Alex Cheong Pui Yin

5th April 2023 - 6 min read

After sharing a teaser last week, Alliance Bank has officially launched its latest digital product for credit cardholders today, known as the Alliance Visa Virtual Credit Card with Dynamic Card Number (DCN). Housed within the bank’s allianceonline mobile banking app, it is the first product of its kind to be rolled out here in Malaysia.

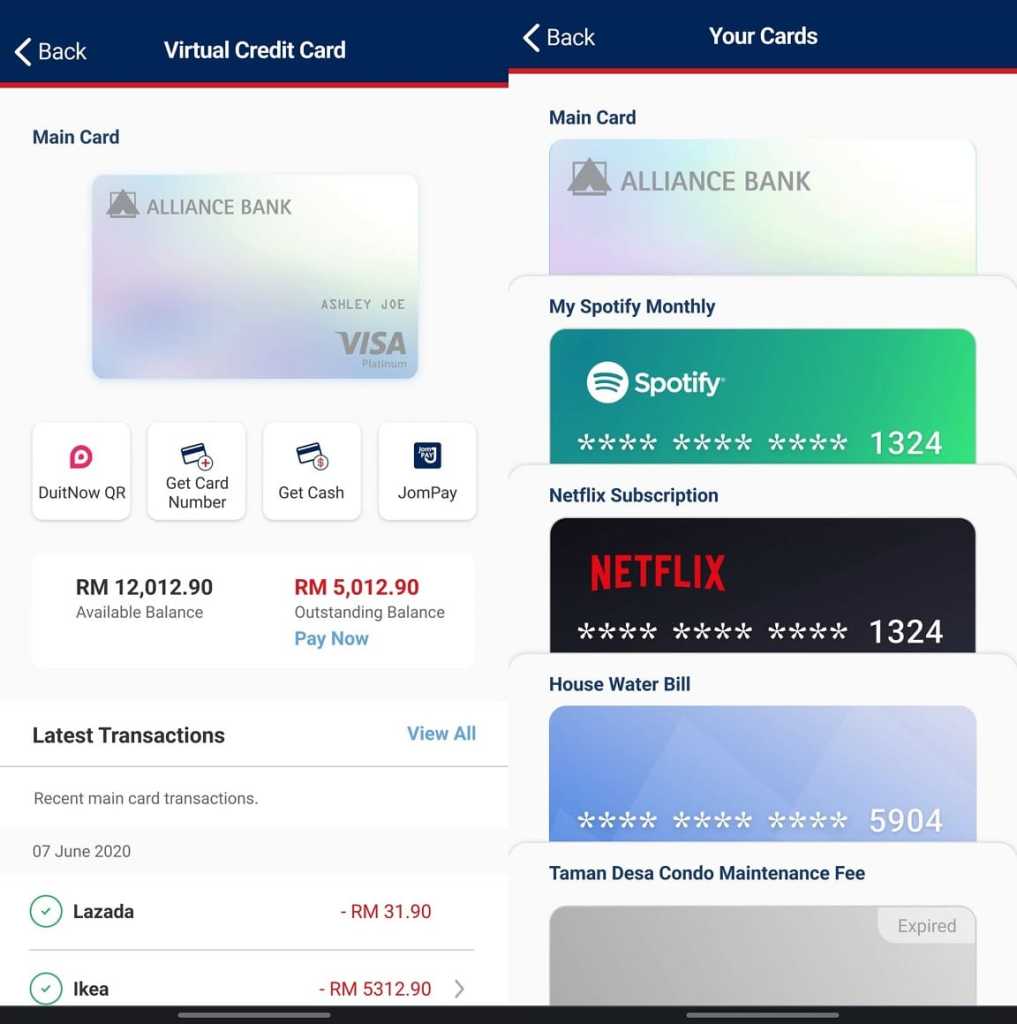

The DCN feature enables cardholders to create randomly generated 16-digit card numbers that they can then use to perform payments, introducing a new layer of security for online transactions and subscriptions management.

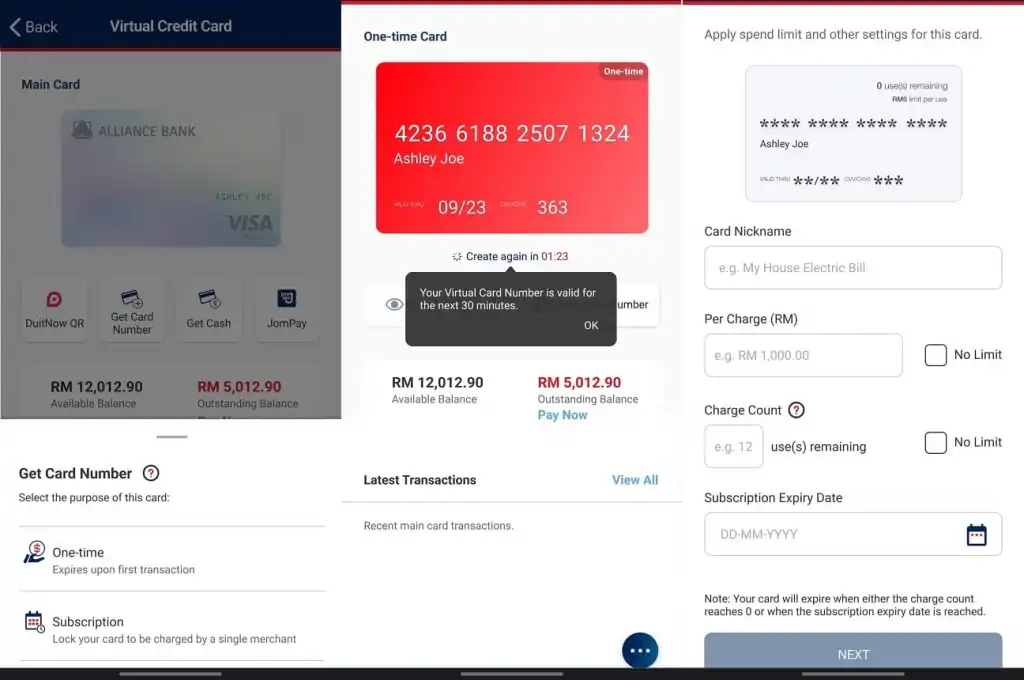

Specifically, there are two types of randomly generated card numbers that you can create as an Alliance Visa VCC cardholder, depending on your needs. For those looking to make one-off purchases, they can opt to generate a “short-term” card number, which is automatically cancelled after you’ve performed your transaction, or within 30 minutes (if no transactions performed) for security purposes. Only one card number can be created each time.

Meanwhile, cardholders who wish to use the Alliance Visa VCC to pay for recurring commitments – such as their monthly bills or payments for subscriptions of services – can opt to generate a card number with greater flexibility, such as introducing a maximum transaction limit (both in transaction value and number of transaction) as well as personalising them with logos of specific services for easier identification. That means you can create one “sub card” just for your Spotify subscription, one for Apple Music, and another for YouTube Music, for example. Note that each card number generated is free and isn’t applicable for SST. You will only be charged a one-time SST fee of RM25 regardless of how many virtual cards you decide to create.

As a virtual credit card, you’ll also enjoy additional features including the ability to “freeze” your card to ensure no transactions can go through without your knowledge. When you would like to use the card again, you can unfreeze it in the app. In addition, transactions will also appear in the app in real time, so you know exactly what transactions are yours.

Ultimately, the idea of the Alliance Visa VCC with the DCN feature is to give cardholders more control over how they would like to manage their credit cards. This is on top of the aim to minimise cardholders’ exposure to fraud risks, identity thefts, and financial scams, in addition to bringing a positive impact to the environment by reducing the use of plastic to produce credit cards.

Aside from that, Alliance Bank also clarified that the benefits of the Alliance Visa VCC will be similar to those offered by the physical Alliance Visa Platinum card. Cardholders will earn 8x Timeless Bonus Points (TBP) for every RM1 spent on e-wallet transactions (capped at RM3,000 per statement cycle) and online transactions, and 3x TBP for overseas and dining transactions. All other spend, meanwhile, will earn you 1x TBP per RM1 spent, including contactless transactions, JomPAY, and QR-based payments using DuitNow QR.

There are no annual fees for this virtual card, unlike the physical Alliance Visa Platinum (RM120 per year, waived with 12 transactions of any amount within the year), although the sales service tax of RM25 will still apply. Additionally, existing Alliance Visa Platinum cardholders are not able to convert their card to the virtual card as they are technically two different cards; you will need to apply for the Alliance Visa VCC separately if you wish to tap into its benefits.

Group chief consumer banking officer of Alliance Bank, Gan Pai Li said that this latest innovation is in line with Alliance Bank’s customer-first mindset, aiming to deliver a seamless digital payment experience. “The new feature on the Alliance Bank Visa Virtual Credit Card provides our customers with greater peace of mind by way of a more secure payment option, addressing concerns of credit card data breach at third party sites when they transact online,” she said, adding that this product is also aligned to the bank’s enhanced Acceler8 strategy.

Meanwhile, the country manager for Visa Malaysia, Ng Kong Boon said that it is important for Malaysians to feel empowered and secure when making digital payments, especially with more people preferring digital commerce. “Hence, we have partnered with Alliance Bank on this dynamic card number solution for the virtual credit card. We hope to give customers more confidence as they shop and pay for their purchases online,” he said.

With this launch, Alliance Bank also noted that there are plans to eventually expand this its VCC with DCN technology to its Alliance Visa Signature and Alliance Visa Infinite cards as well. That said, no timeline has been shared for this target.

As the exclusive acquisition partner for the launch, RinggitPlus is offering some additional goodies for those who apply for the Alliance Bank Visa Virtual Credit Card through the RinggitPlus WhatsApp chatbot. Early birds who apply will enjoy guaranteed cash rewards as well as a chance to win a grand prize of RM1,000 Touch ‘n Go eWallet credits.

In addition, Malaysians who have previously applied and were approved for any credit card in RinggitPlus will also enjoy a “green lane” application process for faster application process. Finally, the first 12,000 RinggitPlus customers will apply and are approved for the card will also enjoy “Double Cashback” of 2x RM15.90 for recurring or subscription payments (for up to 5 subscriptions per customer). *Applications on RinggitPlus will be opened soon.

If you’d like to apply for the enhanced Alliance Visa VCC with DCN feature, you’ll need to first download the allianceonline mobile app from Google Play Store, the App Store, or the Huawei AppGallery. From there, fire up the app and follow these steps:

- Tap on the VCC icon at the top right of the login page

- Start your application and provide the necessary personal and income details required

- Provide all supporting documents required (photo of your IC as well as proof of your income, such as EPF statements)

- Submit!

Once you’re done, you should receive a push notification and an SMS notification to inform you of your application status. Alliance Bank said that they aim to process the applications of existing Alliance Bank customers and cardholders within 24 hours, while the application of new Alliance Bank customers will take up to 48 hours.

Comments (1)

definitely a card that will counter the current credit card fraud cases!