Alex Cheong Pui Yin

16th November 2021 - 7 min read

The Financial Management and Resilience Programme (URUS) is now open for application to eligible individual banking customers who fall under the bottom 50% (B50) income group. Announced back in October 2021 by Prime Minister Datuk Seri Ismail Sabri Yaakob, the programme is intended as another form of assistance to borrowers who are still struggling financially due to the Covid-19 pandemic. It is set to run for a total of three months from now until 31 January 2022.

With URUS now ready to assist Malaysians in need, here are some key details about URUS that you should know.

What is URUS?

URUS is described as a free “holistic assistance package” aimed at borrowers who are still facing prolonged cash flow difficulties due to Covid-19. The programme was drawn up via a collaboration between the banking sector and the Credit Counselling and Debt Management Agency (AKPK), and offers aids such as personalised financial plans as well as financial education programmes.

What assistances are offered under URUS?

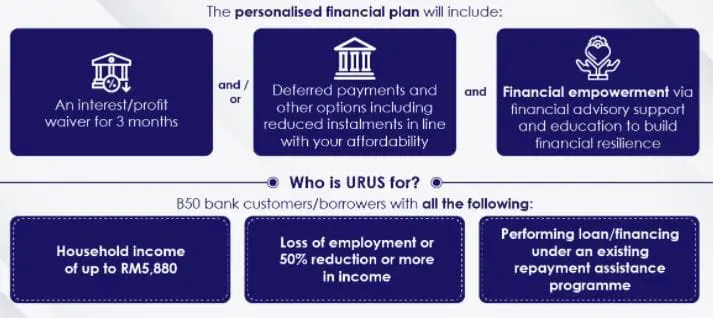

Specifically, eligible borrowers will be able to tap into a personalised financial plan that helps them manage their debt repayment for a period of up to 24 months. The plan may consist of any of the following repayment assistance:

- Interest/profit waiver for a period of 3 months

- Deferred payments, reduced instalments, or other viable options

- Development, education, and advisory support on how to manage your finances

Under URUS, your respective bank(s) and AKPK will draft a personalised financial plan after reviewing your case, taking into account your existing debt obligations, monthly income, and living expenses.

Your enrolment into URUS may result in certain changes in the existing terms of your loans, such as an extension of the maturity date of your loan or financing – which, in turn, could cause your overall borrowing/financing cost to increase. Your loan/financing balance will also be adjusted to reflect the interest/profit waiver.

Who is eligible for URUS?

B50 banking customers who wish to apply for the URUS programme must meet all the following eligibility criteria:

- Household income of up to RM5,880

- Loss of employment, or 50% income reduction

- Loan/financing is already under an existing repayment assistance programme as of 30 September 2021 (via any of the government’s stimulus packages or a bank’s rescheduling and restructuring programme)

- Loan/financing is not in arrears exceeding 90 days as of the date of your URUS application

What loan/financing facilities are covered under URUS?

The various loan/financing facilities that are eligible for the URUS programme include:

- Housing loans/mortgages

- Personal loans and micro financing (including Amanah Saham Bumiputera (ASB) loan/financing, education loans, etc)

- Car loans

- Hire purchase*

- Credit card balances or other revolving credit lines (such as overdraft/cash lines and trade credit facilities) that were previously converted into term loan/financing

* While the list includes hire purchase as one of the facilities eligible for URUS, note that it will not be included as part of the personalised financial plan due to specific legal requirements. Instead, the bank will contact you directly with details of your repayment terms.

How do I apply for URUS?

To apply for the programme, you will need to fill in a common URUS application form that can be found on the website of all participating banks. Required details include basic personal information, as well as information about your employment and income status. You will also need to attach some supporting documents to verify your financial circumstances. All borrowers will need to submit any one of the following documents (although some banks may require more for verification):

- Latest Employees Provident Fund (EPF) statement

- Latest bank statement

- Latest income tax form

- Latest salary slip/payment vouchers

- Letter of termination from previous employer

If you are unable to provide any of the above documents, you can approach your bank to ask about other written records that can also be accepted as supporting documents.

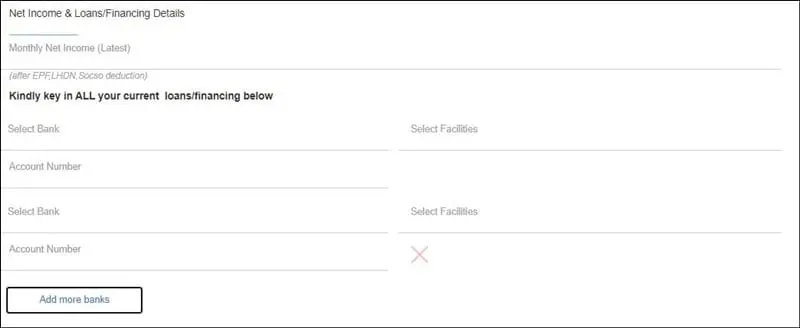

Aside from this, note that borrowers who have loans or financing with multiple banks do not need to make numerous URUS applications (one application for each loan/financing). Instead, you are only required to make one URUS application with any one of your banks as the standardised application form will let you list out all your performing loans with the different financial institutions (as you can see in the sample image below). You are encouraged to list out all of them – or as many as you can – as this will allow AKPK to consolidate your details across banks and develop a more comprehensive repayment plan for you.

What happens after the submission of my URUS application?

Your bank will receive a confirmation message from your bank immediately after submitting your application. Following that, AKPK will contact you via email within 10 working days if you are eligible for the programme, providing you with your personalised financial plan. Upon approval, your new repayment terms under the personalised financial plan will take effect from the following month onwards (AKPK will reconfirm this with you). Repayments must then be made to your respective bank, not to the APKP.

Meanwhile, if your application is not approved, you will be informed by your bank within five working days. You can then reach out to AKPK or available bank personnel for alternative solutions.

Will my CCRIS be affected if I apply to URUS?

Loans that are under URUS will be identified in the borrower’s Central Credit Reference Information System (CCRIS) credit report. However, this identification is only temporary as it is meant to facilitate the process for AKPK to follow up and monitor the borrower’s progress, as well as for the banks to provide any other necessary support. It will be removed from your CCRIS report once you have completed the URUS programme, or six months from the date of your enrolment into URUS (at the earliest).

I am currently enrolled in other repayment assistance programme (under PEMULIH). What happens if I apply for URUS?

In general, URUS will supersede your existing repayment assistance programme. However, it is also possible to maintain your current repayment terms by making adjustments for the three-month interest/profit waiver – provided you are eligible.

What are the other support offered via URUS aside from the personalised financial plan?

On top of the personalised financial plan, URUS also supports borrowers with various development, education, and advisory aid on how to manage their finances. They can tap into AKPK’s financial education programmes for free, which cover topics such as goal setting, wealth management, and cash flow management.

There is also a collaborative effort by the name of Social Synergy Network, which enables borrowers to obtain a range of assistance from relevant agencies via referrals. These referrals may yield aids such as employment opportunities, digital training and business platforms, as well as upskilling and reskilling courses.

Applying to URUS via your respective bank

If you would like to find out more about URUS or are ready to apply for the programme via your respective bank, here are the landing pages for most of the major banks in Malaysia:

- Affin Bank

- Agrobank

- Alliance Bank

- AmBank

- Bank Islam

- Bank Muamalat

- Bank Simpanan Nasional

- CIMB

- Hong Leong Bank

- HSBC Bank

- Maybank

- MBSB Bank

- OCBC Bank

- Public Bank

- RHB Bank

- Standard Chartered Bank

- UOB Bank

Again, do note that some banks may have stricter screening processes, so be sure to check your bank’s requirement list to ensure a smooth application process.

***

Individuals who have enquiries regarding URUS can reach out either to their respective banks, or to AKPK. You can speak to AKPK via the Live Chat function on its website, or by messaging them through their social media. Alternatively, you can find out more via their website here.

Comments (0)