Pang Tun Yau

27th June 2024 - 3 min read

Bank Islam has refreshed its Platinum Credit Card-i with a unique twist. From 1 August 2024, the Bank Islam Platinum Credit Card-i will be available as a Visa or Mastercard option, which determines whether they are a cashback or rewards points card.

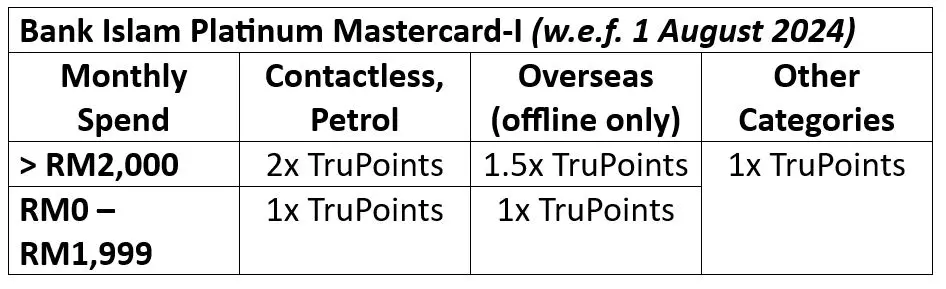

Both the Bank Islam Mastercard Platinum and Visa Platinum Credit Card-i are refreshed versions of existing cards of the same names but with enhanced benefits from 1 August onwards. The Bank Islam Platinum Mastercard Credit Card-i will be the rewards points variant of the two. Transactions made with the card will earn Bank Islam’s TruPoints, with bonus points earned on specific spend categories and based on spending tiers.

Specifically, cardholders earn 2x TruPoints for every RM1 spent on petrol and contactless, and 1.5x TruPoints for overseas transactions. Both these bonus points are subject to a minimum monthly spend requirement of RM2,000 and RM1,500, respectively. Other transactions will earn 1x TruPoints for every RM1 spent. Here’s a table summarising the benefits for thr Bank Islam Platinum Mastercard-i:

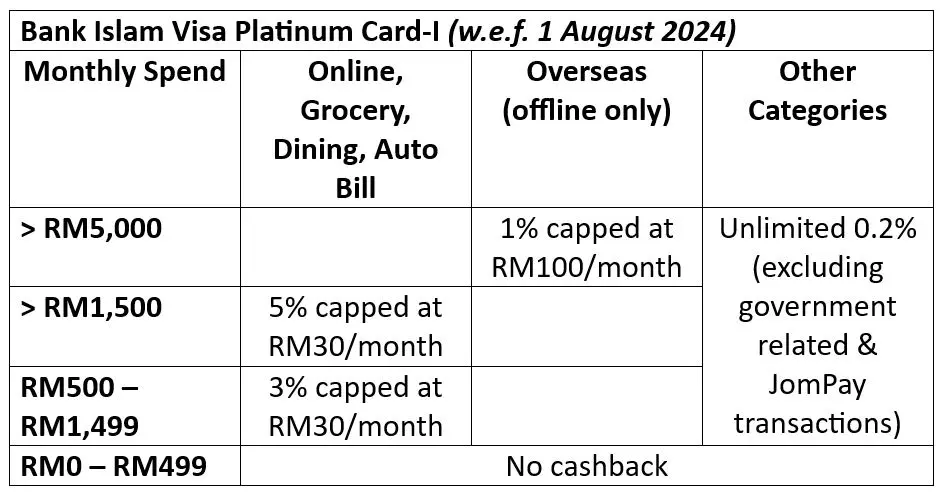

Meanwhile, the Bank Islam Platinum Visa Credit Card-i offers cashback on eligible transactions, with a tiered rate based on the minimum monthly spend requirement. Cardholders can earn up to 5% cashback on online, groceries, dining, and auto-bill spending, and 1% cashback on overseas transactions. Here’s a breakdown of the cashback benefits of the Bank Islam Visa Platinum Credit Card-i:

Alongside the enhanced benefits, Bank Islam is also reducing the annual income requirement for both cards, from RM48,000 to RM36,000 (or RM3,600 per month). As for the annual fee, it will automatically be waived upon performing 12x retail transactions per calendar year. On top of that, Bank Islam is also introducing a new card design for the Bank Islam Platinum Credit Card-i. Featuring a design inspired by metallic fluid, it symbolises “adaptability to the ever-changing environment”.

On top of the refreshed cards, Bank Islam is also introducing a unique card benefit applicable to all new and existing Bank Islam credit card holders: complimentary Takaful coverage and a RM1,000 compensation in the event of the card holder’s demise.

In conjunction with the relaunch of the cards, Bank Islam is also organising a number of campaigns. This includes a new acquisition and activation campaign, which covers a Welcome Bonus as well as a chance to win a fully paid trip to Istanbul for every RM200 spend. There is also a 0% Balance Transfer programme for a 12-month tenure, while cardholders may also opt for a new Balance Transfer With Gift that features longer tenures of up to 36 months, a Gift in the form of the latest Apple iPad Air 11″, and a rate of 5.88% p.a..

Comments (4)

Does bank islam visa platinum card includes petrol payment such as petronas setel app payment in the monthly payment spend for cashback benefit?

the cashback categories are limited to Online, Autobilling, Grocery, and Dining. petrol isn’t covered, and for Setel, it really depends on the bank if it is classified as online/e-wallet/petrol (different banks treat this differently). best to check with Bank Islam directly on this.

however, if you meant to ask if petrol transactions are included in the RM1,000 monthly spend requirement to earn cashback for the other categories, then yes, it will count towards the minimum RM1,000 requirement but will not in itself earn any cashback.

https://www.bankislam.com/wp-content/uploads/1.TERMS-AND-CONDITIONS-BANK-ISLAM-VISA-CREDIT-CARD-i-CASH-BACK-PROGRAM.pdf

Are Online, grocery, dinning, auto billing separate or together capped rm30

For the Bank Islam Visa Platinum Card-i, the RM30 cap applies to the combined categories of online, grocery, dining, and auto billing.