Alex Cheong Pui Yin

12th July 2022 - 2 min read

Maybank has announced that it will be implementing a new method of calculating the interest, profit and dividend rates for its savings and investment products, called the split-tier method. Set to take effect in stages starting from 1 August 2022, it will affect the bank’s current and savings accounts, as well as investment accounts (applicable to both conventional and Islamic products).

In its notice, Maybank explained that the split-tier method is a calculation method that separates a customer’s account balance according to its respective rate tier, with each tier earning a specific rate. The rates are assigned as below:

| Balance tiers/bands | Interest/profit/dividend rate (% p.a.) |

| Below RM2,000 | 0.05 |

| RM2,000 to RM50,000 | 0.65 |

| Subsequent balances above RM50,000 | 0.85 |

The bank also clarified that the split-tier method will use the following formula for its calculations:

Account balance for each band x rate for each band x (total number of days/total days of the year)

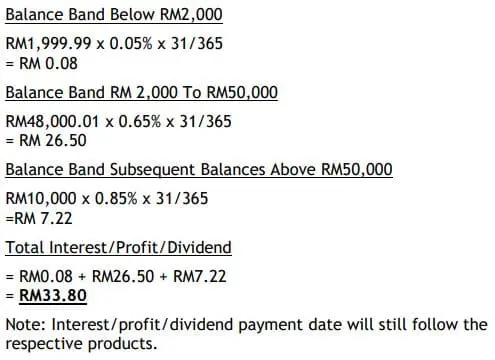

To illustrate how the split-tier method will work, Maybank provided the following sample of a customer who has an account balance of RM60,000 in the month of August 2022, and how his interest/profit will be calculated:

Finally, note that the implementation of the split-tier method for the bank’s various products (conventional and Islamic) will take place as per the following schedule:

Conventional products

| Product type | Products | Implementation date |

| Savings accounts | – Basic Savings Account – Maybank2u Savers – Golden Savers Savings Account – Personal Saver – Flexi Saver Plan | 1 August 2022 |

| Current accounts | – Maybank2u.Premier Account | 1 August 2022 |

| Current accounts | – Premier 1 & Premier Savings Account – Private Banking Account | 1 October 2022 |

Islamic products

| Product type | Products | Implementation date |

| Savings accounts | – Savings Account-i – Basic Savings Account-i – Maybank2u Savers-i – Personal Savers-i – Flexi Savers-i – Yippie-i & imteen i (only for accounts that perform withdrawal more than once a month) | 1 August 2022 |

| Investment accounts | – Golden Savvy Account-i – Zest-i | 16 August 2022 |

| Investment accounts | – Private Banking Account-i – Premier Mudharabah Account-i (Retail, SME/BB and GB) | 16 October 2022 |

If you have enquiries regarding Maybank’s implementation of the split-tier calculation or would like to find out more information regarding the rate for each financial product, you can visit the Maybank2u website. Alternatively, you can also call Maybank’s customer care hotline at 1300 88 6688 or visit the nearest Maybank branch.

(Source: Maybank)

Comments (1)

On what basis the “Balance Band” decided? is it based on balance on last day of the month ? or monthly average balance caculates?