Samuel Chua

21st January 2025 - 3 min read

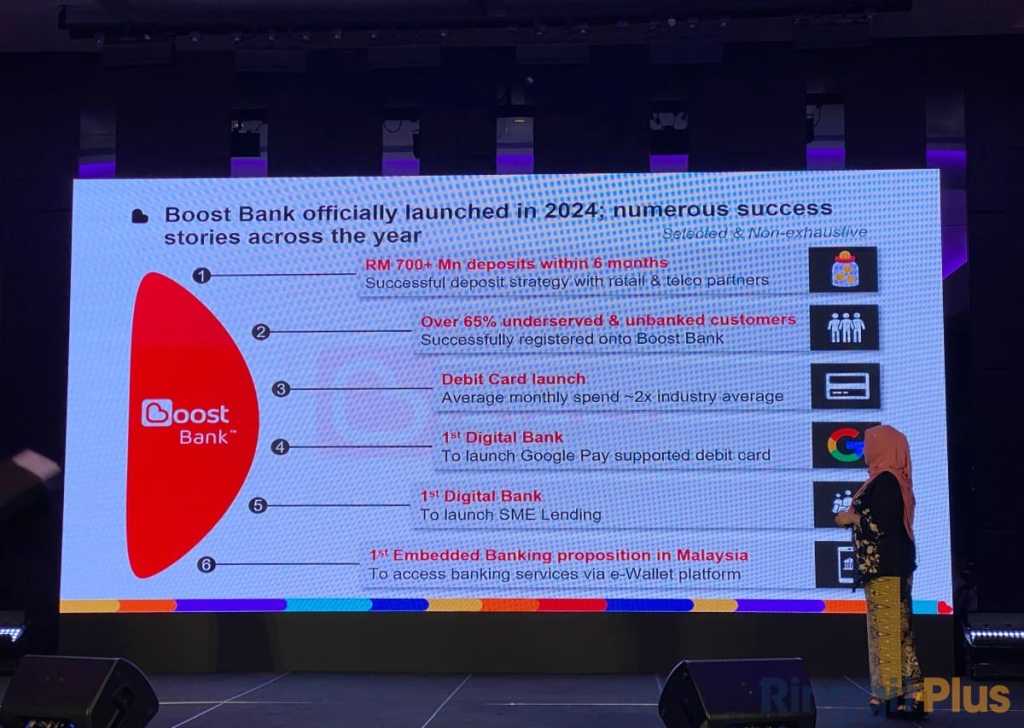

Boost Bank has recorded RM700 million in deposits within six months of its launch, supported by its seamless integration into the Boost app and strategic partnerships with major retailers and service providers.

Sheyantha Abeykoon, Group CEO of Boost, said 2024 marked a pivotal year for the company as it expanded its services to include banking products. “2024 was a landmark year for Boost, solidifying our position as a leading fintech player that has now expanded our suite of services to include banking products and services. Our growth reflects the trust our users and partners have placed in us and the increasing demand for innovative digital financial solutions,” he said at the company’s year-in-review media briefing today.

Boost’s strategic focus on financial inclusion is exemplified by features like RM1 account openings, competitive daily interest rates, and Savings Jars, which have resonated with a broad spectrum of users since June 2024.

Fozia Amanulla, CEO of Boost Bank, said these initiatives have contributed to the platform’s role in empowering individuals and businesses across Malaysia. “The launch of Boost Bank represents a significant leap in our journey to redefine financial inclusion. This is about more than deposits or accounts; it’s about creating a platform that truly empowers individuals and businesses to thrive. Through our innovative digital banking solutions, we aim to unlock greater economic opportunities across the nation, ensuring no one is left behind,” she said.

The company’s lending efforts have also made an impact, with RM5 billion disbursed across Malaysia and Indonesia, supporting thousands of micro, small, and medium enterprises (MSMEs). Its Shariah-compliant Buy Now, Pay Later (BNPL) offering, Boost PayFlex, has onboarded over 121,000 customers and disbursed RM240 million since its introduction.

Sheyantha said Boost is well-positioned to capitalise on Southeast Asia’s growing BNPL market, which is forecasted to reach $53.2 billion by 2027. “Through our expanding suite of services, which now includes lending, payment gateway services, deposits, and investment products offered via an embedded finance proposition, we are uniquely positioned to drive meaningful impact for both small businesses and consumers as we transition towards becoming a regional digital banking group,” he said.

Boost is also strengthening its regional presence. In Indonesia, the company has partnered with ecosystem players to expand its consumer lending portfolio, while in Cambodia, its collaboration with Smart Axiata has helped address financial access gaps. Both initiatives aim to deliver tailored financial solutions and foster economic growth in underserved markets.

Comments (0)