Samuel Chua

29th December 2025 - 2 min read

Standard Chartered Saadiq Berhad has announced a revision to the profit rates [PDF] for its JustOne Priority Plus Savings Account-i, effective 1 January 2026.

The revision affects how balances are tiered for profit calculation, while the profit rates themselves remain unchanged across tiers. All other product features, fees, and charges will stay the same.

What Is Changing From 1 January 2026

The main change involves the balance threshold for earning higher profit rates.

Currently, balances above RM100,000 qualify for higher profit tiers. From 1 January 2026, this threshold will increase to RM350,000. This means customers will need to maintain a higher minimum balance to earn profit rates above the base tier.

Revised Profit Rate Structure Explained

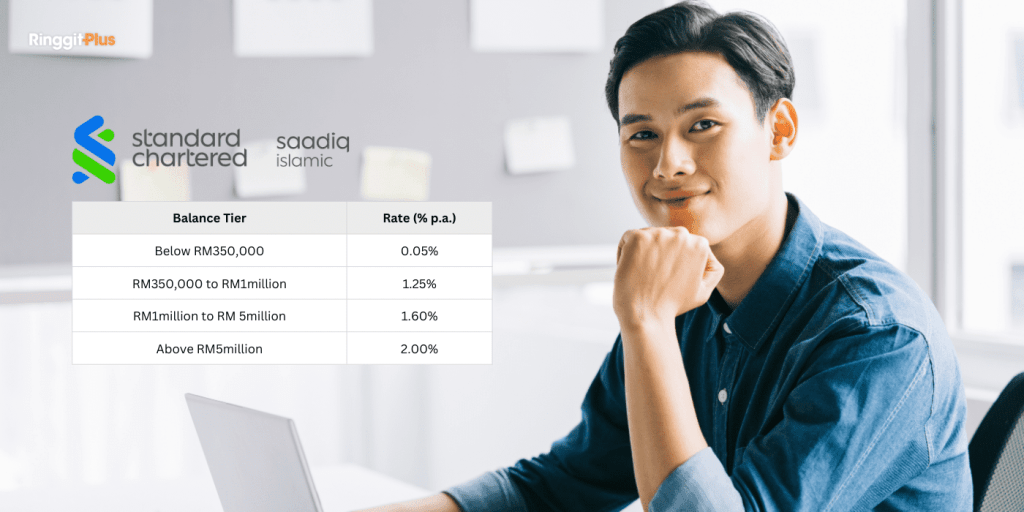

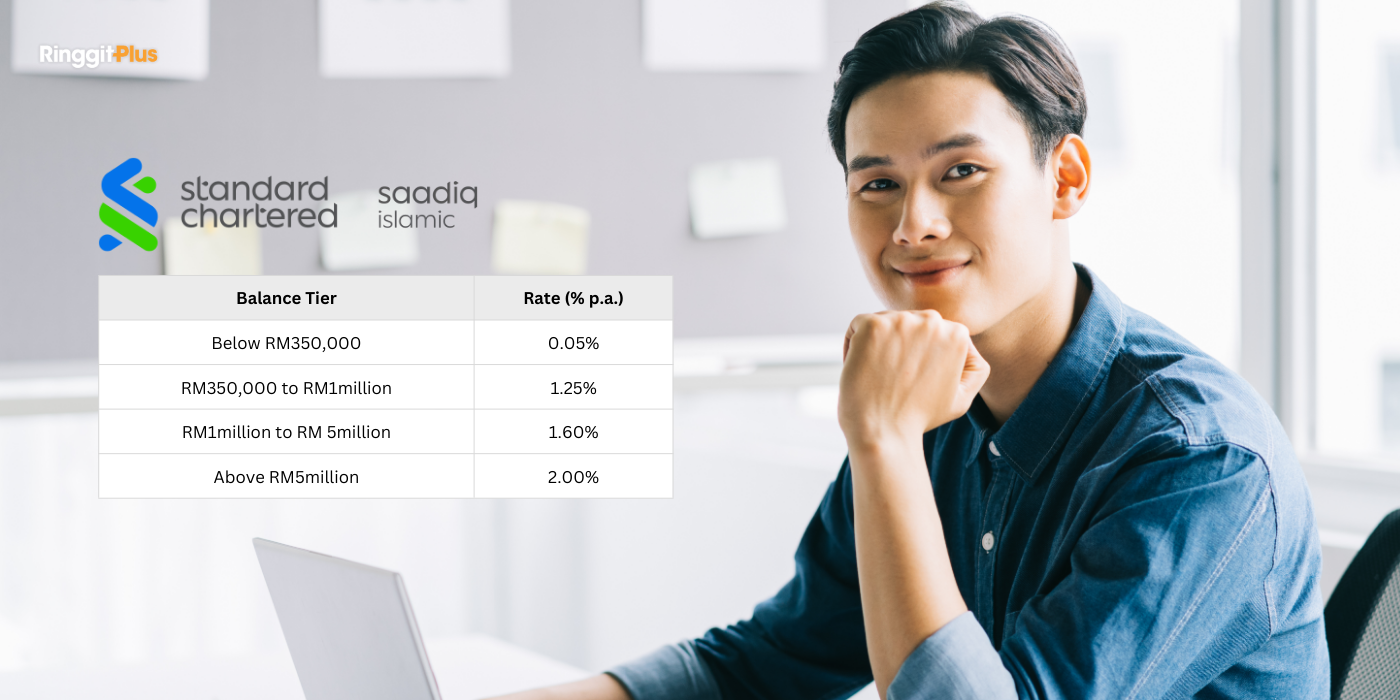

Under the revised structure, balances below RM350,000 will earn a profit rate of 0.05% per annum. Balances between RM350,000 and RM1 million will earn 1.25% per annum.

Balances from RM1 million to RM5 million will continue to earn 1.60% per annum, while balances above RM5 million will earn 2.00% per annum.

The profit rates themselves are unchanged. Only the balance threshold for the second tier has been adjusted.

How This Affects Existing Account Holders

Account holders with balances between RM100,000 and RM349,999 will see a change in the profit rate applied to their savings once the revision takes effect. These balances will fall under the base tier of 0.05% per annum unless topped up to meet the new RM350,000 threshold.

For customers already maintaining balances above RM350,000, the applicable profit rates will remain the same as before.

Profit Rates May Change With OPR Adjustments

Standard Chartered Saadiq noted that the JustOne Priority Plus Savings Account-i profit rate is subject to change if there are revisions to the Overnight Policy Rate announced by Bank Negara Malaysia’s Monetary Policy Committee.

In such cases, the bank will provide at least 21 days’ prior notice before any changes take effect.

Protection And Where To Get More Information

Deposits in the JustOne Priority Plus Savings Account-i are protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to RM250,000 per depositor.

Customers can find the updated rates on the Standard Chartered Malaysia website. For enquiries, assistance is available through Secure Mail on the SC Mobile app or Online Banking. Priority Banking clients may also contact their Relationship Manager via myRM for dedicated support.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)