Samuel Chua

13th May 2025 - 2 min read

RHB Banking Group (RHB) has announced the introduction of enhanced features to its RHB Smart Account/-i, effective from 1 June 2025, offering customers increased flexibility and greater rewards in their everyday banking.

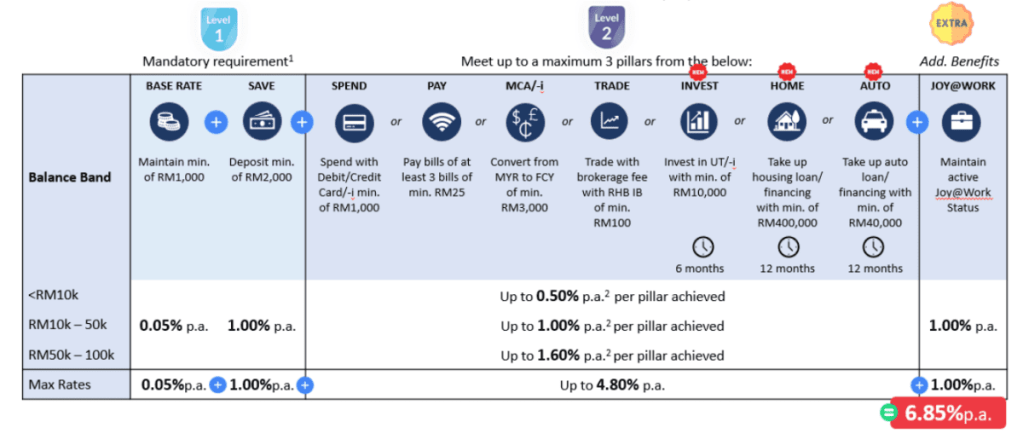

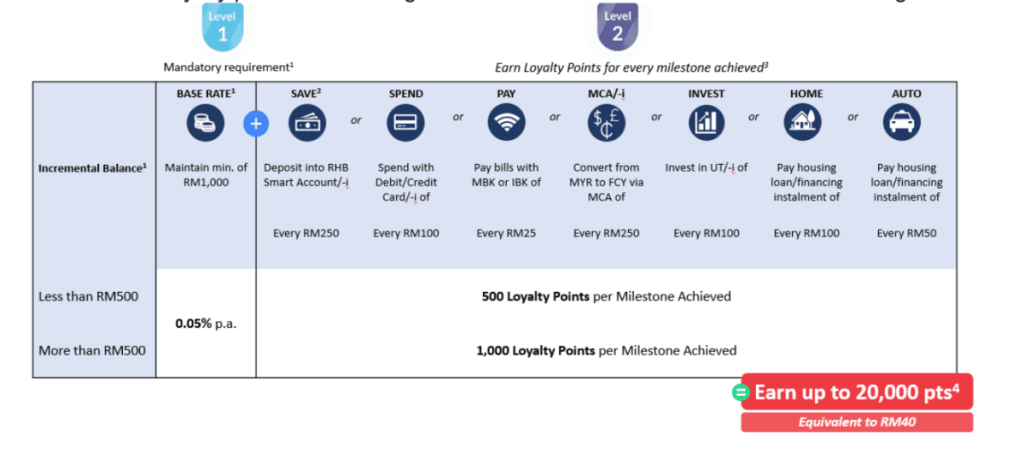

Under the enhanced offering, customers will be able to choose between two reward options tailored to their banking behaviour: Bonus Rates or Loyalty Points.

The Bonus Rates option enables customers to earn attractive interest based on both their incremental balance and their engagement in various transaction categories. The interest rates vary depending on the account’s minimum average balance and the increase in monthly balances. For instance, customers with a minimum average balance of RM1,000 and incremental balance of RM50,000 or more may earn up to 1.60% per annum, subject to the achievement of up to three transaction categories.

Alternatively, the Loyalty Points option allows customers to accumulate points that can be redeemed for gifts and vouchers. These points are awarded based on specific transaction categories and are subject to caps of 5,000 points per category and 20,000 points at the product level on a monthly basis. This reward scheme is exclusive to active Joy@Work customers, thereby encouraging deeper engagement within the bank’s ecosystem.

Customers are encouraged to review the updated terms and explore the options available to optimise their banking experience with RHB.

(Source: RHB)

Comments (0)