Samuel Chua

13th January 2025 - 2 min read

Hong Leong Bank (HLB) has announced revisions to its HLB Essential Credit Card, effective 3 February 2025. These changes include an updated cashback structure and adjustments to eligible transactions. Under the new terms, the card will offer unlimited cashback, replacing the previous monthly cap of RM300.

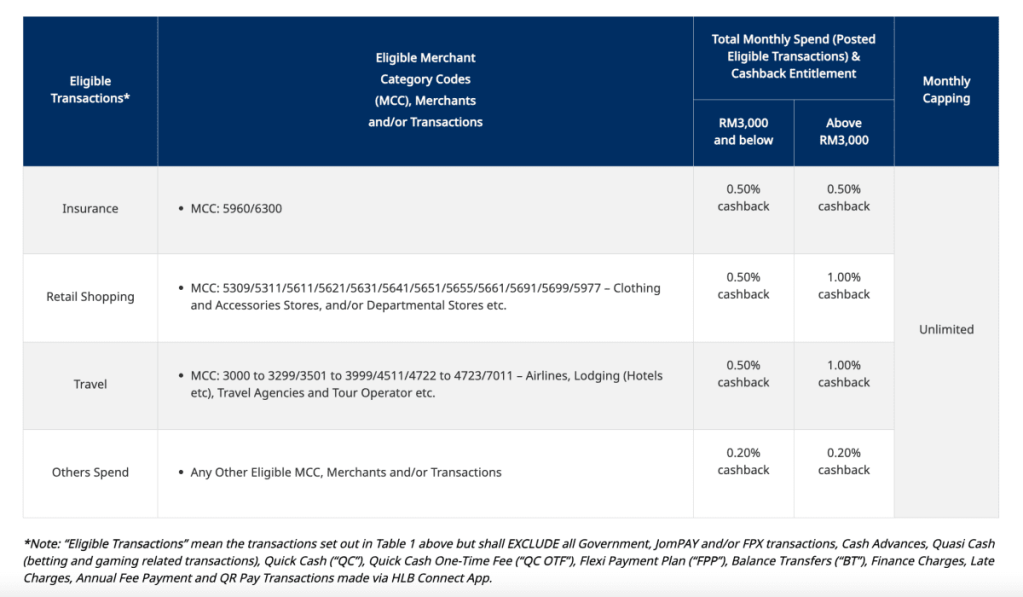

Cashback rates will vary by spending category and monthly expenditure. Retail shopping and travel transactions will earn 0.5% cashback for monthly spending up to RM3,000, increasing to 1% for spending above this threshold. Insurance-related transactions will receive 0.5% cashback, regardless of the amount spent, while all other eligible transactions will earn 0.2% cashback.

Certain exclusions will continue to apply. Cashback will not be awarded for government-related payments, JomPAY and FPX transactions, cash advances, quasi-cash transactions such as betting and gaming, Quick Cash and associated fees, balance transfers, finance charges, late payment fees, annual fees, and QR Pay transactions conducted via the HLB Connect App.

The bank clarified that annual fees will remain unchanged. The principal card will continue to have an annual fee of RM100, while supplementary cards will be RM50. These fees are consistent with the previous structure, providing continuity for cardholders.

These revisions follow previous updates implemented in May 2022, which introduced a monthly cashback cap of RM300 and adjusted cash advance fees and charges. For clarity, the revised cashback structure will only apply to transactions made on or after 3 February 2025. Transactions made before this date will continue to be subject to the current terms and rates.

(Source: Hong Leong Bank)

Comments (0)