Alex Cheong Pui Yin

18th October 2023 - 7 min read

In tabling the Budget 2024 last Friday, Prime Minister Datuk Seri Anwar Ibrahim – who is also the Finance Minister – shared numerous initiatives meant to help Malaysia navigate its way out of a “post-normal era that is characterised by chaos, complexity, and contradiction”. This comes as the world is still yet to fully recover from the impact of Covid-19, and Malaysia continues to struggle with issues such as rising cost of living.

Along with various initiatives aimed at helping the regular Malaysian, there are also multiple plans and assistance programmes proposed to assist micro, small, and medium enterprises (MSMEs) under the latest national budget. Here’s a list of facilities that have been proposed by the prime minister under the second Belanjawan Madani, which MSMEs and businesses can anticipate for 2024.

Mandatory adoption of e-invoicing for taxpayers with over RM100 million revenue

Taxpayers with an annual income or sales of over RM100 million will be required to adopt e-invoicing starting from 1 August 2024, which can lead to better record keeping processes and help reduce tax compliance costs. Originally, this mandatory adoption was slated to begin in June 2024 (Phase 1), with the pilot phase taking place between January 2024 until then.

With this amendment to the timeline, the deadlines for taxpayers in other income categories are also revised; the system will be enforced in phases for them, with a comprehensive implementation target by 1 July 2025.

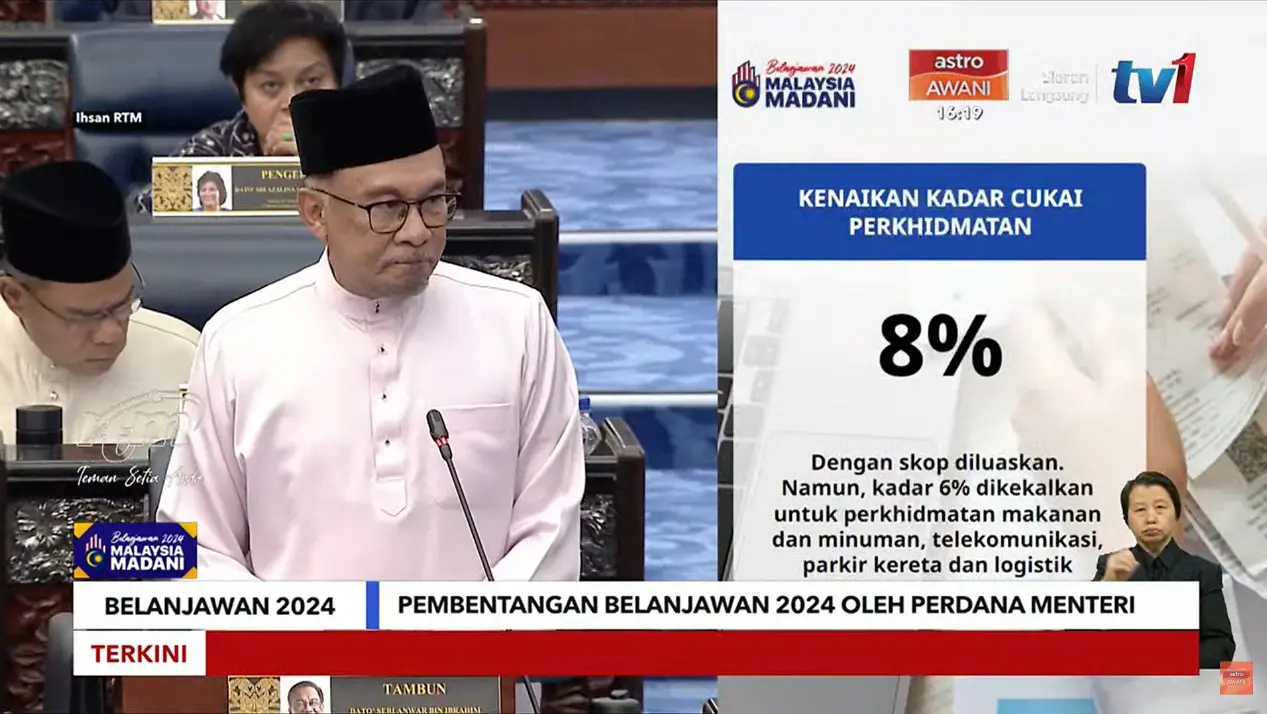

Sales and service tax (SST) increased to 8%

The SST – which is currently set at 6% – will be increased to 8% in 2024, but will exclude essential services like F&B and telecommunication in a bid to avoid burdening the rakyat. The government will also expand the scope of taxable services to include logistics, brokerage, underwriting, and karaoke services.

Improved access to business loan facilities for MSMEs

The government will allocate up to RM44 billion to make loans and financing guarantees available for the benefit of MSMEs.

Additionally, RM2.4 billion will be provided as small loan facilities for microentrepreneurs and small traders via agencies such as BNM, Bank Simpanan Nasional (BSN), and Tabung Ekonomi Kumpulan Usaha Niaga (TEKUN) – to be allocated as such:

- RM1.4 billion under BSN micro loan: For business capital, equipment purchases, premises, and marketing initiatives for hawkers and small entrepreneurs

- RM330 million via TEKUN: For financing facilities to small traders, such as batik and craft operators, orang asli entrepreneurs, and bumiputera of Sabah and Sarawak. RM30 million will be earmarked specifically for businesses run by the Indian community.

- RM720 million allocated specifically for women and youth entrepreneurs

SME loan funds under BNM

A separate amount of RM8 billion in loan funds will be provided via BNM to support SME companies. Of the amount, RM600 million is earmarked for micro enterprises and low-income entrepreneurs, small contractors, sustainable businesses, and businesses in food security-related sectors.

Small business capital by Amanah Ikhtiar Malaysia (AIM)

Microcredit organisation AIM has assisted about one million small businesses by providing them with capital, helping especially single mothers and low-income individuals. The government will allocate RM100 million in funding for AIM to continue its efforts.

Loan facilities and guarantees for bumiputera MSME entrepreneurs

A total of RM1.6 billion worth of loan facilities and guarantees will be provided specifically for bumiputera MSME entrepreneurs under Budget 2024. Inclusive of the provision of venture capital financing for bumiputera startups, this initiative will be rolled out in a bid to increase the capacity and competitiveness of these businesses.

Special financial programmes for halal SMEs

In line with the Halal Industry Masterplan 2030, nine financial institutions will be offering special programmes for halal SMEs under an integrated platform, with access to special funds and capacity building programmes. The process to apply for a halal certificate will also be simplified so that the processing period can be shortened from 51 days to 30 days.

Special financing facility for disabled microentrepreneurs

A special financing facility worth RM50 million will be provided by BSN, allocated especially for microentrepreneurs who are disabled. This is part of the government’s numerous effort to protect the wellbeing and to empower persons with disabilities (OKU) to be self-sufficient.

Additional funds for iTEKAD social finance programme

iTEKAD is an umbrella programme that was established under Bank Negara Malaysia (BNM) to help low-income microentrepreneurs strengthen their financial management and business knowledge. It provides access to social finance instruments (drawing from donations, social impact investments, zakat, and cash waqf) with microfinance, and is supported with structured financial and business training as well.

Under Budget 2024, the government is allocating additional funds of up to RM25 million in matching grants with financial institutions to benefit more entrepreneurs.

Funds for automation and digitalisation

The government has proposed to allocate RM100 million for digitalisation grants, expected to benefit more than 20,000 MSME entrepreneurs. Capped at RM5,000 for each entrepreneur, this grant can be used to upgrade sales, inventory, and digital accounting systems.

A separate RM900 million loan funds will be provided through BNM so that SME companies can increase business productivity through automation and digitisation.

Another RM40 million is allocated to continue the implementation of the Shop Malaysia Online programme, where many small traders (especially home-based F&B businesses) are incentivised to sell their products online.

Government guarantee schemes by SJPP

Syarikat Jaminan Pembiayaan Perniagaan Berhad (SJPP) assists SMEs and businesses by providing government guarantee schemes, so that they can access financing facilities from financial institutions (under normal circumstances, these SMEs may not be able to access these fundings due to their lack of collaterals). At present, SJPP has assisted more than 100,000 SMEs, with a total approved value of more than RM75 billion.

Under Budget 2024, SJPP will further provide guarantee for up to 80% of loans by entrepreneurs, with special attention to those who are involved in the green economy, technology, and halal sectors. A total fund of RM20 billion is provided for this initiative.

Digital Economy Centres (PEDi) enhanced to help SMEs

The government will allocate RM25 million for Digital Economy Centres in each state constituency to enhance its Digital Economy Centre so that they can better support small entrepreneurs who sell their products online.

These centres were first introduced back in 2021, with the aim of helping to increase e-commerce activities within the country, especially in rural areas.

Capital allowance on ICT equipment and computer software increased

The capital allowance on expenses incurred for the purchase of information and communication technology (ICT) equipment and computer software will be increased from 20% to 40%. The time frame for companies to claim this capital allowance will also be reduced from four years to three years.

Talent retaining and skill improvement programmes under HRD Corp

RM1.6 billion will be provided to the Human Resources Development Corporation (HRD Corp) to train 1.7 million workers.

Additionally, the HRD Corp will also reallocate special funds using 15% of the total levy collected to implement the MADANI Training Programme for MSME entrepreneurs and vulnerable groups (including ex-prisoners, the disabled, as well as the elderly and retirees). These individuals can apply to talent retaining and skill improvement programmes.

Extension of Tunas Usahawan Belia Bumiputera Programme (TUBE)

TUBE was introduced by SME Corp Malaysia in 2014, and has since helped to produce more than 7,000 youth bumiputera entrepreneurs, with nearly 14,000 job opportunities created. Among other things, it offers training workshops and a “buddy system” programme to help youths grow into accomplished entrepreneurs.

The government will allocate RM20 million under Budget 2024 to continue this programme.

Extension of tax exemption application period for social enterprises

In a bid to cultivate, assist, and encourage social enterprises in Malaysia – referred to as businesses with specific social objectives, such as to support refugees or protect the environment – the government has proposed to extend the tax exemption application period on their income for two years until 2025. The exemption is currently allowed for applications received by the Ministry of Finance from 1 January 2022 until 31 December 2023.

***

The extensive list of proposed items above are designed to spur and empower SME owners and micro entrepreneurs from various backgrounds – long identified as the backbone of the nation’s economy – in 2024 and beyond. Meanwhile, those who are looking for a condensed version of the latest national budget – specifically the key highlights for individuals – here’s our infographic of Budget 2024 to give you a quick lowdown.

Comments (1)

Good summary of what is available. Tq