Alex Cheong Pui Yin

10th June 2020 - 11 min read

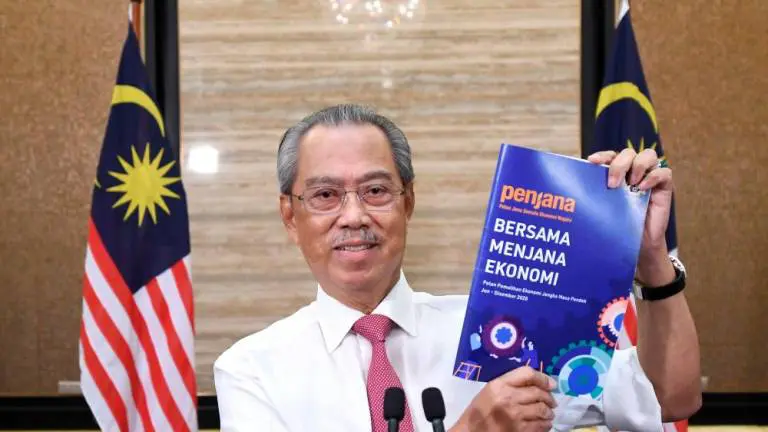

Last Friday, Prime Minister Tan Sri Muhyiddin Yassin unveiled a short-term national economic recovery plan aimed at helping Malaysia get back to its feet amidst the challenging economic landscape post-MCO. The PENJANA plan, which sees a budget allocation of RM35 billion, is drafted with three goals in mind: to empower the people, propel businesses, and stimulate the economy.

As many as 40 initiatives were included in PENJANA, with an emphasis on providing social support for the people, improving domestic consumption, and supporting the digitalisation of small and medium-sized enterprises (SMEs).

Here’s a list of highlights that you can look forward to from the PENJANA economic recovery plan.

PENJANA Benefits For Malaysian Individuals

Salary Subsidy Programme

The ongoing salary subsidy programme will be extended for another three months, until the end of September 2020, with some slight tweaks. The existing programme offers an RM600 salary subsidy for three months to all employees who are earning less than RM4,000 per month, and are working for employers who have suffered an income loss of more than 50% since 1 January 2020.

Following the extension, employers enrolled in the programme can also opt to implement policies such as reduced work week and reduced pay (maximum 30%). Employers in the tourism sector and other businesses that were prohibited from operating during the conditional movement control order (CMCO) are now also allowed to receive wage subsidies for employees on unpaid leave, provided the funds go directly to the employees.

Hiring Incentives

(Image: AutoBuzz)

The government has introduced hiring and training incentives for companies so as to curb the rising rate of unemployment within the country. The benefits are as follows:

- RM600 per month if employers provide apprenticeships for school leavers and graduates (up to 6 months)

- RM800 per month for the employment of individuals below 40 years of age (up to 6 months)

- RM1,000 per month for the employment of individuals above 40 years of age (up to 6 months)

- RM4,000 training allowance can be claimed by unemployed individuals even if they are not covered under the Employment Insurance System (EIS)

Reskilling And Upskilling Programmes

To enhance the employability of graduates, school leavers, and unemployed individuals, the government has prepared a dedicated RM2 billion fund to support reskilling and upskilling programmes offered through various avenues.

For youths

- Government to provide matching fund of RM250 million with the Human Resource Development Fund (HRDF) to co-fund place-and-train and upskilling programmes.

- Enhancing training facilities at community colleges, youth vocational institutes, and industrial training institutes.

- Training subsidy of up to RM3,500 over 6 months for programmes offered by Securities industry Development Corporation (SDEC).

- Relax the application conditions for the PROTÉGÉ Ready-To-Work (RTW) programme. The programme provides entrepreneurial training through apprenticeships, among others.

For unemployed individuals

- Collaboration between the public and private sector to offer upskilling courses in selected sectors, such as electrical & electronics and information communication technology (ICT).

- Incentives to promote short courses in local universities.

- Promoting entrepreneurship programmes offered by agencies such as the Ministry of Agriculture and Food Industries (MOA), the Entrepreneur Development and Cooperatives Ministry (MEDAC), and Majlis Amanah Rakyat (MARA).

- Training subsidy of up to RM800 per month (for 6 months) through the Securities Industry Development Corporation (SIDC).

Supporting The Growth Of The Gig Economy

(Image: SoyaCincau)

The government will provide a matching grant of RM50 million for companies to make SOCSO and EPF contributions for their employees. This includes SOCSO’s employment injury scheme (up to RM162 annually) and EPF’s i-Saraan contribution (up to RM250 annually).

Additionally, Perbadanan Ekonomi Digital Malaysia (MDEC) will be provided with RM25 million for the Global Online Workforce (GLOW) programme, which is intended to train Malaysians so that they can earn income from international clients while working online from home.

Incentives For Flexible Working Arrangements (FWA)

(Image: Focus Malaysia)

To encourage the adoption of a work-from-home policy, employers will be allowed tax deductions if they implement or enhance their flexible working arrangements, starting from 1 July 2020.

Employees will also be permitted income tax exemptions of up to RM5,000 if they receive mobile phones, notebooks, and tablets from their employers to facilitate their flexible working arrangements. This is also effective 1 July 2020. In addition to that, there is a special individual income tax relief of up to RM2,500 for the purchase of these items as well, effective 1 June 2020.

Meanwhile, SOCSO will also expand its Employment Injury Scheme to provide coverage for workers involved in accidents while working at home.

Childcare Subsidy

(Image: Malay Mail)

Working parents can benefit from a subsidy of childcare expenses via e-vouchers of RM800 per household for mobile childcare services. The e-vouchers are valid until end of August 2020. The government will also increase the income tax relief for childcare service expenses from RM2,000 to RM3,000 for YA2020 and YA2021.

Additionally, childcare centres can apply for a one-off grant of up to RM5,000 to comply with new healthcare SOPs. These centres must be registered with the Ministry of Women, Family, and Community Development (KPWKM). There will also be incentives allocated to train new practitioners for child nursing and early education courses under KPWKM, although details have not been released yet.

Public Transport Subsidy

An unlimited monthly travel pass priced at RM30 will be introduced to reduce the cost of daily public transportation. The pass is applicable for all rail services, BRT, RapidKL buses, and MRT feeder buses.

Social Aid For Vulnerable Groups And Enhanced Healthcare Support For PeKa B40

(Image: Harian Metro)

Registered OKUs, single mothers, and volunteers for home help services will be entitled to a one-off financial assistance of RM300. Relevant NGOs supporting these groups will also receive grants to aid them in their services. The government is also launching the PENJANA GLC Community programme, which encourages GLCs to adopt a community, implementing socio-economic development programmes with them.

Separately, the government has increased the existing fund for the PeKa B40 programme from RM50 million to RM100 million. The extra fund will be used to improve four benefits for the group, namely health screenings, medical device assistance, cancer treatment incentives, and subsidy for transportation for health. The healthcare protection scheme, which was originally made available only for BSH recipients and their registered spouses aged 50 to 60, has been expanded to cover BSH recipients aged 40 and above in 2020.

Free “Productivity Internet”

The government will be replacing the allowance of 1GB free mobile data during the MCO and CMCO period with a new free internet access plan. The revised plan will offer Malaysians 1GB of data for specific online learning and productivity tools, as well as news by participating telecommunication companies.

The service will also offer unlimited access to Microsoft Office 365 applications, and the Zoom video conferencing service. Additionally, Malaysians will get free and zero-rated access to all government websites and Covid-19 related apps, such as Gerak Malaysia, MySejahtera, and MyTrace.

Just like before, the free data offered will be valid only from 8am to 6pm daily. It will be available until end of December 2020.

ePenjana Credits For E-Wallets

(Image: The Sun Daily)

In a bid to further encourage e-wallet usage for contactless and cashless payments, as well as to boost consumer spending, the government will provide RM50 of e-wallet credit for eligible individuals. The ePenjana credits will also be matched by participating e-wallet service providers in the form of various vouchers, cashback offers, and discounts.

To qualify for the ePenjana incentive, you must be a citizen aged 18 and above, and are earning an annual income of less than RM100,000. You will also need to take an extra step of downloading and registering with the MySejahtera app.

Tax Exemptions And Financial Aid For Home Buyers

(Image: Malay Mail)

The Home Ownership Campaign will be reintroduced to stimulate the property sector and to financially aid home buyers. Through this campaign, home buyers will be exempted from stamp duty fees for land title transfers and loan agreements if the value of the property stands between RM300,000 to RM2.5 million:

- Stamp duty exemption for the land title transfers limited to the first RM1 million of the property value

- Full exemption is allowed for loan agreements

This benefit is applicable for agreements signed between 1 June 2020 to 31 May 2021, subject to a rebate of at least 10% from the developers.

During the period of the campaign, Malaysians purchasing their third home will also be excused from the financing limit of 70% of the property value. Applicable for homes valued at RM600,000 and above, the new financing limit will be determined by the internal risk management practices of the banks offering the loans instead.

Meanwhile, Malaysians wishing to sell their residential properties between 1 June 2020 to 31 December 2021 will also be exempted from the real property gains tax (RGPT). However, this is limited only to three residential properties per individual.

Tax Incentives For Car Purchase

Between mid-June to end of December 2020, those buying locally assembled cars will enjoy full sales tax exemption. Those purchasing imported cars, on the other hand, will get a 50% sales tax exemption instead.

PENJANA Benefits For Malaysian SMEs

SME E-Commerce And Shop Malaysia Online Campaign

(Image: Free Malaysia Today)

Eligible micro enterprises and SMEs will be encouraged to join an e-commerce campaign to digitalise and future-proof their businesses, as well as to widen their market reach. Through the campaign, the businesses can tap into aids such as on-boarding training, seller subsidies, and sales support.

Meanwhile, the government will also run the Shop Malaysia Online campaign to encourage online consumption. It will see the government collaborating with e-commerce platforms to co-fund digital discount vouchers for the Malaysian public to spend on products from local retailers.

Financial Aid For The Digitisation Of SMEs And Mid-Tier Companies

Grants and loans will also be provided to encourage SMEs and mid-tier companies to digitalise their operations and trade channels. They will be carried out via selected programmes, such as the SME Digitalisation Matching Grant, SME Technology Transformation Fund, and Smart Automation Grant.

A total of RM700 million is allocated for this initiative, with the bulk of it going to the SME Technology Transformation Fund. The fund will be offering up to RM500 million loans, and application opens in July 2020.

Meanwhile, the SME Digitalisation Matching Grant and Smart Automation Grant are both allotted RM100 million each. Note that the Smart Automation Grant has a cap of up to RM1 million per company.

Financing Aid For SMEs, Micro Entrepreneurs, And Other Businesses

Impacted SMEs can tap into a RM2 billion financing facility by banks, offered at a concession rate of 3.5% p.a.. The facility will be available starting mid-June 2020, and each SME can get a maximum loan of RM500,000.

Micro enterprises are also entitled to an aggregated approved financing of up to RM50,000 per enterprise. The interest rate for this facility is also set at 3.5% p.a.. Additionally, RM50 million has been specially earmarked for women entrepreneurs. The government will also dedicate an amount of the funding for youth entrepreneurs and social enterprises.

Meanwhile, bumiputera-owned and shariah-compliant businesses can benefit from a RM500 million financial aid set aside for them, provided through Perbadanan Usahawan Nasional Berhad (PUNB) and Majlis Amanah Rakyat (MARA). Aids include loans of up to RM1 million at 3.5% p.a. interest rate.

Lastly, the tourism sector will also have a RM1 billion financing facility dedicated to them, but further details will only be revealed in July 2020.

Tax Relief For Covid-19 Related Expenses

(Image: Malay Mail)

Expenses spent by businesses on implementing social distancing practices and Covid-19 prevention – such as Covid-19 testing kits, PPEs, and thermal scanners – are now allowed for tax deductions. This is to encourage businesses to adapt to the new norm and to adhere to new healthcare SOPs.

Setting Up of New Businesses

To encourage the establishment of new businesses, SMEs established between 1 July 2020 to 31 December 2021 will enjoy an income tax rebate of up to RM20,000 per year for three years of assessment. Meanwhile, SMEs aiming for mergers or acquisitions will be exempted from paying stamp duty fees for any applicable instruments, starting from 1 July 2020 to 30 June 2021.

***

Of course, this is not the complete list of initiatives announced as part of the PENJANA plan, but we’ve highlighted these as the most relevant ones.

Malaysia is currently in the midst of implementing a six-phase strategy to reboot the country’s economy; the six phases are: resolve, resilience, restart, recovery, revitalise, and reform. PENJANA marks the start of the fourth phase, recovery. The final two stages will be introduced in the form of the upcoming Budget 2021 and the 12th Malaysian Plan.

Comments (0)