Alex Cheong Pui Yin

5th October 2023 - 3 min read

Boost has officially launched its Beyond prepaid card today, in collaboration with CelcomDigi and Mastercard. The card – which is the first in Malaysia to offer a unique two-payment-options-in-one-card feature – will be available for application for Celcom and Digi customers soon.

In a statement, Boost explained that with the Beyond card, cardholders will be given two payment options when they shop. During checkout, they can choose to either draw directly from their Boost Wallet balance to make a full up-front payment, or tap into a shariah-compliant pre-approved credit line called Boost PayFlex. Boost PayFlex allows you to spread the payment of your purchases by up to three months, with the ability to earn up to 3x Boost Stars (depending on your rank).

Do note, however, that there are fees to opting for the Boost PayFlex feature (whether you pay within 30 days or in instalments of up to three months), including the wakalah fee and profit/interest rate – as we’ve previously reported here. That said, Boost reassured that this pre-approved credit line will be offered to cardholders in a responsible manner, using robust scoring techniques to ensure that those who tap into it will have the ability to repay.

In terms of security, each transaction is password-protected, and you can also freeze your Beyond card instantly if you suspect that your data has been compromised.

In addition to being the first card in Malaysia to offer this two-in-one feature, Boost said that the Beyond card is also the first in Southeast Asia to offer Mastercard Travel Rewards. With this, qualified customers will be able to enjoy benefits like cashback from Lazada and Malaysia Airlines flight bookings, complimentary gifts, and additional savings at Mitsui Outlet Park.

“It gives me great privilege to be able to launch a first in the market product together with our sister company, CelcomDigi, and be able to provide a Tier 1 card experience to a large segment of our combined customer base,” said the group chief executive officer of Boost, Sheyantha Abeykoon, adding that the Beyond card is intended to address financial inclusion gaps and to provide a premium experience to individuals who currently do not own cards or only have basic cards.

Similarly, chief innovation officer of CelcomDigi, T. Kugan said that the partnership marks a pivotal step towards financial inclusivity together with telecommunications products and services, especially for Malaysians who have shifted to a digital-first lifestyle.

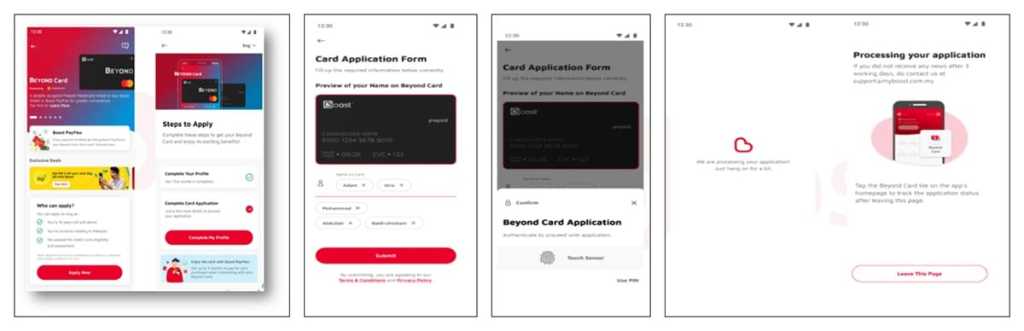

On the availability of the Beyond card, Boost said that Celcom users will be given exclusive access to apply for the card first, starting from 9 October 2023. This is subsequently followed by Digi users. To apply, you must have downloaded the Boost app and created a Premium Wallet; you can then tap on the “Beyond Card” tile on your home screen and complete the necessary application process.

Once successfully pre-approved, you’ll receive your virtual Beyond card instantly on the app, which can be used for online transactions. There is also the option to request for a physical card, but it will cost you RM20 (covering delivery and SST charges) – although this will also entitle you to rewards worth up to RM100, including discount vouchers from Lazada, Gong Cha, and Agoda.

Boost first announced its intention to introduce the Beyond prepaid card back in 2021, and subsequently began rolling it out to selected users during a beta phase in July 2023.

Comments (1)

seems useless to me