Alex Cheong Pui Yin

4th June 2024 - 3 min read

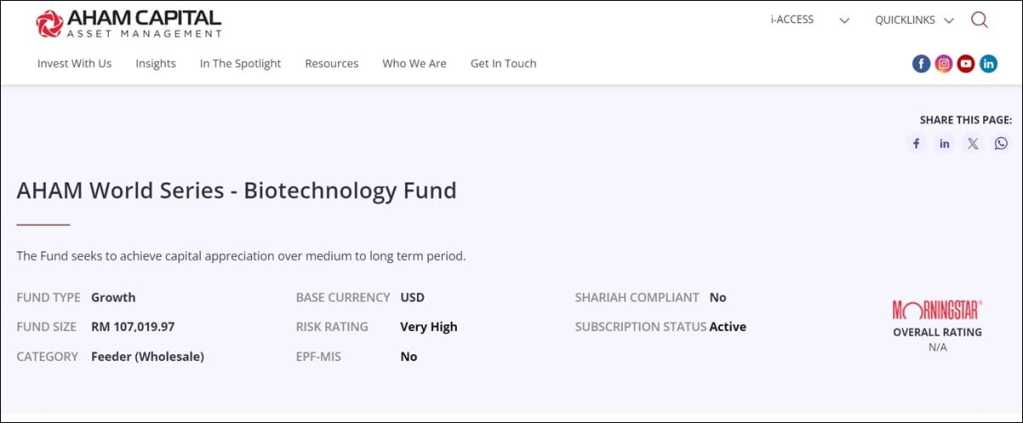

AHAM Asset Management Bhd (AHAM Capital) has officially launched a new AHAM World Series fund, called the Biotechnology Fund, which provides investors with access to investment opportunities in the biotechnology industry.

In a statement, AHAM Capital explained that the fund – which is suited for sophisticated investors with high risk appetite and a medium- to long-term investment horizon – will invest at least 85% of its net asset value (NAV) in the Janus Henderson Horizon Biotechnology Fund, managed by global asset management group Janus Henderson. The remaining 15% (or less), meanwhile, will be allocated for money market instruments, deposits, and/or cash for liquidity.

AHAM further highlighted that while the base currency of the Biotechnology Fund is in USD, it will be available in three currency classes to cater to investors’ preferences: USD Class, MYR Class, and MYR-Hedged Class. Depending on your preference, the minimum investment amount will differ:

| Fund | Launch price | Minimum initial investment |

| AHAM World Series – Biotechnology Fund (USD Class) | US$0.50 | US$10,000 |

| AHAM World Series – Biotechnology Fund (MYR Class) | MYR0.50 | MYR30,000 |

| AHAM World Series – Biotechnology Fund (MYR-Hedged Class) | MYR0.50 | MYR30,000 |

As for fees and charges, there is a sales charge of up to 5.50% on the NAV per unit, as well as a management and trustee fee of up to 1.80% p.a. and 0.06% p.a., respectively. Aside from that, there are no transfer or switching fees, or repurchase charges.

Chief officer of product solutions and customer experience at AHAM Capital, Anton Tan said that the biotech sector offers a broad spectrum of opportunities across small and large-cap companies, and can help to diversify an investor’s portfolio.

“Healthcare spending is poised to increase driven by a demographic shift in the US, coupled with aging populations and globalisation. These long-term secular forces create an attractive fundamental backdrop for biotechnology investments. Despite experiencing its worst drawdown on record, the biotech sector is currently trading at a substantial discount to the broader market, presenting a unique ‘innovation on sale’ opportunity,” said Tan.

Portfolio manager at Janus Henderson, Andy Acker also echoed Tan’s sentiment. “Biotechnology is currently undergoing unprecedented levels of innovation, thanks to dramatic improvements in life science tools, genetic engineering, and new modalities for treating human diseases such as cancer, autoimmune disease, and rare genetic conditions. These advancements are unearthing opportunities for investors to identify the next blockbuster (billion dollar) therapies and generate alpha for clients,” he said.

If you’re interested in finding out more about AHAM Capital’s new World Series fund, you can head on over to the Biotechnology Fund webpage here.

Comments (0)