Jacie Tan

1st March 2020 - 13 min read

NOTE: This article pertains to income tax filing for the year of assessment 2019. If you are filing your taxes in 2021 for YA 2020, then head on over to our new article on everything you should claim here.

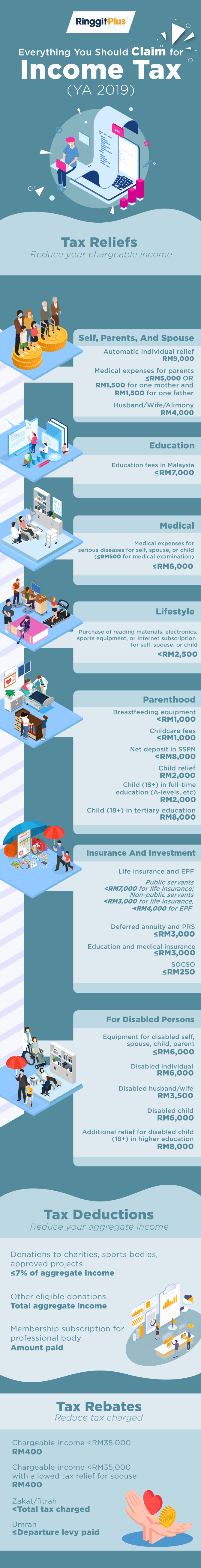

If you earn more than RM34,000 a year, you’re not going to escape paying your taxes, but what you can do is try to get them back in your tax refund. When it comes to getting the biggest possible tax refund each year, the key lies in making the most of the tax reliefs, tax deductions, and tax rebates. And to do that, you have to know what they are and how to make use of them.

Generally, tax deductions, tax reliefs, and tax rebates help you reduce your aggregate income, chargeable income, and amount of tax charged respectively. Claiming these incentives can let you enjoy a lower tax rate and pay less in tax altogether. If you want to find out more about how exactly the different incentives work to lower your taxes, you can read our article on it here – but for now, let’s see how you can use them to maximise your tax refund.

Malaysia Income Tax Relief YA 2019 Explained

Are you feeling a bit uncertain about which tax reliefs you’re actually eligible for? Here’s a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019.

Individual and dependent relatives

Granted automatically to an individual for themselves and their dependents.

Claim allowed: RM9,000

Medical treatment, special needs, and carer expenses for parents

Includes care and treatment by a nursing home, and non-cosmetic dental treatment. Must be evidenced by a registered medical practitioner or written certification of a carer. Parents must reside and treatment must be provided in Malaysia.

Claim allowed: Up to RM 5,000

Parents

Those who did not make a claim for medical treatment for parents are entitled to this relief. Parents must be legitimate or legally adoptive parents (stepparents not included), aged 60 years and above, and each parent’s annual income from all sources must not exceed RM24,000 for that year of assessment. The allowable relief is RM1,500 for one mother and RM1,500 for one father; if more than one individual claims for this deduction, the amount has to be equally divided according to number of individuals claiming for that same parent.

Claim allowed: RM1,500 per parent (only allowed if no claims made under medical expenses for parents)

Husband/Wife/Alimony

You can claim this relief if your spouse has no source of income OR elects for joint assessment in your name. This deduction is not allowed if your spouse has a gross income exceeding RM4,000 derived from sources outside Malaysia.

For husbands paying alimony to a former wife, the deduction is allowed for the amount of alimony paid or up to a limit of RM4,000. The total deduction for a wife and alimony payments to a former life is restricted to RM4,000. Only formal alimony agreements qualify for this tax relief.

Claim allowed: Up to RM4,000

Education fees (self)

You can claim for fees expended on a course of study undertaken in a recognised institution or professional body in Malaysia. For Masters or Doctorate degrees, any course of study undertaken is eligible. For others, any course of study up to tertiary level undertaken for law, accounting, Islamic finance, technical, vocational, industrial, scientific or technological skills or qualifications will be eligible.

Claim allowed: Up to RM7,000

Medical expenses on serious diseases for self, spouse, or child

Receipt of the treatment and a certification by a registered medical practitioner must be kept for future reference. Includes treatment of AIDS, Parkinson’s disease, cancer, renal failure, leukemia, heart attack, pulmonary hypertension, chronic liver disease, fulminant viral hepatitis, head trauma with neurological deficit, tumour in brain or vascular malformation, major burns, major organ transplant, and major amputation of limbs.

Claim allowed: Up to RM6,000 in total for self, spouse, or child; the RM6,000 limit is inclusive of any claims made under complete medical examination below.

Complete medical examination for self, spouse, or child

Refers to a thorough examination as defined by the Malaysian Medical Council (MMC).

Claim allowed: Up to RM500 for self, spouse, or child, but the total deduction allowable for both this relief and the relief for medical expenses on serious diseases above is RM6,000.

Lifestyle purchases for self, spouse, or child

You can claim for the purchase of:

- Books, journals, magazines, printed newspapers, and other similar publications in both hardcopy and electronic forms; banned and offensive materials excluded

- Personal computer, smartphone or table; additional charges for warranty or devices used for the purposes of own business excluded

- Sports equipment for sports activities defined under the Sports Development Act 1997, including golf balls and shuttlecocks but excluding motorised bicycles, and payment for gym membership excluding club membership which provides gym facilities

- Internet subscription paid through monthly bill registered under your own name

You can get up to RM2,500 worth of tax relief for lifestyle expenses under this category. Buying reading materials, a personal computer, smartphone or tablet, or sports equipment and gym memberships for yourself, spouse, or child allows you to claim for tax relief. You can also claim for your monthly home Internet subscription. Yes, you get tax relief for just paying your monthly Internet bills from Unifi, Streamyx, and so on! It’s also the only utility payment you can get a tax relief for, so make sure you don’t miss out on claiming for it.

Claim allowed: Up to RM2,500 for all lifestyle purchases for self, spouse, or child.

Breastfeeding equipment

You can make use of this relief if you are a breastfeeding mother and have purchased breastfeeding equipment for your own use to breastfeed your own child aged 2 years and below. Qualified breastfeeding equipment are: breast pump kit and ice pack; breast milk collection and storage equipment; and cooler set or cooler bag.

Claim allowed: Up to RM1,000 per mother, allowed once every 2 years.

Childcare fees

This tax relief is allowed for child care fees for a child aged 6 years and below, paid to a registered child care centre or registered kindergarten. The maximum claim for this relief is restricted to RM1,000 even if the number of children who are eligible for this care exceeds one. If a married couple are assessed separately, this relief can only be claimed by either the husband or the wife who makes the expenditure.

Claim allowed: Up to RM1,000 by husband or wife even if there is more than one child

Net deposit in SSPN

The Skim Simpanan Pendidikan Nasional (SSPN) or the National Educations Savings Scheme is a savings plan introduced by PTPTN to enable parents to invest for their children’s higher education. You can claim tax relief for the net deposit in SSPN up to the claim limitation if your total deposit for the year 2019 is higher than your total withdrawal.

Claim allowed: Up to RM8,000 per individual with children

Ordinary child relief

A deduction is allowed for every child who is unmarried and who is below the age of 18 years at any time during the year of assessment.

Claim allowed: RM2,000 per child

Child relief for child (18+) in full-time education

For those with children who are unmarried, 18 years of age and above, and receiving full-time education, a deduction of RM2,000 is allowed.

For those with children who are unmarried, 18 years of age and above, and satisfy any one of the following conditions, a claim of RM8,000 is allowed:

- In full-time education (other than matriculation/pre-degree/A-Levels) at an educational establishment in Malaysia

- Serving under articles or indentures to qualify in a trade or profession in Malaysia

- Pursuing a full-time degree (or equivalent, including Masters or Doctorate) outside Malaysia

Claim allowed: RM2,000 per child or RM8,000 per child

Life insurance and EPF

Paying life insurance premiums on your own life or your spouse is deductible under this relief, as are contributions to approved schemes such as the Employees Provident Fund (EPF). Private retirement scheme contributions do not count under this relief.

While this relief covers contributions to both life insurance premiums and EPF, pensionable public servants who have opted for pensionable retirement and did not contribute to any approved schemes other than private retirement schemes will find that the EPF relief allocation does not apply to them here. Therefore, the claim limits for pensionable public servants and those who are not public servants differ accordingly.

Claim allowed: Up to RM7,000 for life insurance for pensionable public servants; Up to RM3,000 for life insurance and up to RM4,000 for EPF for non-public servants

Private retirement scheme (PRS) and deferred annuity

The total deduction under this relief is restricted to RM3,000 for an individual and RM3,000 for a spouse who has a source of income. If you elect for joint assessment, the deduction allowed is restricted to RM3,000. You can consider investing in a PRS or deferred annuity for your long-term goals to get this relief, which you wouldn’t be eligible for if you opted for a unit trust or mutual fund for example.

Claim allowed: Up to RM3,000

Education and medical insurance

This claim is allowed for insurance premiums that are related to education or medical benefits either for yourself, spouse, or child. The total deduction under this relief is restricted to RM3,000 for an individual and RM3,000 for a spouse who has a source of income. If you elect for joint assessment, the deduction allowed is restricted to RM3,000.

Claim allowed: Up to RM3,000 for self, spouse, or child

SOCSO contributions

Your contributions to the Social Security Organisation (SOCSO) can be claimed as relief during the year of assessment.

Claim allowed: Up to RM250

Equipment for disabled self, spouse, child, or parent

You can claim for expenses incurred for the purchase of any necessary basic supporting equipment for the use of yourself, spouse, child, or parent, if the individual concerned is disabled. This person must be registered with the Department of Social Welfare as a disabled person for the expenditure to qualify. Basic supporting equipment includes haemodialysis machine, wheelchair, artificial leg, and hearing aids, excluding spectacles and optical lenses.

Claim allowed: Up to RM6,000 for self, spouse, child, or parent

Disabled individual

Disabled individuals who have been certified in writing by the Department of Social Welfare as a disabled person are eligible for a further deduction under this relief.

Claim allowed: RM6,000

Disabled husband/wife

Those who have a disabled spouse are entitled to a further deduction under this relief.

Claim allowed: RM3,500

Disabled child

If you have a disabled child who is unmarried, you are entitled to a deduction under this relief.

Claim allowed: RM6,000

Disabled child in higher education

This is an additional relief that you can claim if you have a disabled child who is unmarried, 18 years of age and above, and in higher education under one of the following conditions:

- In full-time education (other than matriculation/pre-degree/A-Levels) at an educational establishment in Malaysia

- Serving under articles or indentures to qualify in a trade or profession in Malaysia

- Pursuing a full-time degree (or equivalent, including Masters or Doctorate) outside Malaysia

Claim allowed: RM8,000

Malaysia Income Tax Deduction YA 2019 Explained

A tax deduction reduces the amount of your aggregate income – which the sum of your total income for the year put together. For income tax filing in the year 2020 (YA 2019), you can deduct the following contributions from your aggregate income.

Donations to charities, sports bodies, and approved projects

Donations that fall under these categories are restricted to 7% of your aggregate income:

- Gift of money to approved institutions/organisations/funds

- Gift of money for any approved sports activity

- Gift of money or cost of contribution in kind for any approved project of national interest

Deduction allowed: Up to 7% of aggregate income

Other donations, gifts, and contributions

Donations under these categories are not restricted to the 7% limit:

- Gift of money to the government/state government/local authority

- Gift of artefacts, manuscripts, or paintings

- Gift of money not exceeding RM20,000 for libraries

- Gift of money or contribution in kind for disability facilities in public places

- Gift of money or medical equipment not exceeding RM20,000 to approved healthcare facilities

- Gift of paintings to the National Art Gallery or state art galleries

Deduction allowed: Up to value of gift unless otherwise stated

Subscriptions to professional bodies

The membership subscription paid to professional bodies for one’s profession, like medical or legal professional fees, can be claimed as a deduction.

Deduction allowed: Membership subscription paid

Malaysia Income Tax Rebate YA 2019 Explained

An income tax rebate is calculated at the end section of your BE form, after you’ve determined the amount of tax charged on your chargeable income. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019.

Tax rebate for self

If your chargeable income (after tax reliefs and deductions) does not exceed RM35,000, you will be granted a rebate of RM400 from your tax charged.

Rebate amount: RM400

Tax rebate for spouse

If your chargeable income (after tax reliefs and deductions) does not exceed RM35,000, and you have been allowed the tax relief of RM4,000 for your spouse, you can claim this rebate. To refresh your memory, the conditions for the tax relief for spouse are that your spouse has no source of income or elects for joint assessment in your name.

Rebate amount: RM400

Departure levy rebate for umrah or religious travel

This rebate is granted to anyone who leaves Malaysia by air to perform umrah or other kinds of religious pilgrimage, but not for the purpose of performing hajj. To claim this rebate, the evidence required is a copy of the visa issued by Saudi Arabia for the umrah and a written verification by a recognised religious body for any other religious pilgrimage.

Rebate amount: The amount of departure levy paid, limited to 2 trips per lifetime

Zakat/fitrah

The rebate is applied to the payment of obligatory zakat and fitrah during the basis of the assessment year.

Rebate amount: Zakat/fitrah paid

Don’t Miss Out On Maximising Your Income Tax Refund 2020

Now that you know about all the income tax reliefs, rebates, and deductions that are available for Malaysia personal income tax 2020 (YA 2019), make sure to get your tax filing in order so you don’t miss out on any claims. Remember, claiming for tax reliefs and the like are the key to maximising your tax refund for the year, so start listing down all the reliefs you’re eligible for and start filing!

Remember to refer to our Income Tax Guide 2020 (YA 2020) and our other income tax articles for more advice on filing your taxes this year!

(Source: LHDN)

Comments (37)

Hi i have a question, i’m filing BE form for yr 2021, can i know, the EPF claim is it only for those who self-contribute or also for those who deducted thru salary can claim ya?

What about the rental income for the property that still under housing loan, can I deduct the interest paid to bank ? Where should I enter this tax deduction at e-filing YA 2020, I did not see that option

Hi can i find out i brought a used desktop pc can i claim under personal computer?

Hi, can we claim tax relief for only blood check up from pathlab ?

If spouse is not resident, can claim spouse relief?

Can a foreigner claim his home country life insurance and Medical insurance under Insurance tax relief?

Hi all, Can i claim the parents section for the 1500 + 1500 , my dad is retired and my mom is below 60 and working with 1500rm per month . No medical bills cause they healthy . Do I have to have a record of transferring money to their bank accounts to be eligible ?

You can claim for both parents as long as your other siblings do not claim in their tax filings. No need for transaction history.

Hi,under the lifestyle tax relief,

1.does purchasing an ebook from google playstore counts or is it just from amazon?

2.does audiobook counts as ebook and get the tax relief?

Under the lifestyle deduction, is optical can be included?

For computer, can i buy every year and claim under lifestyle? Thanks

Hi, i want to know for Medical treatment, special needs, and carer expenses for parents. Is general doctor consultation and physiology treatment considered under this category?

My daughter has attained the age 25 and started working in 2019 but she is a post liver transplanted patient. Because of her low income only about Rm2600 in Kl, she is definitely cannot support her huge medical expenses of about RM8000 like mycophenolate , levetiracetam, zonisamide and agomelatine. As such, I have to support her medical expenses.

Can I claim for tax medicate relief for serious disease?

Thank you

I bought cellphones for personal use last year and the receipts stated my name..can I claim them under lifestyles.. are personal loan claimable

Hi

Can i claim my wife education fee for her studying Phd from my tax?

For the medical treatment, special needs, carer expenses for parents -> if my parents medical bill was RM18k and I did claimed RM5k in Year 2018, am I allow to claim the balance RM5k in Year 2019?

Unfortunately not, as you can only claim for expenses made under the current Year of Assessment.

Hi

May i know is MLTA for house loan is considered life insurance and tax deductable?

Thanks

I had purchased a handphone in 2017 but forgotten to include in my 2018 income tax relief.. can I submit the receipt this year for the 2020 income tax relief?i still have the original receipt in tact.hope to get some advise .tq

Unfortunately, you can’t – the relief only applies for purchases made for the year of assessment.

Under the lifestyle deduction, are sports shoes considered sports equipment and can be included?

Nope!

Please send the article for proofreading! Wrong info regarding disabled child!

For the medical treatment, special needs, carer expenses for parents -> if I applied a maid to take care of my disabled mother, is this eligible to claim for deduction?

According to the LHDN’s explanatory notes, the medical care and treatment must be provided by a nursing home. However, you can double check directly with LHDN for confirmation.

For Subscriptions to professional bodies, is there any eligible / approved professional bodies list for reference?

is acca membership fee claimable?

Can I claim my child insurance premium (under medical category) if the policy owner is under my husband’s name? He is not entitle to file Malaysian income tax

With case-specific questions like these, it’s always best to get the answer straight from the horse’s mouth itself – try emailing or calling LHDN with your query 🙂

Hi, the explanation in hasil.gov.my for life insurance and provident fund is up to 6000, but you stated 7000.

Hello! RM6,000 was the allowance for YA2018. Do check the new allowance for YA2019, also on the hasil.gov.my website.

Can we claim tax relief under smart phone purchase if I bought a used phone from direct owner, I also have the purchase receipt with the name of previous owner on it.

It’s unlikely that you will be able to claim for this.

Can a foreigner claim his home country life insurance under Insurance tax relief?

In the case of specific enquiries such as these, it’s better to call or email the Inland Revenue Board of Malaysia for further clarification.

Good day

Regarding the below for Form BE:

Subscriptions to professional bodies

The membership subscription paid to professional bodies for one’s profession, like medical or legal professional fees, can be claimed as a deduction.

Deduction allowed: Membership subscription paid

May i know where can we insert the fees for taxable income deductions?

TQ

Darren

Claim against the aggregate income