Nur Adilah Ramli

13th June 2022 - 3 min read

Alliance Bank has said that it is aiming to provide up to RM200 million in loans to small and medium enterprises (SMEs) through its digital solution, Digital SME, this financial year. This is in comparison to RM60 million loaned out in the previous financial year, in a bid to help boost the local SMEs’ growth moving forward.

To note, the Digital SME solution – which was launched back in 2020 – provides up to RM500,000 collateral-free financing to businesses that have been operating for at least a year, with annual revenue of between RM50,000 and RM30 million. Offered online, eligible businesses are only required to submit their bank statements for the previous six months to apply for the loan; they will then be notified of their loan approval status in as short as 24 hours.

The Digital SME application process is also available in three languages – English, Bahasa Malaysia, and Mandarin – to offer convenience to its customers from varied backgrounds. Applicants in further need of assistance may also contact the bank at any point in their application process.

Aside from offering loans via Digital SME, Alliance Bank is also ready to provide additional support to SME owners who are in need of extra assistance. For instance, the bank is willing to advise and help SMEs establish and improve their credit profile before they apply for Digital SME, so that they can easily secure future financing.

“We also know that micro enterprises may face issues obtaining financing due to their limited credit history. We want to help them build their credit history by starting them with a small credit line, and subsequently help them expand by providing them quick access to financing via Digital SME once they are ready,” said the senior vice president and head of Digital SME at Alliance Bank, Kevin Shum.

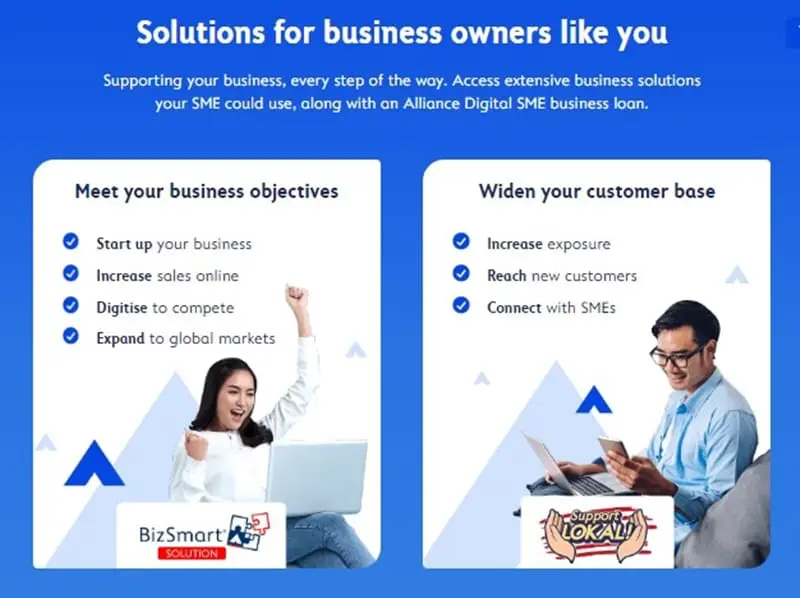

Additionally, Alliance Bank also enables SME owners to access its BizSmart® Solution portal, which offers relevant products and services such as digital marketing, logistics, accounting, and data analytics at affordable rates. These services will help SMEs to run and grow their businesses in a more efficient manner.

Finally, Kevin hinted that the bank is also looking to introduce new digital solutions for businesses, including a feature that enables them to open their digital accounts online. “We want to enable our business customers to remotely open a digital business current account anytime, anywhere. The digital business account will comprise several innovative features, including a small overdraft line and a business credit or debit card to help business owners manage their expenses more efficiently,” he added.

(Source: Alliance Bank [1, 2])

Comments (0)