Pang Tun Yau

24th February 2023 - 4 min read

One of the major announcements under the revised Budget 2023 was the reduction of income tax rates for the M40 and increase in rates for the T20. In his speech, Prime Minister Datuk Seri Anwar Ibrahim stated that the M40s would save up to RM1,300 in tax payments – but how much extra would the T20 group have to pay for their income taxes starting next year?

In practice, as Malaysia uses a progressive tax system, we know that the 2% reduction in income tax rates for the M40 isn’t targeted directly at this group only – it means that as long as your chargeable/taxable income hits a specific bracket, you must pay the cumulative income tax of the previous brackets, as shown in our 2022 income tax guide:

| Chargeable Income (RM) | Calculations (RM) | Rate % | Tax (RM) |

| 0 – 5,000 | On the first 5,000 | 0 | 0 |

| 5,001 – 20,000 | On the first 5,000 Next 15,000 | 1 | 0 150 |

| 20,001 – 35,000 | On the first 20,000 Next 15,000 | 3 | 150 450 |

| 35,001 – 50,000 | On the first 35,000 Next 15,000 | 8 | 600 1,200 |

| 50,001 – 70,000 | On the first 50,000 Next 20,000 | 13 | 1,800 2,600 |

| 70,001 – 100,000 | On the first 70,000 Next 30,000 | 21 | 4,400 6,300 |

| 100,001 – 250,000 | On the first 100,000 Next 150,000 | 24 | 10,700 36,000 |

| 250,001 – 400,000 | On the first 250,000 Next 150,000 | 24.5 | 46,700 36,750 |

| 400,001 – 600,000 | On the first 400,000 Next 200,000 | 25 | 83,450 50,000 |

| 600,001 – 1,000,000 | On the first 600,000 Next 400,000 | 26 | 133,450 104,000 |

| 1,000,001 – 2,000,000 | On the first 1,000,000 Next 1,000,000 | 28 | 237,450 280,000 |

| Exceeding 2,000,000 | On First 2,000,000 Next ringgit | 30 | 517,450 ……….. |

Therefore, the 2% reduction for the RM35,000 – RM100,000 income brackets will be enjoyed by all taxpayers whose income is RM35,000 and above. Hence, even those whose chargeable incomes are above RM100,000 will still enjoy the RM1,300 savings – but of course, they will also now have to pay more in taxes.

How Much Additional Taxes Will The T20 Pay?

Under the Ministry of Finance’s Budget 2023 microsite, there are additional resources that further explain Prime Minister Datuk Seri Anwar Ibrahim’s speech. Specifically, it also contains additional information on the extra income tax to be borne by the high-income groups.

For starters, here’s the proposed rates that are targeted for the high-income groups:

| Chargeable Income (RM) | Current Tax Rate (%) | Proposed Tax Rate (%) |

| 100,001 – 250,000 | 24 | 25 |

| 250,001 – 400,000 | 24.5 | 25 |

| 400,001 – 600,000 | 25 | 26 |

| 600,001 – 1,000,000 | 26 | 28 |

| 1,000,001 – 2,000,000 | 28 | 28 |

| Exceeding 2,000,000 | 30 | 30 |

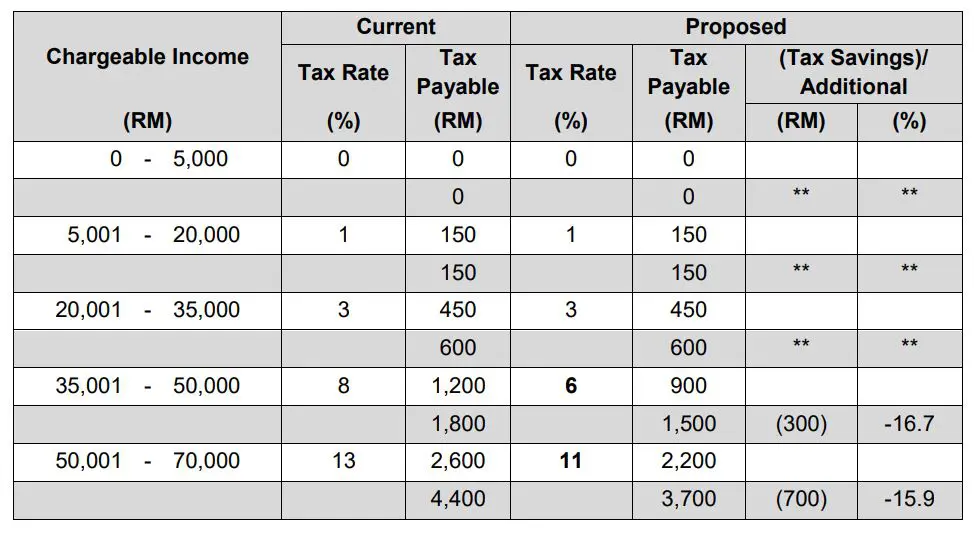

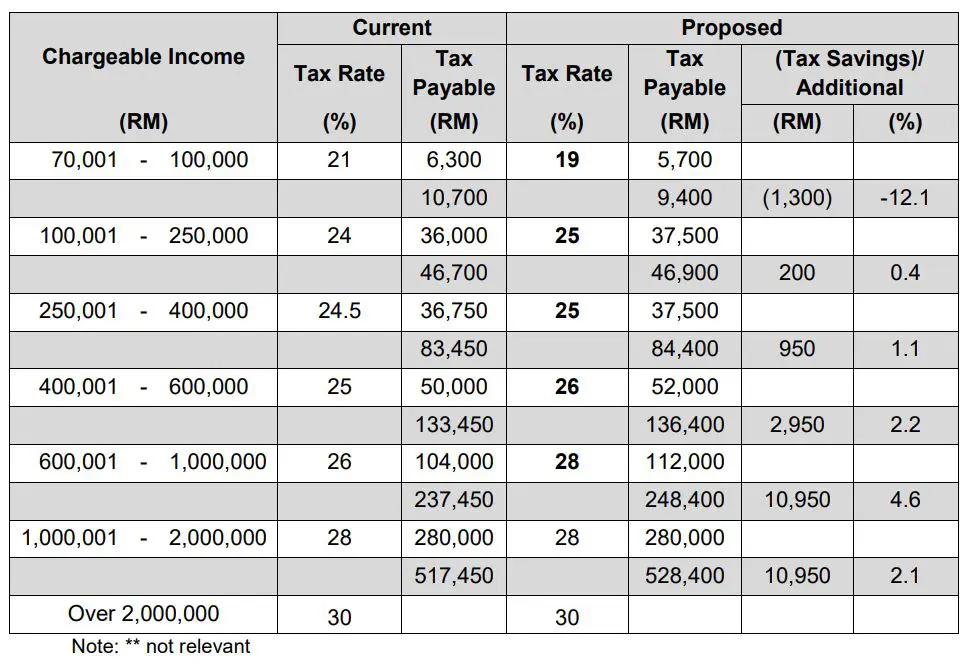

Now, here’s a closer look at the breakdown of the additional income tax to be paid based on the proposed tax rates:

If you’re in the RM100,001 to RM250,000 income bracket, you’re actually only paying an additional RM200 (or 0.4% extra from what you’d normally pay in previous assessment years). This is mainly because of the tax savings that apply in the previous income brackets which as we’ve explained applies to all taxpayers.

Naturally, further up the income brackets the additional tax increase up to a maximum of RM10,950. From the table above, we can see that the worst hit will be those whose chargeable incomes are in the RM600,001 to RM1,000,000 range, where they will have to pay 4.6% more – the highest increase among the income brackets. Finally, there is no cap on those with taxable incomes of more than RM2 million – but they will still be paying an additional RM10,950 from the changes in tax rates in the lower tiers.

Conclusion

This “rebalancing” of income tax rates is aimed at increasing the disposable income of those in the lower to middle income groups – but as Malaysia uses a progressive tax system, the savings extend to the higher income groups as well. In relation to that, Malaysia’s tax system also has a cap to the total tax payable for all income brackets up to RM2,000,000, so a taxpayer doesn’t really pay a direct calculation of the tax rate (and also explains the maximum increase of RM10,950 instead of a much higher number).

Of course, these proposed changes (if approved) will be in effect from YA 2023, so if you wish to further reduce your chargeable income (and thus effectively pay less taxes) via the many tax reliefs you’re eligible for, you have the whole year to plan it out.

Comments (0)