Desiree Nair

20th September 2016 - 4 min read

Now most loan defaulters will be subject to an eventual blacklist, poor credit rating, late payment penalties and other conditions that vary between banks. That however, isn’t the extent of their powers.

Here’s how banks can further penalise you if you fail to pay up on these types of loans:

1. Hire-Purchase Auto Loans

One of the worst things to happen when you default on a car loan is repossession; this is when your car is taken from you and held by the bank. Typically, missing more than two payments can start the repo process but this varies between lenders.

You are also likely liable for legal fees as well as costs incurred to repossess and hold your car. Note though, if you have already paid up more than 75% of your car loan, a court order will need to be issued before your car can be repossessed.

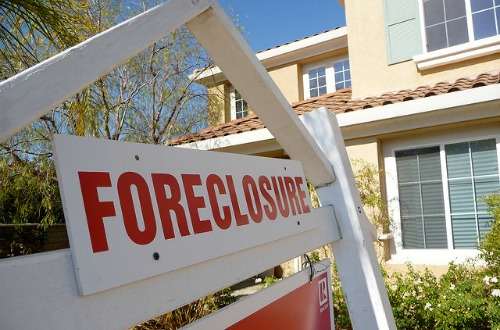

2. Housing Loans

Stiffing mortgage payments can pose more severe penalties than other types of loans because the amount is usually much bigger. Missing more than three to four months of instalment payments can trigger foreclosure actions by the bank which could lead to your property being auctioned. Moreover, your guarantor is now liable to cover your debt and could be blacklisted as well. In addition, any collateral you pledged for the loan might be liquidated to pay down what you owe.

If your home has been auctioned and the proceeds were found insufficient to cover the loan amount; you will still be liable to pay off the balance. Now, if that balance amounts to RM30,000 over a period of six months, the bank may even file a bankruptcy petition against you.

3. Credit Cards and Personal Loans

Since credit cards and most personal loans are forms of unsecured financing, failure to make payment will result in your getting sued for monies owed, but this is often the last resort action of lenders.

You will first be penalised with late payment charges and if you still don’t pay up, your lender may seek help from debt collection services to recover the dues. At this point, your credit score will be smeared and chances to gain financing from banks will be close to impossible.

Now if your bank finds that there is no way to recoup what you owe, they may move to file a bankruptcy petition against you if possible.

Take Early Precautions

Before it gets to a stage where your bank is blacklisting you or taking away your house and car, be proactive and take control of the situation with these actions:

Consult your bank to request for extensions or revisions to your loan. This may not always work, but it’s worth a shot at leniency and an opportunity to pay off your debts.

Find other ways to cover your debt. With home, car and personal loans, you can refinance for better terms, i.e. lower interest rates and more affordable monthly repayments. In the case of credit cards, you can try to apply for a balance transfer to wipe out interests for a certain period and lower your monthly repayments. You can also take out a personal loan to cover your credit card dues if interest rates are lower than your credit card.

If mounting debt is getting to be too much for you to manage, do contact the Credit Counselling and Debt Management Agency for help negotiating with banks on your behalf.

Before you take on any loan, do research the affordability of all financing packages offered to you. Need help? Just check out our comparison page to find the most affordable home, personal and car loans available. If you have anything to add to this article, do share your thoughts and comments with us in the comments section down below!

Image credit: Jeff Turner’s photostream.

Comments (3)

Ambank

My car take already

So how can I take it back?

Or need to call bank?

Tq

You should contact the bank for further information on this.

I am unemployed and couldn’t get a job as of now.. but still need to serve my housing loan .. in this case what are the action i can take from falling into auction or bankruptcy? Pls advise