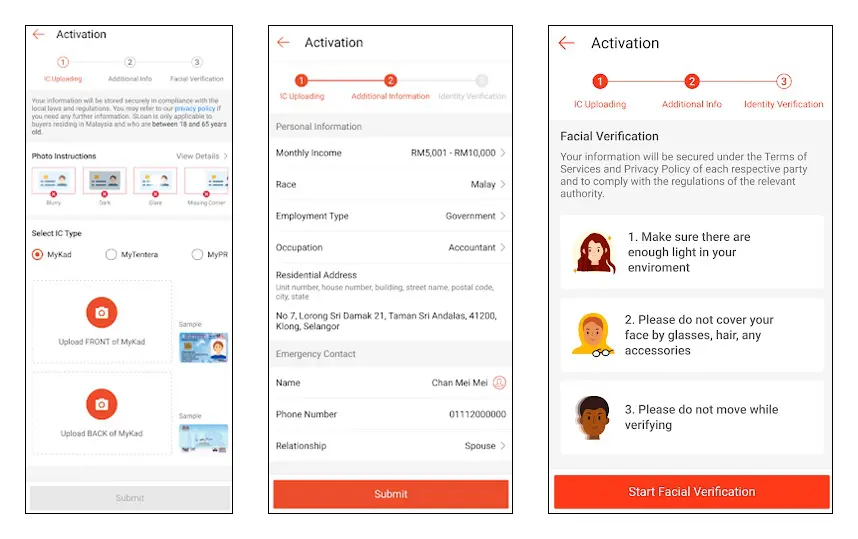

If you’d like to use Shopee’s SLoan, you will first need to activate the service in your Shopee account (if it has already been offered to you) in order to apply for your SLoan credit limit. You can start this by heading over to your profile page in your Shopee app, then tapping on the SLoan link under the “My Wallet” section. You’ll then be required to go through the standard eKYC procedure.

Once your SLoan is activated, you can then begin to submit requests for loan withdrawals based on your available credit limit. Multiple loan withdrawals are permitted, provided you are still within your credit limit, and you do not have any overdue repayments.

Aside from Malaysia, Shopee has also offered SLoan to several of its other markets, including the Philippines, Indonesia, and Thailand – although the name of the service may differ in some of these regions. Indonesia, for instance, knows the product as SPinjam, while Thailand recognises it as SEasyCash.

(Source: Shopee)

Comments (0)