Alex Cheong Pui Yin

9th November 2020 - 8 min read

Last Friday, Finance Minister Tengku Zafrul Abdul Aziz tabled the highly awaited Budget 2021, which was described as an expansionary budget that will support the people and revive the economy of the country. It saw various measures being introduced to benefit different economic sectors and segments of the society, especially amidst the current challenging financial landscape.

For small and medium enterprises (SMEs), micro SMES (MSMEs), and business owners, here’s a list of key benefits that you can expect to tap into from the latest national budget.

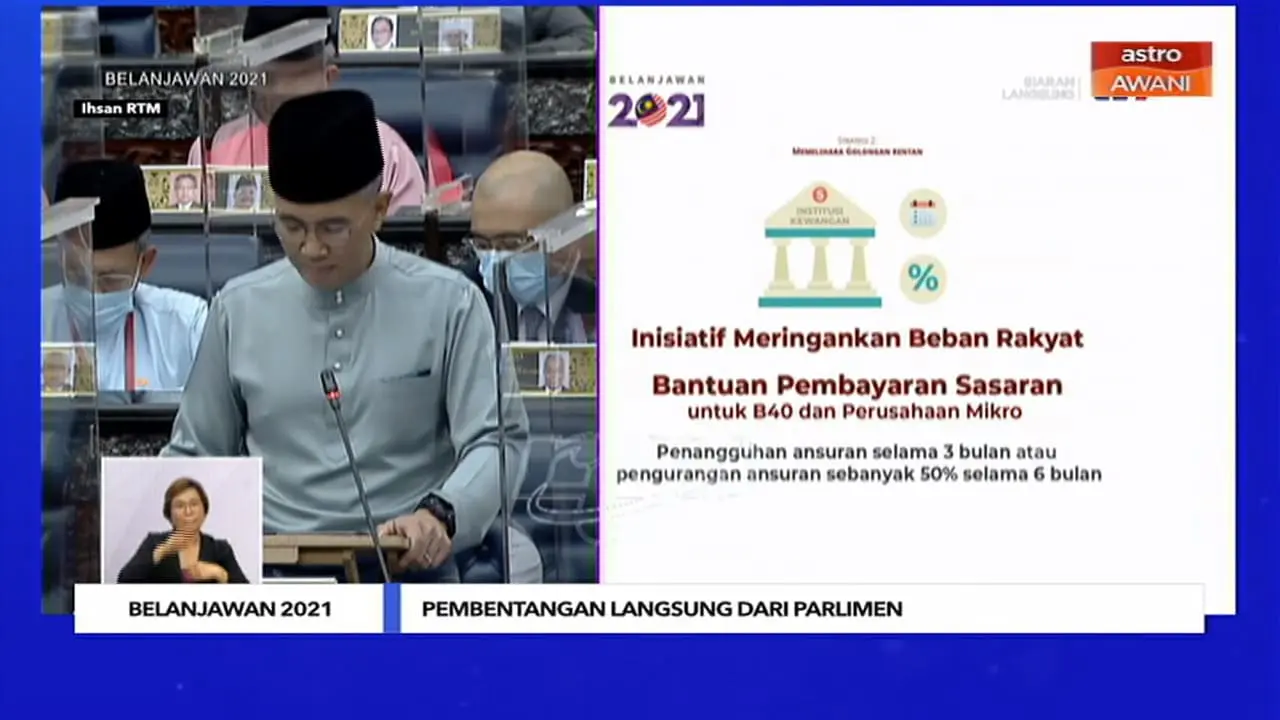

Enhanced targeted loan repayment assistance

Micro-enterprises with loans of up to RM150,000 will have access to an enhanced targeted repayment assistance programme from December 2020 onwards. You will be given two new options, namely:

- Option 1: Postponement of repayment for 3 months

- Option 2: 50% reduction in monthly instalment for 6 months

This enhanced assistance will also cover loan facilities that were approved before 1 October 2020, provided they are not in arrears for more than 90 days. If you wish to take on either options, you can head on to your respective banks to speak to their representatives. No additional documentations are required, according to the finance minister.

Financial aid for bumiputera entrepreneurs and entrepreneurs from other communities

A total of RM4.6 billion will be set aside to assist bumiputera entrepreneurs, providing them with financing options via several avenues, including:

- TEKUN Nasional and Perbadanan Usahawan Nasional Berhad (PUNB)

- RM510 million to finance bumiputera SMEs and MSMEs

- Syarikat Jaminan Pembiayaan Perniagaan (SJPP)

- RM2 billion to finance bumiputera SMEs

- Bank Pembangunan Malaysia and SME Bank

- RM800 million for capacity building programmes, such as employee upskilling and tool upgrades

The government is also allocating RM1.3 billion for various capacity building programmes, including professional development, Dana Kemakmuran Bumiputera, as well as other specific programmes or projects specifically for bumiputeras.

Apart from that, the government will provide RM20 million specifically for Skim Pembangunan Usahawan Masyarakat India (SPUMI), and another RM5 million for entrepreneurship development for other minority communities.

Financing aid and training programmes for women entrepreneurs

(Image: Malay Mail/Hari Anggara)

RM95 million will be set aside for a special micro credit financing facility specifically for women entrepreneurs, to be disbursed via TEKUN Nasional, MARA, and Agrobank. This is on top of another RM50 million that is offered to support them via Ar-Rahnu BizNita, a programme parked under the Islamic Economic Development Foundation (YaPEIM).

Additionally, more than 2,000 women entrepreneurs will be able to benefit from guidance courses via the Micro Entrepreneur Business Development Programme (BizMe). These guidance programmes include coaching in matters such as packaging and labelling, marketing strategies, as well as technical guidance of businesses.

Improved access to financing aid via micro credit financing

(Image: The Malaysian Reserve)

As much as RM1.9 billion of soft loan funds and grants have been provided via the PRIHATIN and PENJANA packages to help SMEs and MSMEs facing difficulties accessing financing aid. The government aims to continue helping these entrepreneurs by enhancing different avenues for micro credit financing.

Firstly, SME Bank will provide the Lestari Bumi financing facility scheme with funds amounting to RM300 million. This fund is aimed at encouraging SMEs and MSMEs to move up the value chain by transforming and improving their businesses.

In addition to that, the government will also introduce the National Supply Chain Finance Platform, dubbed Jana Niaga, to assist SMEs that supply to the government or government-linked companies (GLCs). This platform is expected to help these businesses with cash flow issues due to their long invoice payment period, as well as enable them to secure loans from financial institutions. It will be spearheaded by the Export-Import Bank of Malaysia (EXIM Bank), with a fund allocation of RM300 million. For now, Jana Niaga will be implemented together with Petronas and Telekom Malaysia, and will soon be extended to other GLCs, ministries, and government agencies.

(Image: Berita Harian)

Businesses can also tap into an enhanced peer-to-peer (P2P) financing facility, an alternative financial aid under the supervision of the Securities Commission Malaysia. This facility has generated financing in excess of RM900 million for SMEs, especially those based on an invoice financing, and now the government will be supporting it with an injection of RM50 million fund.

Aside from that, micro credit financing aid worth almost RM1.2 billion will also be disbursed through TEKUN, PUNB, Agrobank, Bank Simpanan Nasional, as well as other financial institutions. This amount includes a total of RM110 million that is allocated under the Micro Enterprise Facility (via Bank Negara Malaysia) to encourage entrepreneurship among gig workers and the self-employed, as well as to enhance the iTEKAD programme. To clarify, the iTEKAD programme was introduced to empower microentrepreneurs from the B40 segment to generate sustainable income.

Finally, the government will allocate RM230 million through PUNB as financing for SMEs. Businesses can tap into this allocation for working capital, funds for the upgrading of their automation systems and equipment, as well as expenses related to the implementation of Covid-19 standard operating procedure (SOP) compliance.

Enhanced government guarantee schemes

The government will provide an additional RM10 billion for government guarantee schemes that are provided via Syarikat Jaminan Pembiayaan Perniagaan (SJPP), with RM2 billion reserved specifically for bumiputera entrepreneurs. This is on top of the RM25 billion that has already been allocated for this initiative thus far.

Simply put, government guarantee schemes are alternative solutions where the Malaysian government stands in as a guarantor for eligible SMEs so that these businesses can obtain credit facilities from participating banks. These schemes provide a guarantee coverage of up to 80%, and the facilities obtained can only be used for working capital or capital expenditure.

Targeted assistance and rehabilitation facility

SMEs that are financially affected can also look into the Targeted Assistance and Rehabilitation Facility that is worth RM2 billion. Parked under the jurisdiction of Bank Negara Malaysia (BNM), this fund will be introduced via loans from banking institutions.

Incentives for local entrepreneurs and to boost consumption of local products

(Image: The Star)

The government will introduce the Micro Franchise Development programme and the Affordable Franchise Scheme to help entrepreneurs who are interested in venturing into the local franchising industry. In addition to that, the Buy Made In Malaysia programme – which was launched in July 2020 to boost consumption of local products and services – will also be continued. A total of RM25 million will be allocated for the three aforementioned incentives.

Aside from that, RM150 million is to be set aside to re-implement the Shop Malaysia Online initiative, which was previously introduced under the PENJANA economic recovery plan and had ended in September. The initiative operated on the collaboration between the government and several participating e-commerce platforms to offer discount vouchers for consumers, thereby stimulating the e-commerce ecosystem. This round, it is expected to benefit 500,000 local sellers, including halal products and handicraft entrepreneurs.

The government is also injecting another RM150 million for the e-Commerce SME and Micro SME campaign to encourage 100,000 local entrepreneurs to embark on their e-commerce journey. The fund can be used for training programmes, sales assistance, and digital equipment.

Lastly, RM35 million will be parked under the Trade And Investment Mission effort to promote Malaysian-made products and services in foreign countries.

Exemption from Human Resources Development Fund (HRDF) levies

Companies that are still affected by the Covid-19 pandemic will be exempted from paying the HRDF levies for 6 months, starting from 1 January 2021. It will also cover the tourism sector.

To clarify, the HRDF levy is mandatory levy payment collected by the HRDF from employers in specific industries, and it is intended to provide employee training for the Malaysian workforce. Depending on the size of your company’s workforce, the rate of HRDF levy imposed can be either 0.5% or 1% of the monthly wages of each employee.

Financial aid for the digitalisation of businesses

The government has emphasised that it will focus on long-term productivity via new technology to accelerate the country’s transformation towards a high-income nation. For this reason, grants and loans will continue to be provided to encourage SMEs and businesses to digitalise their operations and trade channels.

Chief of this is the Industrial Digitalisation Transformation Scheme that is valued at RM1 billion, to be provided via Bank Pembangunan Malaysia Berhad (BPMB). Aimed at boosting digitalisation activities, this fund will be available until 31 December 2023.

On top of that, the government is also injecting an additional RM150 million into the existing SME Digitalisation Grant Scheme and Smart Automation Grant in support of automation and modernisation. There are also plans to relax the eligibility requirements for MSMEs and start-ups applying for these grants if they have operated for at least six months.

Tax exemption for equity crowd financing (ECF)

Start-ups and businesses that tap into equity crowd financing as a form of alternative financing method will be entitled to a tax exemption of 50% of the investment amount (capped at RM50,000). In addition to that, RM30 million will also be allocated through matching grants to be invested on ECF platforms – an initiative to be supervised by the Securities Commission Malaysia.

***

With this, we hope that you now have an idea of some key initiatives in Budget 2021 that will benefit SMEs, MSMEs, and other businesses in the upcoming year. You can also check out our comprehensive infographic for other highlights of the latest national budget, and our in-depth coverage here.

Comments (0)