Alex Cheong Pui Yin

29th July 2021 - 13 min read

If you’ve taken a look at the benefits of investing in unit trust funds and are ready to begin your own venture into it, kudos to you! It is impossible to overemphasise the importance of investing, and unit trust funds are a great way to get started – particularly for beginners.

As you do your research into the funds that you’d like to buy, don’t forget to also consider the various ways or channels that you can invest in unit trusts. You’ll probably know that you can invest via unit trust agents, but there are actually several other channels that you can use as well – depending on your preferences!

Here, we will share some of the different ways you can invest in unit trusts, as well as the benefits and drawbacks that come with them.

Unit trust agents

Arguably the most common method, many individuals may opt to carry out their unit trust investments via agents because of the convenience and services that are offered. Briefly, unit trust agents are representatives of unit trust management companies (such as Affin Hwang, Public Mutual, and so on), and hold a licence issued by the Federation of Investment Managers Malaysia.

Typically, a unit trust agent will reach out to you (either via cold calls or from a recommendation from someone you know), and then go on to help you submit your purchase request to the unit trust management company (if you agree to invest). A reliable agent will also attend to your subsequent questions or requests after that, such as if you need to obtain statements and documents related to your funds. These services could often save you a lot of time and trouble, especially if you’re still new to the process.

Aside from that, agents also come with the benefit of human interaction and fostering trust. They can explain the different funds to you, allay your concerns, and discuss the relevance of your funds in relation to your overall finances. This may appeal to those who feel more confident about investing only after having spoken to someone. It’s crucial to note, however, that agents should not be mistaken as financial planners; while the former can share insights as they interact with their clients, only financial planners are qualified to offer legitimate financial advice.

One key drawback to investing via agents, however, lies in the hefty commission that they draw from every successful transaction secured. This usually ranges between 1.5% to 2.75%, charged based on the amount that you decide to invest. So for instance, if you decide to invest RM1,000, your agent will earn at least RM15 from you. Every subsequent transaction carried out via your agent will incur similar charges, and this can turn out to be quite the sum after a while.

On top of that, most unit trust agents are usually only attached to one asset management firm, and thus their recommendations would be tied only to products from his or her company. As such, it’s important to note that their insights should be validated by yourself before making a decision – remember, these agents earn a commission for every transaction you deal with them, and unfortunately that means some agents will put their needs above their clients.

Banks

It is also possible for you to invest in unit trusts through banks, and some people may actually prefer this channel over others – especially if you’ve been a long-time customer of a particular bank or have a dedicated relationship manager to attend to your needs. The familiarity with the bank’s procedures, as well as trust built over time will give you an added level of assurance and confidence.

Additionally, there is also a matter of convenience as banks typically include their unit trust investment functions as part of their existing mobile banking apps. This means that if you’re already a customer of a particular bank and are using its banking app, you will not need to download another app, register with a new entity, or go through the various verification processes in order to begin your investment journey. Hence, you enjoy the ability to access your financial information and conduct your transactions all in one channel; all your details can be viewed from a single dashboard, and you can also quickly set up autodebit instructions as per required.

Some banks may even have a special investment programme that you can take part in to ensure consistent investment. For instance, Maybank has something called the Regular Savings Plan (RSP) Investment, where you allow the bank to automatically debit your savings or current account for your unit trust investment on a regular basis. Meanwhile, there is a growing number of banks that bundle various services into one product, and incentivise customers with additional interest and bonus perks. Standard Chartered’s Privilege$aver account is one such example; on top of offering bonus interest for depositing and spending a certain amount each month, account holders can earn extra interest by investing in unit trust funds with the bank.

As for the key disadvantage of purchasing unit trust via banks, note that the range of funds offered by a bank may be quite limited. Often, your accessibility is restricted only to funds from the bank’s unit trust management company (UTMC), or from a few fund houses. This naturally means you won’t be able to invest in the hundreds of funds available to Malaysians, but only those partnered with the bank – and that could impact your investment returns in the long run.

Some banks also charge relatively high charges and fees, going up to a maximum of 6% sales charge for unit trust investments. This is not inclusive of other fees you’d normally pay in a unit trust fund, such as fund management fees, and so on.

EPF i-Invest

Back in 2019, the Employees Provident Fund (EPF) launched the i-Invest platform to allow eligible members to invest a portion of their EPF Akaun 1 savings into unit trust funds from 10 approved fund management companies.

There are a number of benefits to investing in unit trust via the i-Invest platform, chief of which is potentially higher returns by investing in growth funds (note that the EPF has a relatively low risk tolerance, with a 10-year average dividend yield of 6.11% p.a.). In addition, investing through EPF i-Akaun is convenient and is available at lower sales charges. EPF members can make their investments directly from the EPF i-Akaun portal, which means that members will not need to go through any paperwork processing between the EPF (to withdraw money) and the fund management company (to invest). Additionally, the EPF has also capped the sales charge at a maximum of 0.5%, with some funds even offering 0% sales charges.

It also goes without saying that investing through this channel will not affect your current cashflow as you’ll be drawing from your EPF Akaun 1 for the investment – a pool of fund which is mandatorily locked away for your retirement anyway. In other words, you do not need to specifically change your current spending habits just to squirrel away extra cash for investment purposes. Similarly, the redemption of your investment will also be deposited directly back into your EPF Akaun 1 – unless you are 55 years of age and above, in which case, the money will be deposited into your personal bank account.

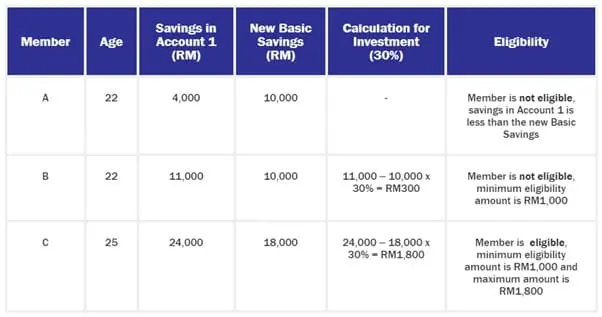

That said, do be aware you have to meet several requirements in order to be eligible to use i-Invest. Specifically, you can only use the platform if you are 55 years of age or younger, and your Akaun 1 savings meet the basic savings requirement that matches your age band.

Given the EPF’s goal of diversifying part of its members retirement funds for higher-growth opportunities, there remains some restrictions to manage its members risks. For example, there is a cap on the amount of your Akaun 1 savings that can be invested into i-Invest; you can only invest up to 30% of the amount in excess of the basic savings that you have in your Akaun 1. Note also that despite the risk management measures in place, funds invested in i-Invest do not have the minimum 2.5% p.a. returns mandate – so there is a risk of making a loss (but with the potential of greater than EPF average returns).

Private Retirement Schemes (PRS)

PRS are voluntary long-term investment schemes designed to help Malaysians be more actively involved in saving for their retirement, complementing the contributions that are already being made to the EPF. These special schemes consist of a range of retirement funds that have been vetted and comply with specific regulations set by the Securities Commission Malaysia (SC) – offered by eight approved fund companies.

Most people who opt to invest in unit trust funds via PRS do so for a number of reasons, one of which is that many of the funds offered have 0% sales charge. Moreover, PRS also features something called the default option of core funds – which is essentially a pre-packaged mix of asset classes with differing levels of market risk, offered to you based on your stage in life:

- 45 years old and below: Growth fund (higher risk)

- Between 45 to 54 years old: Moderate fund (moderate risk)

- 55 years old and above: Conservative fund (lower risk)

PRS contributors who are less experienced can opt for this default option of core funds for convenience, whereas investors who are more involved in strategising their portfolios can self-select their funds instead.

Another major benefit that comes with investing via PRS is the claimable tax relief of up to RM3,000 per annum for their voluntary contributions. The tax incentive was provided as a form of introductory offer when PRS was first rolled out back in 2012, and was initially offered for 10 years – up until 2021. Under Budget 2021, the benefit was further extended until 2025.

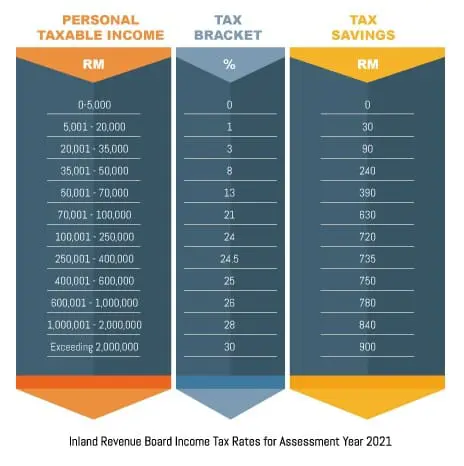

To give you an idea of how much tax savings you can enjoy, the Private Pension Administrator (PPA) shared the following illustration (based on an annual PRS contribution of RM3,000):

The tax savings effectively equates to an “instant return of investment”, as our Licensed Financial Planners like to put it. If you are in the higher ranges of wage earners, the ROI for the RM3,000 invested in PRS funds is in the 20+% range, well above our licensed financial planners’ annual target returns of 9% p.a. for a unit trust fund.

In terms of drawbacks, some people may be deterred from investing via PRS because of its account structure and withdrawal mechanics. Your PRS account is basically structured similar to your EPF account; there are two sub-accounts provided: Sub-Account A (70% of PRS contribution) and Sub-Account B (30% of PRS contribution).

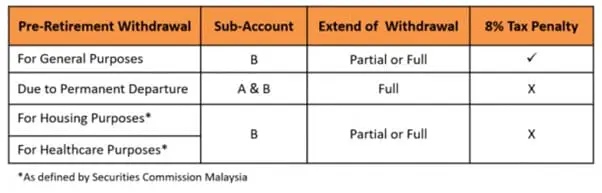

The money saved within Sub-Account A is locked away, and can only be withdrawn upon reaching the age of retirement at 55 years old. Meanwhile, cash in Sub-Account B is allocated for potential situations where you need to make pre-retirement withdrawals. However, making pre-retirement withdrawals from Sub-Account B will incur a tax penalty of 8% (except for housing or healthcare purposes). This can be quite a hefty amount; for instance, if you were to partially withdraw RM10,000 from your Sub-Account B, you’ll be hit with a penalty of RM800.

Here’s a quick summary of how you may be charged when you make any sort of pre-retirement withdrawals from your PRS:

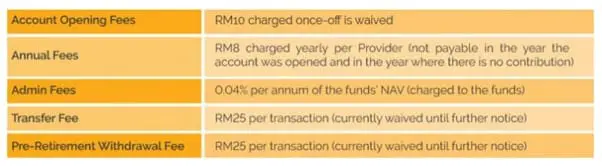

It is crucial to understand that the tax penalty is primarily implemented as a prevention measure to stop you from tapping into what should be your retirement fund, so if you are looking to invest in unit trusts with a medium term investment horizon, going the PRS route will not be the best option. On top of the pre-retirement withdrawal fees, there are also a number of other investment charges that you should take note of. The PPA – which is the central administrator for PRS – has a list of charges imposed for PRS investors:

The PRS providers, too, will impose some additional costs of their own, such as fund annual management fees and annual scheme trustee fees. An instance of the separate fees that are charged by a PRS provider, Affin Hwang are as follows:

Ultimately, make sure to check on the separate PRS providers as each will have their own fee structures, and remember to calculate the costs that you may incur before deciding!

Online unit trust marketplaces

Finally, online unit trust marketplaces are one-stop online platforms where you can find hundreds of unit trust funds that you can invest in. Just as you would see different vendors plying their wares for sale in a marketplace, an online unit trust marketplace also has multiple fund houses sharing many (or all) their funds with potential investors.

The chief advantage of this channel is the accessibility that it offers to a wide selection of funds – with varying risk levels, as well as regional and industry exposure – to meet the different risk appetite and preferences of investors. It is then up to you to shop around, doing your own research and comparisons to decide on which funds to invest in. Unit trust marketplaces also typically offer lower fees and charges as compared to the other channels, making it a popular choice of investment channel with savvy investors.

Perhaps the one drawback to purchasing unit trust from marketplaces is the fact that it is a heavily do-it-yourself (DIY) experience. This can be a little daunting for those who are just starting out on their own investment journey, but it also offers a rewarding learning experience if you take the time to do it. Experienced investors, meanwhile, will relish the freedom offered by these marketplaces.

In Malaysia, one of the best-known and largest unit trust marketplaces is FSMOne, which has been in operation since 2008. It is popular for its diverse selection of funds, as well as low fees and frequent offers of discounted sales charges. In fact, the sales charge can sometimes go even lower than if you were to invest directly with the fund houses themselves.

On top of that, FSMOne also offers an extensive database of fund information and articles from its analysts, discussing current economic and investment matters. This trove of information will be invaluable to both beginners and seasoned investors. The marketplace is further complemented by additional features as value-added services to its customers, such as the Managed Portfolio feature – an online asset management and advisory service. It allows you to request for assistance from FSMOne’s dedicated fund managers if you need help managing your investments.

Finally, FSMOne is also the only channel that you can use to invest in nine curated unit trust funds that are recommended by our in-house licensed financial planners in RinggitPlus Financial Planner:

- KAF Vision Fund

- PMB Shariah Growth Fund

- Kenanga Growth Opportunities Fund

- Principal Greater China Equity Fund (AUD Hedged, MYR, MYR Hedged, RMB Hedged, SGD Hedged, USD)

- Eastspring Investments Dinasti Equity Fund

- Affin Hwang Select Asia (Ex Japan) Quantum Fund (AUD, GBP, MYR, SGD, USD)

- Manulife Investment US Equity Fund

- Principal Global Titans Fund

- RHB US Focus Equity Fund

***

With this, we hope that you now have a clearer idea as to where you can potentially kickstart your unit trust investment journey! As you can see, each channel carries with it different pros and cons, so make sure to give some thought as to how they may suit your lifestyle and preferences.

Comments (0)