Alex Cheong Pui Yin

7th December 2021 - 2 min read

OCBC Bank customers are now able to digitally sign up for the bank’s FRANK by OCBC service, without having to step foot into a physical branch. This is following the latest update to the mobile-first banking solution, which sees it now equipped with electronic Know Your Customer (eKYC) features.

Developed together with credit reporting agency CTOS Data Systems, OCBC said that the eKYC platform will allow customers to apply for a FRANK account and have access to its functions within minutes. This convenient onboarding experience, in turn, will make FRANK by OCBC even more appealing to individuals who are looking for a cutting-edge and secure banking product.

“We are constantly on the lookout for digital banking solutions that make things simpler, faster, and more convenient for our customers – without compromising on security. Now that we are onboarding customers remotely, they will only need to snap a photo of their MyKad, and then provide verification by uploading a selfie during the process,” said the managing director and head of consumer financial services for OCBC, Anne Leh, adding that this convenience is key in addressing customers’ digital banking needs.

The chief executive officer of CTOS Data Systems, Eric Chin also chimed in on the ease of use and safety offered by the fully digitised FRANK by OCBC service. “Powered by CTOS eKYC, OCBC Bank customers now have easy access to account opening services, remotely and safely,” he commented, adding that the eKYC feature is crucial in meeting customers’ demands for a next-generation core banking solution.

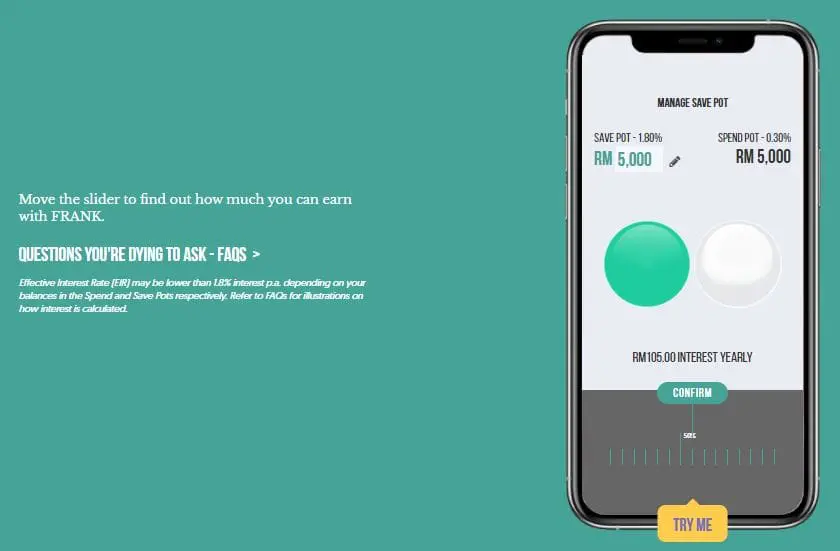

OCBC first launched FRANK by OCBC back in September 2020 as a mobile-first digital banking solution that provides greater personal control over an individual’s finances. A key element of its appeal lies in the Save and Spend Pots, where customers can enjoy the flexibility of a savings account even as they earn higher interest rates through their savings. Aside from that, FRANK by OCBC also offers several financial management features – such as Money In$ights, an improved expense tracker – and does not charge foreign exchange mark-ups when customers perform overseas transaction or spend in foreign currency while making online purchases.

(Source: OCBC)

Comments (0)