Jacie Tan

21st May 2021 - 3 min read

Affin Bank has released a new FAQ document for its Affin Duo Visa Cash Back Credit Card, aimed at providing clarification to the revision that will take place on 1 July 2021. The bank has also amended its original notice to clarify that the term “outstanding balance” refers to a cardholder’s “previous balance” and provides further explanation in the FAQ.

To recap, earlier this week Affin Bank had announced a revision to its popular Affin Visa Cash Back Credit Card. The revision introduced a new “outstanding balance” criterion of RM3,000 which would determine whether your monthly cashback would be capped at RM80 or RM50. Unfortunately, the meaning of the term “outstanding balance” was less than clear at the time, given that most banks tend to use monthly spend as a requirement for earning higher cashback benefits.

Now that Affin has confirmed that outstanding balance refers to “Your Previous Balance” as stated in your monthly credit card statement, what does this mean for your cashback earnings?

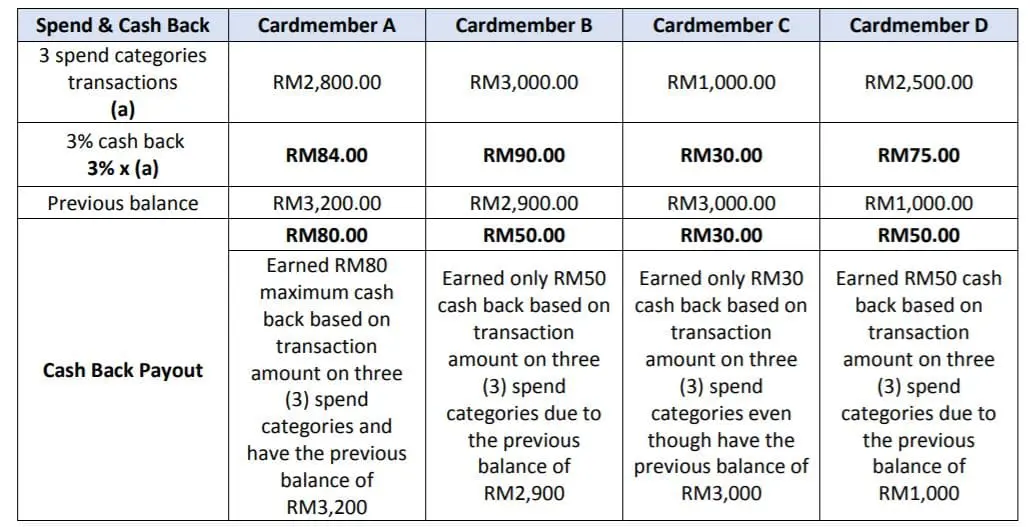

Some situational examples offered by Affin Bank

For those who want to earn a maximum of RM80 in cashback, from 1 July onwards you will have to maintain a previous balance of RM3,000. Take note, however, that this doesn’t necessarily mean you just need to spend RM3,000 in the previous statement month. If you check your statement, you will notice that any cashback credited to you actually reduces your balance for that month. So, if you are earning RM80 worth of cashback in a given month, you will need to spend RM3,080 in total to ensure your eligibility to earn RM80 in cashback the following month.

Here’s another scenario that might make calculating your previous balance less straightforward: if you have opted for a balance transfer or cash-on-call instalment plan. In your credit card statement, you will notice that your monthly instalment amount for either one of these plans will be included as part of your statement balance. As such, it is assumed that this will also count towards that RM3,000 previous balance requirement – although we can only confirm this for certain when the revision takes effect in July.

These two scenarios above both apply to those who are gunning for the RM80 maximum cap on cashback each month. Incidentally, if you are aiming for the RM80 cashback cap, your effective cashback rate actually stands at lower than 3%. Under the new revision, the only time you will earn an effective 3% cashback rate is when you spend up to RM1,667 in a month. Of course, spending below RM1,667 means that you will only earn a maximum of RM50 in cashback, but this may still be the preferable option since you won’t have to worry about maintaining that RM3,000 previous balance amount.

The Affin Visa Cash Back was first launched in August last year as part of the Affin Duo cards, and offers 3% cashback on online, e-wallet, and auto-billing transactions.

(Source: Affin Bank)

Comments (2)

Hi, may I know what it means by online banking which found in exclusion list? If pay insurance premium via the respective insurance portal e-payment service, is this entitle for cash back (online transaction)?

Meanwhile, is auto-billing similar as direct debit from credit card? Means I set a payment as auto billing (monthly – for example insurance premium), is this entitle to cash back as well. Thanks

If I understand you correctly, “online banking” transactions using the Affin Duo Visa will not be eligible for cashback, hence it is in the exclusion list (alongside a few others). As for insurance premiums, I’ve seen most cardholders getting cashback with this card via auto-billing – not sure about online via the insurance e-payment portals though…you might need to try it out to see the result for this one!