Samuel Chua

28th February 2025 - 1 min read

Public Bank has announced that its PB engage MY app will be officially discontinued from June 2025 onwards. Customers are required to migrate to the MyPB App, which will become the bank’s exclusive mobile banking platform.

To ensure a smooth transition, users must ensure that their mobile devices are running on Android 11 or higher. Those still using Android 10 or below are advised to update their operating systems to access the MyPB App.

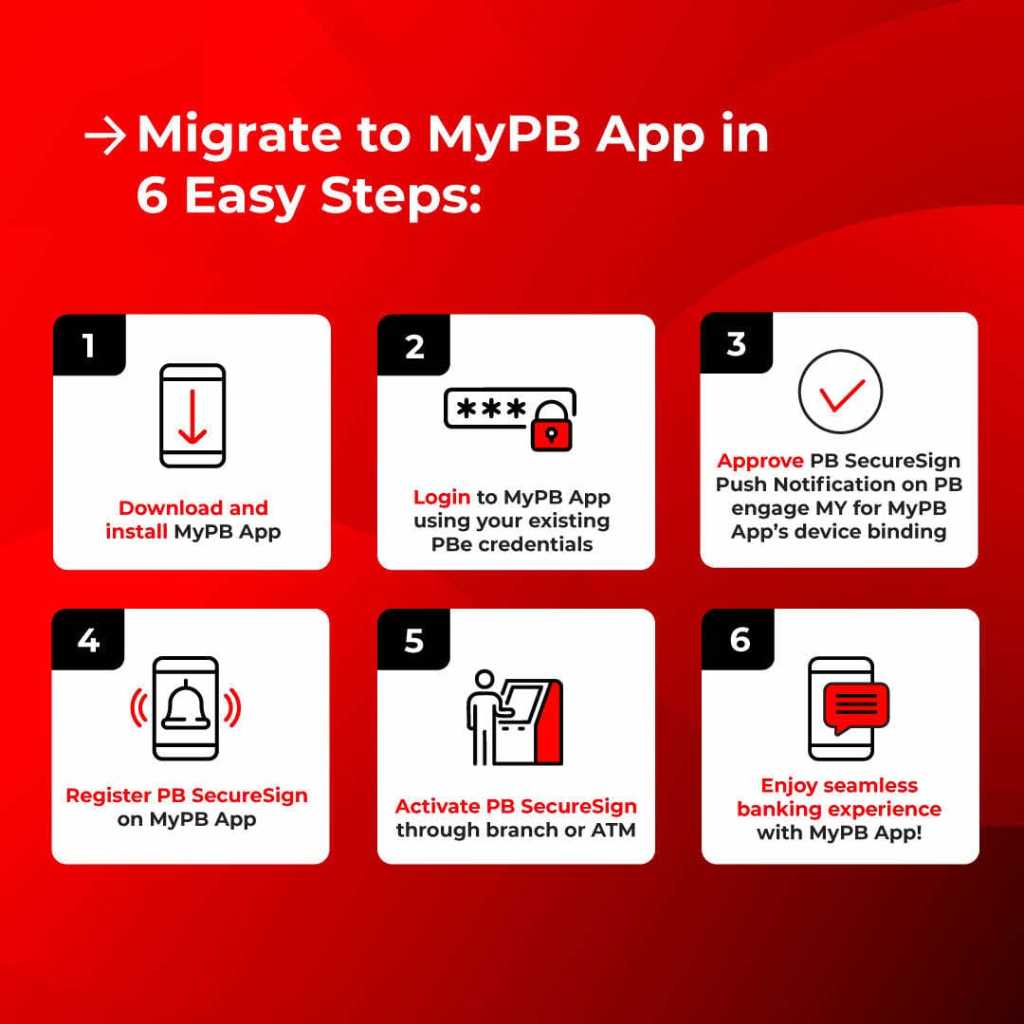

The bank has provided a six-step migration process for users to switch to the new platform. Customers need to download and install the MyPB App, log in using existing credentials, approve PB SecureSign push notifications, register PB SecureSign, and activate it through a branch or ATM before enjoying the new banking experience.

Additionally, Public Bank has implemented a 12-hour cooling-off period for PB SecureSign activation on the MyPB App. Users are encouraged to complete the migration steps ahead of time to avoid disruptions to their mobile banking services.

For more details, customers are advised to visit Public Bank’s official website or contact customer support.

(Source: Public Bank)

Comments (2)

May I know if the Pbb bank account holder work at oversea, how to activate the new system of MyPB App?

Hi there! Please visit Public Bank’s official website ( https://www.pbebank.com/ ) or email customer support at customersupport@publicbank.com.my for more information.