Samuel Chua

12th December 2024 - 3 min read

The Employees Provident Fund (EPF) has launched the updated Belanjawanku 2024/2025 Guide and the Retirement Income Adequacy (RIA) Framework, aimed at enhancing Malaysians’ financial literacy and retirement preparedness. This dual initiative introduces revised savings benchmarks to align with rising living costs while introducing a comprehensive three-tier savings framework.

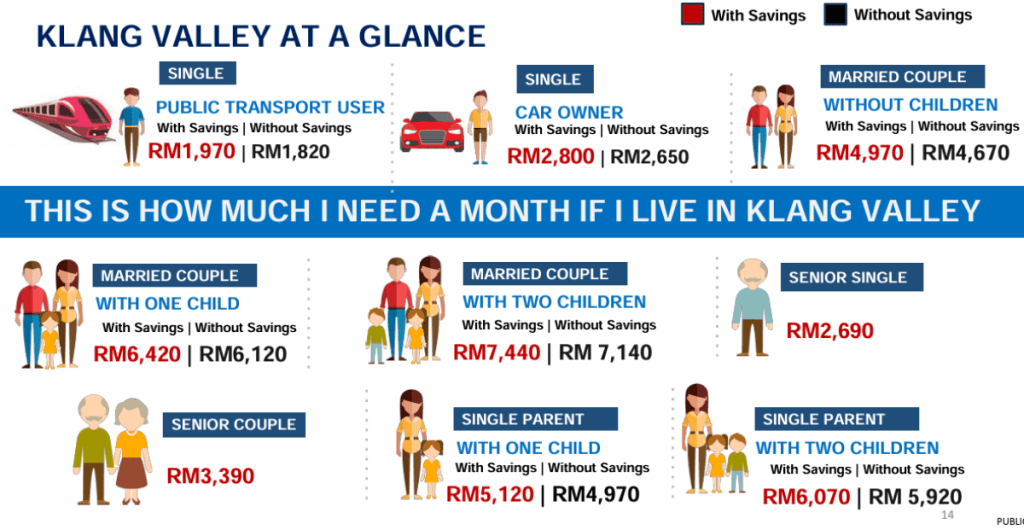

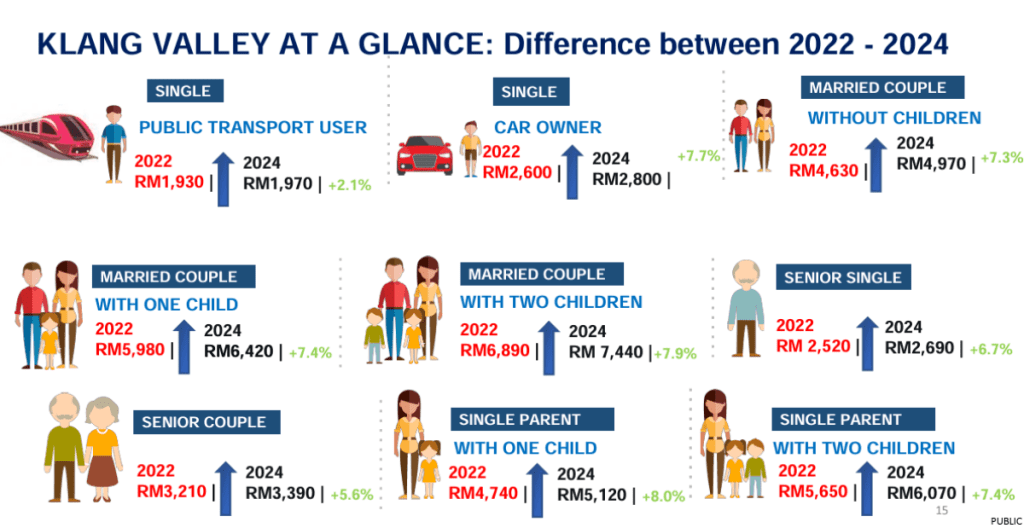

The Belanjawanku Guide serves as an expenditure guide, offering Malaysians realistic benchmarks to estimate the minimum monthly expenses required to maintain a reasonable standard of living. First introduced in 2019, the guide has been updated for 2024/2025 to reflect prevailing economic conditions and the spending patterns of urban households across 12 major cities in Malaysia.

It categorises expenses into key areas such as housing, food, transport, utilities, healthcare, and discretionary costs, such as social participation and family contributions. The guide provides a flexible framework that can be adapted to individual lifestyles, offering Malaysians a practical and reliable tool to plan their personal and family budgets effectively.

EPF Chief Executive Officer, Ahmad Zulqarnain Onn, stated that these updates demonstrate EPF’s commitment to adapting to Malaysians’ evolving needs. “By offering a comprehensive view of monthly expenditures and introducing new savings benchmarks, we aim to guide our members towards achieving a dignified and fulfilling retirement. These initiatives also reflect EPF’s objective of staying relevant and responsive to changing times,” he said.

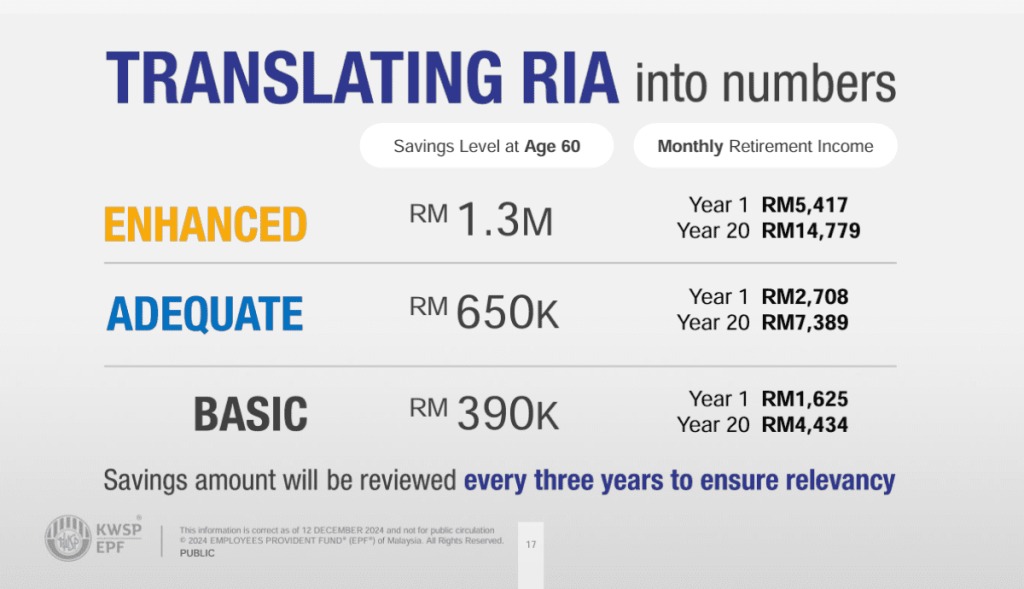

Complementing the Belanjawanku Guide, the Retirement Income Adequacy (RIA) Framework represents a significant shift from the current single-tier Basic Savings benchmark, first introduced in 2008, to a new three-tier savings structure. Anchored on the Belanjawanku Guide, the framework establishes savings targets that cater to different retirement aspirations and lifestyles.

The new structure, which will take effect in January 2026, includes Basic Savings, Adequate Savings, and Enhanced Savings levels. Basic Savings, set at RM390,000 at age 60, ensures essential retirement needs are met. Adequate Savings, benchmarked at RM650,000, provides for a reasonable standard of living, while Enhanced Savings, targeting RM1.3 million, supports financial independence and a higher quality of life.

The framework is designed to provide members with sustainable retirement income over a 20-year period. For example, those achieving Adequate Savings would be able to withdraw RM2,708 monthly in the first year of retirement, rising to RM7,389 by the twentieth year. Similarly, Enhanced Savings would allow monthly withdrawals starting at RM5,417, increasing to RM14,779 in the same timeframe.

To ensure a smooth transition, the Basic Savings benchmark will be gradually increased from RM240,000 to RM390,000 by 2028, with annual increments of RM50,000. The EPF will also align policies such as the withdrawal of savings exceeding RM1 million with the Enhanced Savings benchmark, granting members greater flexibility in managing surplus funds.

Additionally, members will continue to have the option to diversify their investments under the Members Investment Scheme (MIS), which allows for 30% of savings above the Basic Savings benchmark to be invested in approved funds.

The Belanjawanku 2024/2025 can be downloaded from the EPF website at www.kwsp.gov.my. The Belanjawanku App can also be downloaded for free from the Apple App Store, Google Play, and Huawei App Gallery.

Comments (2)

So. If I have 1.3mil. My full sum amount going to lock at EPF until I’m age 80?!!

The EPF savings, including your RM1.3 million, would generally be locked until the eligible withdrawal age, which is typically 55. However, with the introduction of the Three-Tier RIA framework, there might be more options for managing your funds through investment accounts. It’s best to review the specific details and conditions of the framework or consult with EPF directly for more personalized guidance on accessing your funds.