Diana Chai

16th July 2013 - 4 min read

Debt has been the topic of conversation almost everywhere

you turn in the media. The release of information regarding the percentage of

household debt in the country stands at 86% against our gross domestic product:

the highest in the region.

If you’ve found yourself forming part of the debt statistic;

it doesn’t have to be a bleak situation. There are ways to take back control of

your debt.

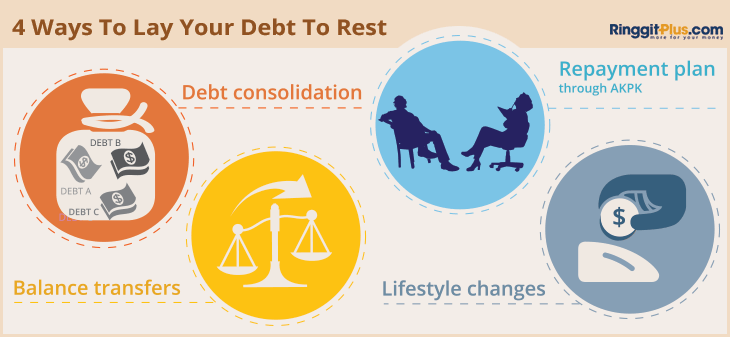

Debt consolidation

Consolidate your debts into a single loan with one

repayment. Though repayments may be slightly more and tenure longer; paying

just one monthly fee will free up cash and reduce your overall commitment

ratio. Freeing up cash of course means more disposable income for necessities

reducing the need to pull out the credit cards again.

Depending on how much you have in debt, and if you have any

available assets to leverage; you could refinance your home. Home loan interest

rates can be taken for 35 years (although it is not advisable to take the

longest tenure available unless you don’t have a choice) and interest rates are

as low as 4.20%.

If you do not have assets to refinance: you could apply for

a debt consolidating personal loan. Some banks offer loan products specifically

for this purpose. Even if you are unable to find a debt consolidation loan

specifically for this purpose; any personal loan can be used but this will

depend on if you are still able to borrow on your current debt ratio.

Balance transfers

According to Bank Negara’s Financial Stability and Payment

Systems Report 2012, 51% of credit card holders carry revolving balances. If you’re

stuck with credit card debt; balance transfers could be the answer for you. With

a balance of RM5000 and usual credit card interest rates of 18%; on a 0%

balance transfer (assuming you repay only the 5% minimum amount every month)

you save over RM745 in interest.

Repayment negotiations

For situations where none of the above can apply; you can

always seek the help of the Credit Counselling and Debt Management Agency

(AKPK). AKPK will study your financial position and create a plan specifically

for your needs. However, upon registering with the programme; you will need to

surrender your credit cards and have your finances monitored until all your

loans have been repaid. If necessary, AKPK will also negotiate on your behalf with

banks to re-organise your debt in a way that is manageable to you. Do note that

this will only be done if there is truly no other way for you to meet your

commitments on your available income.

Lifestyle changes

Besides using banking products and other financial tools to

help your debt situation; a change in lifestyle will go a long way to dealing

with debt and improving your financial health. Changing your usual spending

patterns and habits will create better cash flow to sustain a low level of

indebtedness.

These are just some best practices you can consider:

- Do not carry revolving credit card balances. If

for any reason you had to use your card for a large purchase; try your utmost

to repay this quickly. When doing so; refrain from adding any more spending

onto your card. - Do not apply for loans unless you are able to

afford the monthly repayments along with all your other commitments easily. - Create a standing instruction for your savings

at the beginning of every month. - Not all debt is bad and you will have to have

some loans. For most average wage-earners; you’re unlikely to be able to afford

to pay for houses and cars with cash. But even in situations where a loan was

necessary; ensure you are able to meet your payments every month.

Comments (0)