Samuel Chua

2nd May 2025 - 2 min read

RHB Bank Berhad and RHB Islamic Bank Berhad have launched a new campaign aimed at encouraging greater use of digital banking services among their customers. Running from 1 May to 31 October 2025, the “Banking Digitally with RHB” campaign offers cashback rewards to eligible participants who perform a series of qualifying digital transactions through the bank’s online and mobile banking platforms.

Open to both new and existing RHB customers, the campaign targets users with current and savings accounts, credit cards, and various financing products. However, certain account types and corporate cardholders are excluded from participation. Individuals under the age of 18, RHB employees, and corporate entities are also not eligible.

Participants are automatically entered into the campaign upon completing qualifying transactions such as DuitNow QR payments of RM10 or more, first-time logins to RHB’s digital platforms, setting up DuitNow IDs, initiating new recurring JomPAY payments, or investing in term deposits via FPX. Each activity earns entries into a prize pool, with bonus entries awarded for transactions performed on the last day of each calendar month.

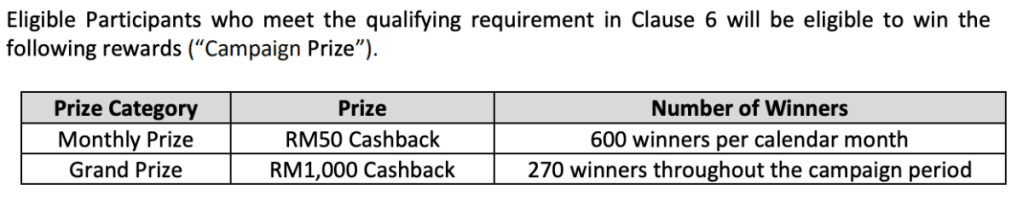

The campaign offers two categories of rewards: a monthly prize of RM50 cashback awarded to 600 winners each month, and a grand prize of RM1,000 cashback for 270 winners at the end of the campaign. Winners are determined based on the number of eligible entries accumulated, with tiebreakers settled by the earliest transaction timestamp.

To qualify, customers must ensure that their accounts remain active and in good standing throughout the campaign and until the rewards are disbursed. Cashback prizes will be credited directly into the participant’s RHB account associated with the qualifying transaction within six to eight weeks after the campaign ends.

The campaign offers customers an opportunity to earn monthly and grand cash rewards through eligible digital transactions, with participation tied directly to activity on RHB’s mobile and online banking platforms.

(Source: RHB)

Comments (0)