Yasier Mahayudin

25th January 2019 - 4 min read

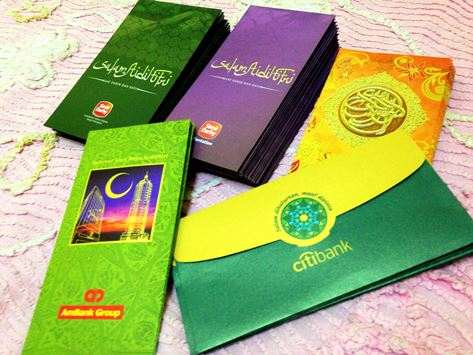

Who doesn’t love a fat sampul of duit raya on Aidilfitri? The culture of giving duit raya has been around for as long as I can remember. The beauty of the act itself is something that will always be special.

But if you are keen to try a new way of giving this Raya; we’ve come up with a few ways you can do that. Here are 4 different ways to give out duit raya to your loved ones and at the same time help lay a brick for their future.

1. Unit Trusts

For a parent expecting a child; planning to have a child; or has recently had a child; giving out duit raya to their offspring in the form of a Unit Trust is a great idea.

It does not have to be a whopping RM1,000. Even an RM20 fund will help them kick-start saving for their newborn.

This will serve as a starter to encourage the parents to save more for their child. The Unit Trust account will also bring in more capital gain when the child grows up. It’s a gift that keeps on giving!

2. Open an SSPN Account

Our friends at SaveMoney have an excellent guide on the SSPN account in case you weren’t familiar with the concept. The SSPN account is a savings account created by PTPTN for the purpose of saving for your child’s education.

In order to obtain funding for education in future from PTPTN; a student will need to have an SSPN account.

By opening an SSPN account, the child will have a gift that will serve him in the future. The introduction of an education fund is the best gift you can give a child.

3. Open a Savings Account

Opening a savings account for children will help nurture the saving habit beyond the coins in their coin box.

The parents of the child may already have a savings account but you could give this as an additional pot where the child can not only save his other collected monies – he can feel like a real grown up managing a bank account all by himself!

4. A Fixed Deposit

For those thinking of a really big duit raya offering – for a child, a parent or a spouse – consider the benefits of a good fixed deposit. Many fixed deposits can be started with a minimum fund of RM500.

As far as gifts go; this is a good gift to ensure the money is available for use but also provides the interest earning option to the recipient with no fuss or fund knowledge required of the recipient nor the giver.

A Gift of Love

For parents and adults out there preparing for Aidilfitri and planning to give out duit raya, I applaud you. It is not just an act of giving but also an act of love.

The ‘cue’ before the duit raya giving is the most unique. It is usually during the early morning before the Solat Sunat Aidilfitri and right before the group of guests is about to leave the visited house.

There is also the usual reminder that comes with the duit raya packet: “Jangan belanja yang bukan-bukan.” (Don’t buy anything nonsensical), “Belajar rajin-rajin.” (Study hard) and many more that show you the additional care and concern our elders have for us.

These are just some of the small reasons that make duit raya giving so meaningful to me and, and I’m sure to many of you readers as well. We hope that in simply changing the way we distribute these packets of love; we can give our loved ones more lessons or opportunities to grow wealth for a better future.

Selamat Hari Raya Aidilfitri and Maaf Zahir Batin!

Comments (0)