Alex Cheong Pui Yin

28th February 2023 - 3 min read

A joint report released by CTOS and Monash University School of Business has found that 28.3% of Malaysian credit consumers have poor credit scores, falling below the “Fair” rating, which means that they do not qualify for credit facilities from banks. In turn, this could force them to turn to illegal lenders, who often provide loans at exorbitant interest rates.

Revealed in the CTOS State of Consumers Credit Report for Malaysia 2022, the credit reporting agency stressed that this means over one quarter of consumers in Malaysia is in crucial need of comprehensive financial education to help them boost their credit scores and financial literacy. Meanwhile, the remaining population – who have credit scores above the “Fair” rating – must learn to maintain their financial health.

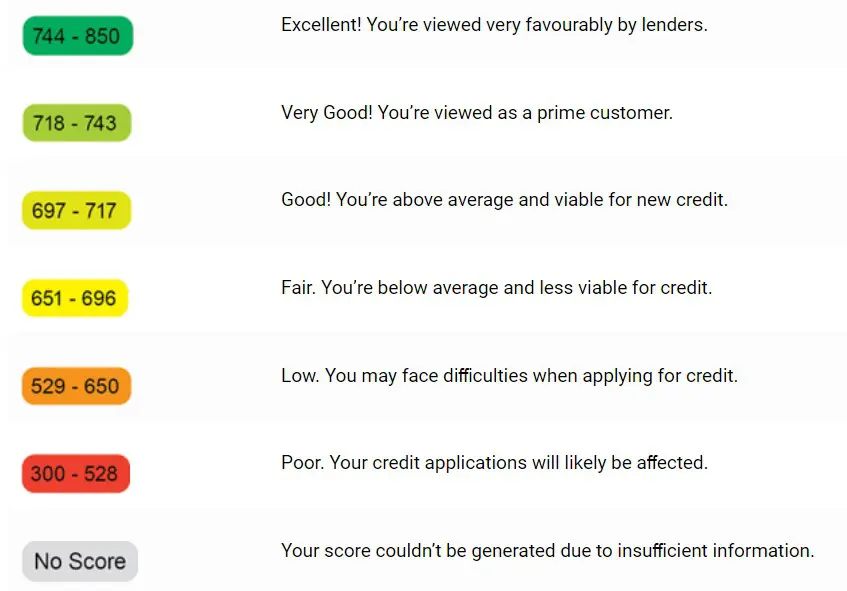

Briefly, the credit scores provided by CTOS (known as CTOS Score) is a three-digit number that represents individuals’ creditworthiness, based on their payment history, background, and financial management. It ranges from 300 to 850, rated and tiered as below:

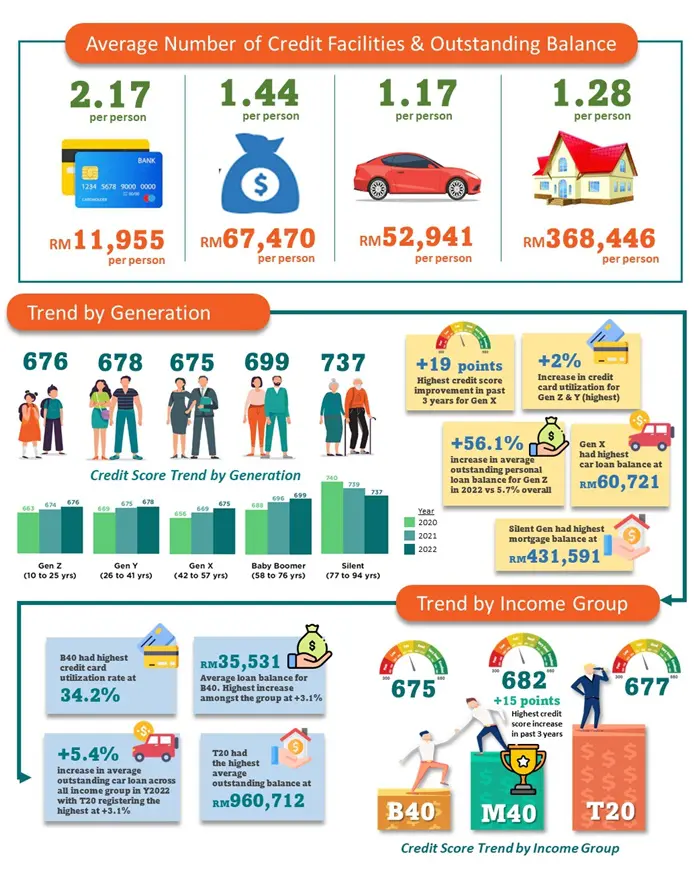

That said, it is not all gloom and doom in the latest study as it also found that there has been a positive increase in the average CTOS Scores of Malaysians over the past three years, from 663 to 678 (+15 points). Additionally, Malaysians overall managed to maintain a “Fair” credit range despite the Covid-19 pandemic.

Furthermore, average credit card utilisation for Malaysia held steady at 23.7%, indicating that consumers in general did not have to rely on unsecured credit spending to survive the difficult period – although some consumer segments did record a slightly higher use. For instance, the B40 group had a credit card utilisation rate of 34.2%, mainly to sustain their finances.

“Besides income groups, the trends also show that the younger generation (Gen Y & Z) used credit cards more than before possibly due to social preferences, which resulted in increased spending behaviour,” said the head of Monash School of Business, Professor Dr Nafis Alam.

CTOS further acknowledged that while there were improvements, Malaysia also still has some work to do to catch up to the average credit score of other countries on the global stage; credit consumers in the United States, for instance, have an average credit score of 716, in comparison to Malaysia’s 678. This lower average score also means that while most of Malaysians may qualify for a majority of financial products by lenders, they may not get the best credit deals on the market, as compared to those with “Good” or “Excellent” scores.

In light of this, group chief executive officer of CTOS Digital, Erick Hamburger said that CTOS is committed to empowering Malaysians with the tools and resources required to manage their credit health effectively.

“We have also carried out around 150 financial education programmes in the last three years together with various organisations, including the Ministry of Finance, Bank Negara Malaysia, AKPK, EPF, KPKT, and other NGOs. Through these initiatives, we provide consumers with the opportunity to learn, engage, and strengthen their financial management skills, empowering them to improve their credit health and personal finances,” Hamburger further said.

The CTOS State of Consumers Credit Report for Malaysia 2022 had a sample of over 1.4 million individual CTOS users, and also included other statistics such as comparisons of generational creditworthiness, average outstanding loan balances by income groups, and types of credit facilities.

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (0)