Alex Cheong Pui Yin

4th December 2020 - 4 min read

(Image: The Edge Markets)

Managing director of information technology services provider Hitachi Vantara, Moti Uttam has said that Malaysian banks may eventually be challenged by major Chinese tech firms, such as Alibaba and Tencent, in the virtual banking space. This comes as the banks are found to be underspending in the investment of technology.

Uttam drew data from Global Data, a data analytics and consulting company, which projected that Malaysia’s tech industry will see an investment of about US$25.2 billion (approximately RM102.39 billion) by 2023. Out of the total amount, however, the banking and financial services industry is forecasted to contribute only 12.3% of it, coming in third behind manufacturing and energy sector.

(Image: The Star)

“Hence, banks ought to look beyond their current offerings of deposits, payments, and loans space, and close the gap between themselves and digital and/or virtual banks. They also need to start creating a business model that addresses the demands, needs or pain points of a new generation and digitally-savvy discerning customers,” said Uttam in a report from Bernama.

Uttam also said that that the arrival of digital banks will spur the digital transformation in Malaysia as the plan saw wide support from the public. He further cited statistics from the PwC 2019 Report, which found that 77% of Malaysians polled are eager for digital banks. Meanwhile, only 36% of them continue to trust traditional banks to keep their data and monies secure.

In line with this trend, BNM had announced the exposure draft for the licencing framework for digital banks at the end of 2019, which sought to issue five digital bank licences. However, the consultation period for the exposure draft was postponed from March to June 2020 due to the Covid-19 pandemic. BNM is currently at the stage of finalising the updated exposure draft.

Uttam further commented that with BNM’s virtual banking licensing framework taking flight from June 2020, the banking industry has been paying more attention to the capabilities needed for digitalisation. Banks began observing more paperless, branchless, and signatureless transactions over the web. Statistics from the central bank also revealed that 35.1 million Malaysians have subscribed to online banking as of June 2020.

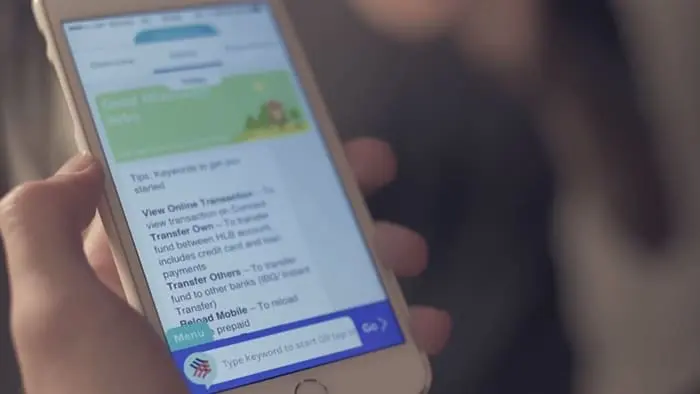

(Image: Amanz)

That said, Uttam clarified that the banking industry is not a latecomer to the digital scene. In fact, it was one of the early adopters that started their digital journey in the late 20th century, growing gradually in the past two decades. They are also one of the essential providers in digitalisation with the pervasiveness of mobile devices, encouraging early adoption of online banking as the demand for instant and convenient accessibility to banking services grew.

“They started with internet banking, mobile banking, changing from swipe cards to newer chip-based automatic teller machine (ATM) cards and launching the Malaysian Electronic Payment System (MEPS) dash. Today, we see further enhancements with the use of a combination of password, PIN token, two-factors authentication or QR code in the authorisation process,” said Uttam.

(Image: New Straits Times)

“With transactional capabilities in place, digital banking leaders are now shifting their focus from developing features to creating personalised user experiences that increase customer retention and drive revenue growth,” Uttam also noted. He added that by using analytics, banks can identify customer preferences and accelerate digital access to information, which helps them to pinpoint crucial features for a better consumer experience.

Finally, Uttam said that this shift to online banking has created a surge in transaction volume and frequency. As such, banks are forced to rethink their IT architecture and to ensure that it can cope with the new demands.

(Source: Bernama)

Comments (0)